When analysts discuss concerning the financial system, the main focus is usually on shopper sentiment—to what diploma individuals really feel adequate about their monetary prospects to maintain spending. As shopper spending drives two-thirds of the U.S. financial system, taking a look at shopper sentiment as a key indicator is smart. Or does it?

Shoppers Don’t Lead, They React

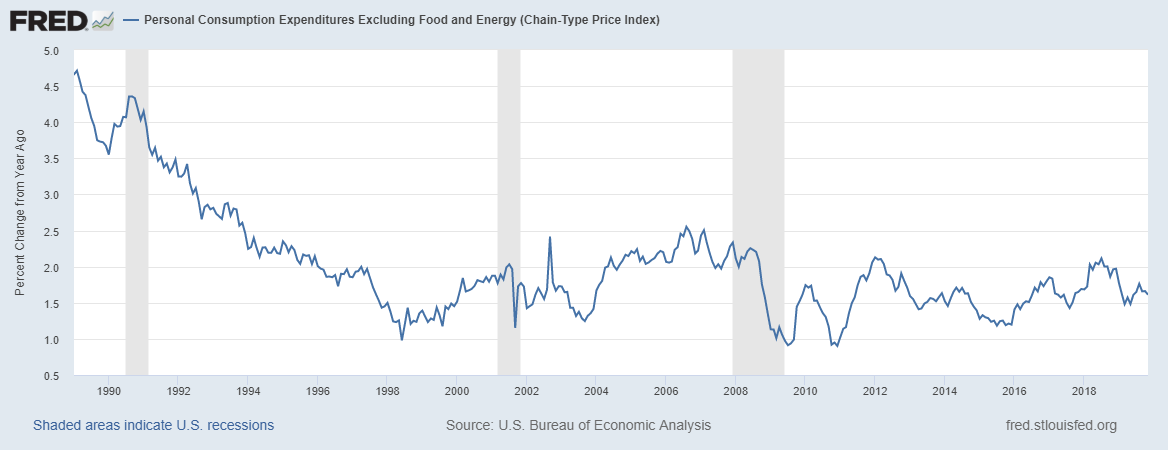

Because the chart beneath signifies, throughout the previous three recessions, U.S. customers stored spending throughout the downturn and solely stepped again as soon as the underside fell out of the financial system. From this knowledge, we are able to see that shopper spending does a poor job as a number one financial indicator. Shoppers merely react to the financial system, fairly than lead it.

Enterprise Is Higher

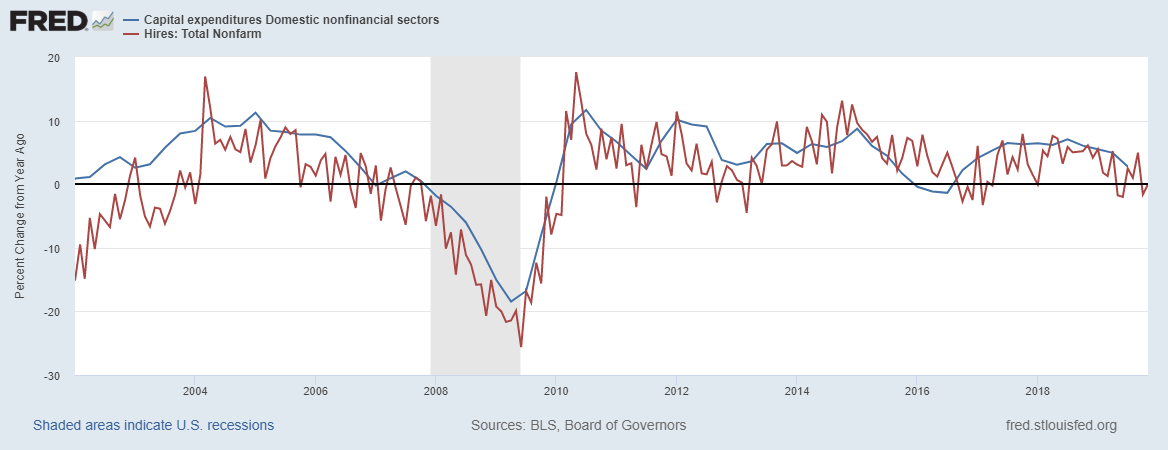

Companies, however, can rapidly modify to financial challenges by altering the quantity of funds allotted to capital expenditures and personnel hires. As demonstrated by the chart beneath, these levers for enterprise improvement could be managed comparatively rapidly, based mostly on the outlook for the general financial system. Accordingly, enterprise is a greater main indicator for the well being of the financial system than the buyer.

Look to the CFOs

We must also look past the headlines and take into account the actions of the company leaders writing the checks—the CFOs—to trace shifts in enterprise sentiment. As a harbinger of financial developments, these shifts give us useful perception into elements that would quickly be influencing the broader financial system. Right here, we’re lucky to have the Duke CFO Global Business Outlook, which is a joint enterprise of Duke College and CFO Journal.

The Duke CFO World Enterprise Outlook, accomplished on a quarterly foundation since July 1996, is a world survey of CFOs from each private and non-private corporations. The survey asks about company spending, employment developments, and optimism relating to the financial system. To drill down into the optimism part, questions get into particular particulars relating to sentiment concerning the respondent’s personal firm, the U.S. financial system, and the broader financial system. By capturing the CFO’s expectations for the following 12 months, the survey can make clear future progress developments.

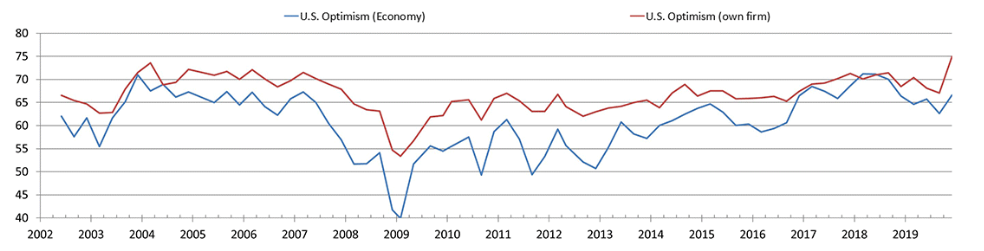

CFOs, on the whole, are presently optimistic about how their companies are positioned for the following 12 months. As for his or her optimism concerning the common financial system, their ideas have modified over time. Trying again, CFOs have been much less optimistic concerning the U.S. financial system on the finish of 2007 and in early 2008. In the course of the lengthy bull market that adopted the monetary disaster, each firm-specific optimism and broad financial optimism moved larger. Then, in 2019, as considerations relating to world commerce flared, CFO sentiment as soon as once more began to shift downward. The chart beneath captures these adjustments in sentiment.

CFO views on the combination financial system could be understood by taking a look at their approvals for capital expenditures and R&D tasks. In periods of subdued or declining optimism concerning the financial system, CFOs anticipate that their companies will in the reduction of on capital and R&D spending. This pattern was evident within the September 2019 survey, which captured the height of world commerce uncertainty that was pushed by each day bulletins relating to the U.S. and China commerce coverage. Subsequently, the destructive expectations on company spending have been reversed within the responses to the December survey. At that time, the commerce rhetoric quieted down and the section one deal had been signed.

Monitoring the Well being of the Economic system

Towards the tip of 2019, enterprise sentiment clearly indicated that the final well being of the financial system was inching into the difficulty zone. This threat gave buyers trigger for concern. Lately, nonetheless, sentiment has bounced larger, which might result in an uptick in enterprise spending. In flip, larger spending might function a tailwind for the U.S. financial system for the following couple of quarters. The scenario will bear watching, nonetheless, as enterprise sentiment might rapidly flip and grow to be a headwind for the financial system. Thus, it’s solely considered one of a number of indicators that we should actively monitor to know the present and future well being of the financial system.

Editor’s Observe: The original version of this article appeared on the Unbiased

Market Observer.