Transport Company of India Ltd – Leaders in Logistics

Based in 1958, TCI delivers built-in multimodal logistics and provide chain options throughout highway, rail, and sea. Catering to various industries, from cars to electronics and retail, TCI manages over 2,300+ prepare actions, 8,000+ containers, 10,000 vans, 6 coastal ships, and 15+ warehouses with a workforce of three,500+ as of Q1FY25.

Merchandise and Providers

The corporate’s choices might be categorized into the next classes:

- TCI Freight – Supplies whole transport options for cargo of any dimension or product phase.

- TCI Provide Chain Options – Providers supplied are Provide Chain Consultancy, Inbound Logistics, Warehousing / Distribution Centre Administration & Outbound Logistics.

- TCI Seaways – Caters to the coastal cargo necessities for transporting containers and bulk cargo.

- TCI Chemical Logistics Options – Specialised within the storage and transportation of varied chemical compounds, together with liquids, dry substances, and gases, in compliant warehouses.

Subsidiaries: As of FY24, TCI has 9 subsidiaries, 1 three way partnership, and 1 affiliate firm.

Development Methods

- TCI has ordered two new ships (7,300 DWT) price $38.8 million, anticipated in CY 2026-27, and is contemplating buying second-hand ships.

- Regardless of a FY24 decline, Q1FY25 noticed elevated seaway gross sales, with plans for capability growth.

- Rs.375 crore capex for FY25, together with Rs.80 crore for ship advance funds.

- The corporate bought two new vans and plans so as to add 75 new branches within the LTL enterprise, specializing in chilly chain alternatives.

- Provide chain enterprise delivered sturdy outcomes, significantly in automotive, with progress within the EV and parts market.

- Seaways operations outperformed expectations, with stability anticipated regardless of gas value fluctuations.

- The three way partnership with Concur achieved 13.8% progress, and the chilly chain phase expanded by over one-third.

Q1FY25

- Income: ₹1,056 crore in Q1FY25, up 10% from ₹958 crore in Q1FY24.

- Working Revenue: ₹136 crore in Q1FY25, a 7% YoY progress from ₹127 crore in Q1FY24.

- Internet Revenue: ₹92 crore in Q1FY25, an 11% enhance from ₹83 crore in Q1FY24.

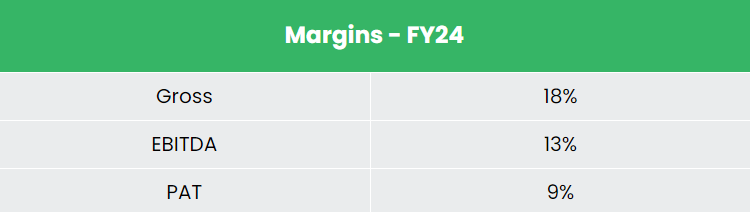

FY24

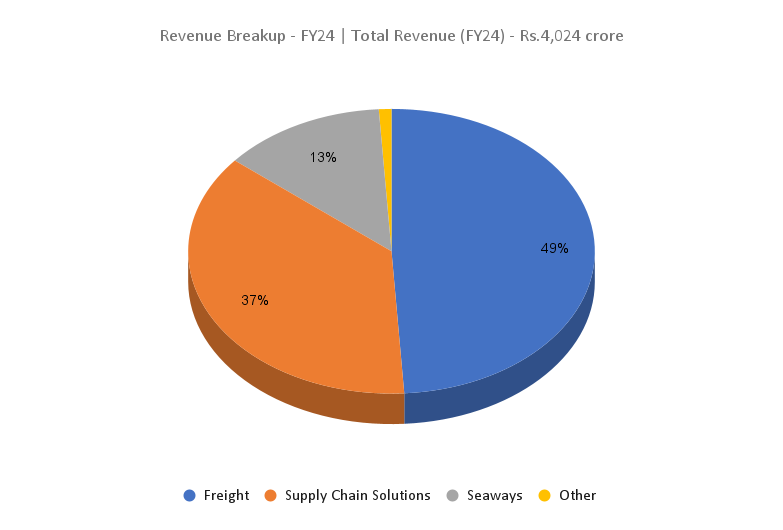

- Income: ₹4,024 crore in FY24, up 6% from FY23.

- Working Revenue: ₹532 crore in FY24, a 7% YoY progress.

- Internet Revenue: ₹355 crore in FY24, an 11% enhance YoY.

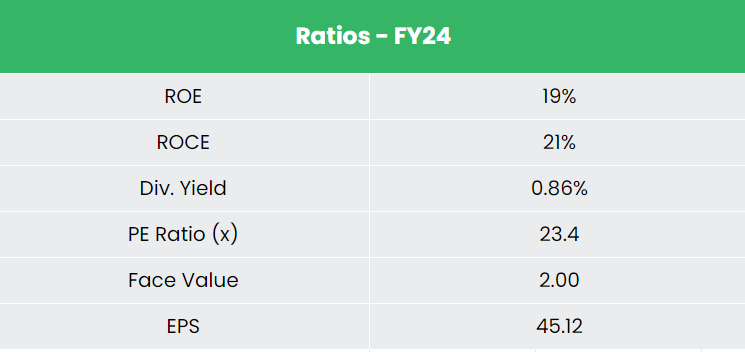

Monetary Efficiency (FY21-24)

- Income CAGR: ~13%

- PAT CAGR: ~31%

- 3-12 months Common ROE: ~20%

- 3-12 months Common ROCE: ~22%

- Debt-to-Fairness Ratio: 0.10 (sturdy capital construction)

Trade outlook

- The worldwide logistics market is projected to exceed $15.79 trillion by FY2028 and attain $18.23 trillion by 2030.

- Development drivers embrace evolving shopper preferences, e-commerce growth, and international commerce.

- India’s logistics sector is forecasted to develop at a CAGR of seven.85%, rising from $282.3 billion to $563 billion by 2030.

- The Indian authorities’s VISION 2047 goals to reinforce the transport community throughout all key modes, unlocking logistics potential and boosting competitiveness.

Development Drivers

- Authorities initiatives such because the PLI scheme, Atmanirbhar Bharat, and Make in India.

- Rising demand for multimodal logistics, digitalization, automation, and sustainable transportation options.

- Capex allocation of ₹11 trillion for the logistics sector within the FY24-25 finances, a ten% YoY enhance.

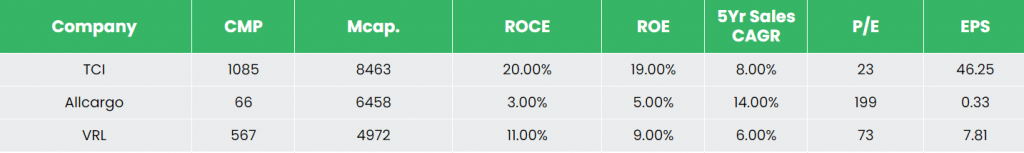

Aggressive Benefit

TCI is taken into account essentially the most undervalued inventory amongst opponents like Allcargo Logistics Ltd and VRL Logistics Ltd, boasting wholesome returns on capital employed and steady gross sales progress.

Outlook

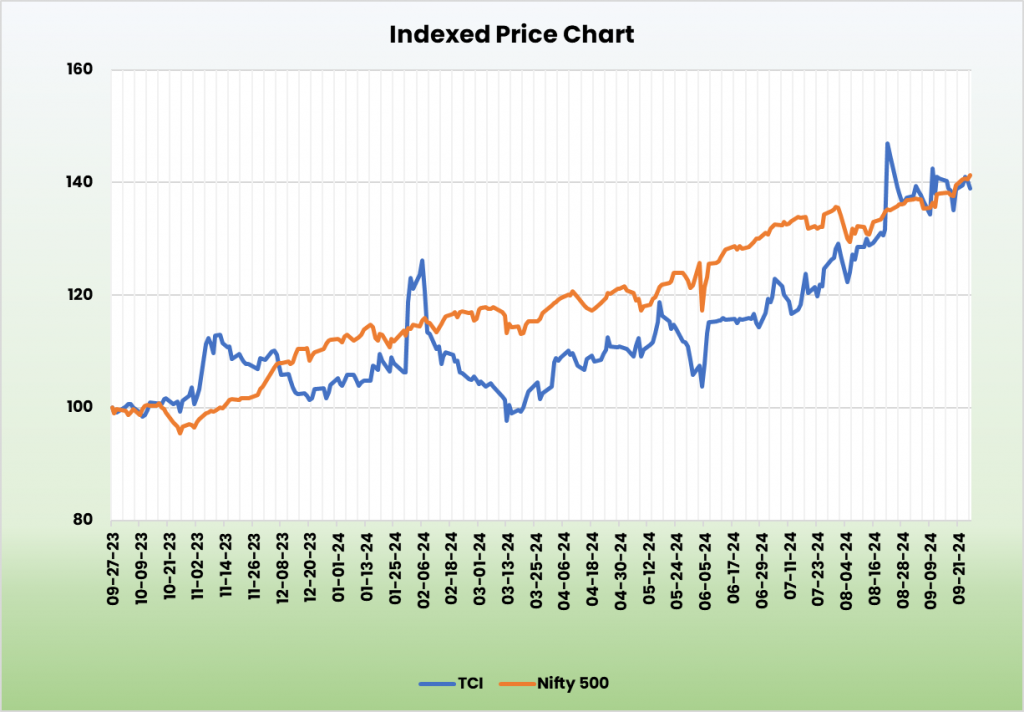

- TCI is poised to learn from an bettering home commerce atmosphere, pushed by festive season stocking, monsoon withdrawal, and enhanced quarterly efficiency throughout segments.

- The corporate is well-positioned to enhance market penetration by way of its built-in diversified providers and multimodal capabilities.

- Anticipated progress of 10-15% in each high line and backside line for total enterprise.

- Anticipated ROCE upkeep at 20%.

- Administration tasks 10% progress in seaways.

- Planning ₹1,100 crore in capex over the following 4 years.

Valuation

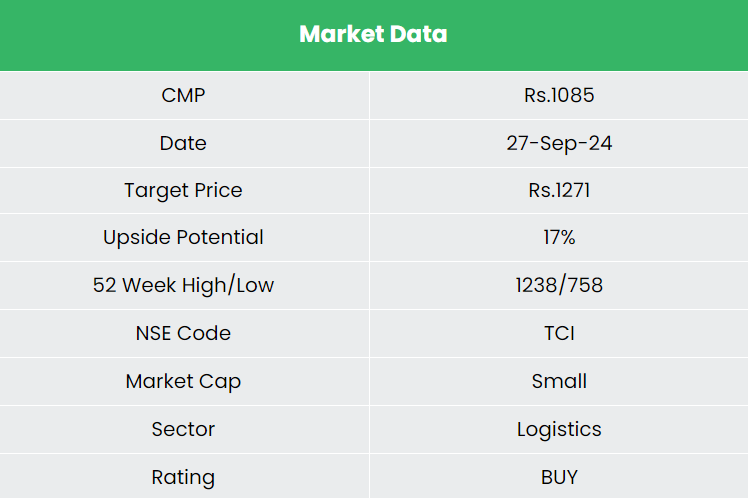

We consider TCI is properly positioned to cater to the necessities of its various shopper base attributable to its nationwide community and multimodal capabilities. We suggest a BUY score within the inventory with the goal value (TP) of Rs.1,271, 24x FY26E EPS.

Dangers

- Enter Prices: Rising tolls, gas costs, manpower prices, and challenges in accessing high quality labor could stress margins.

- Socio-Financial Threat: Unexpected occasions that disrupt the motion of products throughout areas might adversely have an effect on firm operations.

Be aware: Please observe that this isn’t a advice and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

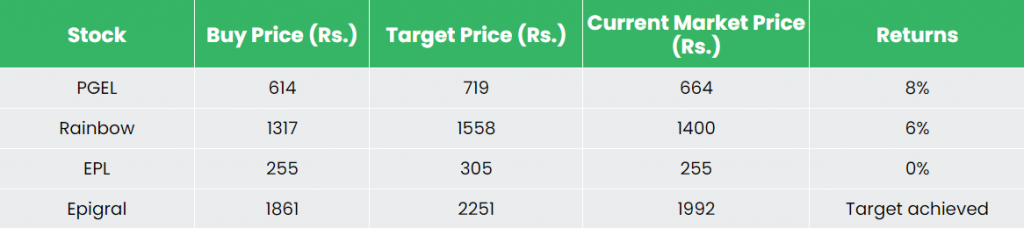

Recap of our earlier suggestions (As on 27 September 2024)

Rainbow Children’s Medicare Ltd

Different articles you could like

Submit Views:

1,565