When you’re critical about constructing wealth, it’s solely a matter of time earlier than you face probably the most debated questions in private finance: Must you spend money on actual property or the inventory market? Each promise monetary progress. Each include dangers. And each have diehard followers who declare their technique is superior. However look past the headlines, previous the gross sales pitches and surface-level comparisons. You’ll discover that the higher alternative depends upon extra than simply potential returns—it hinges in your persona, targets, danger tolerance, time dedication, and even your temperament.

Why Actual Property Has a Loyal Following

Actual property has been a trusted path to wealth for generations, praised for its tangible nature and long-term appreciation. The thought of proudly owning a bit of the earth, incomes passive earnings from hire, and ultimately paying off a property that continues to develop in worth has deep attraction. It gives a way of safety and management that no inventory certificates can match. There’s one thing highly effective about figuring out you possibly can stroll by way of your funding, contact its partitions, and enhance it with your individual effort.

Actual property additionally permits for leverage. You should utilize different folks’s cash (normally the financial institution’s) to purchase an asset, which may considerably enhance your return on funding if issues go effectively. However most gurus gloss over how energetic real estate investing is. Coping with tenants, property taxes, repairs, vacancies, and the actual property market’s fluctuations may be overwhelming, particularly for those who go in with out a plan or underneath the phantasm it’s “simple cash.”

The Inventory Market’s Silent Energy

Alternatively, shares characterize possession in corporations that make up the engine of the financial system. From tech giants to shopper staples, the inventory market gives a slice of hundreds of companies throughout the globe. Probably the most compelling points of shares is their liquidity. With only a few clicks, you should buy or promote your holdings, and your funding is diversified throughout dozens or a whole bunch of corporations for those who use index funds.

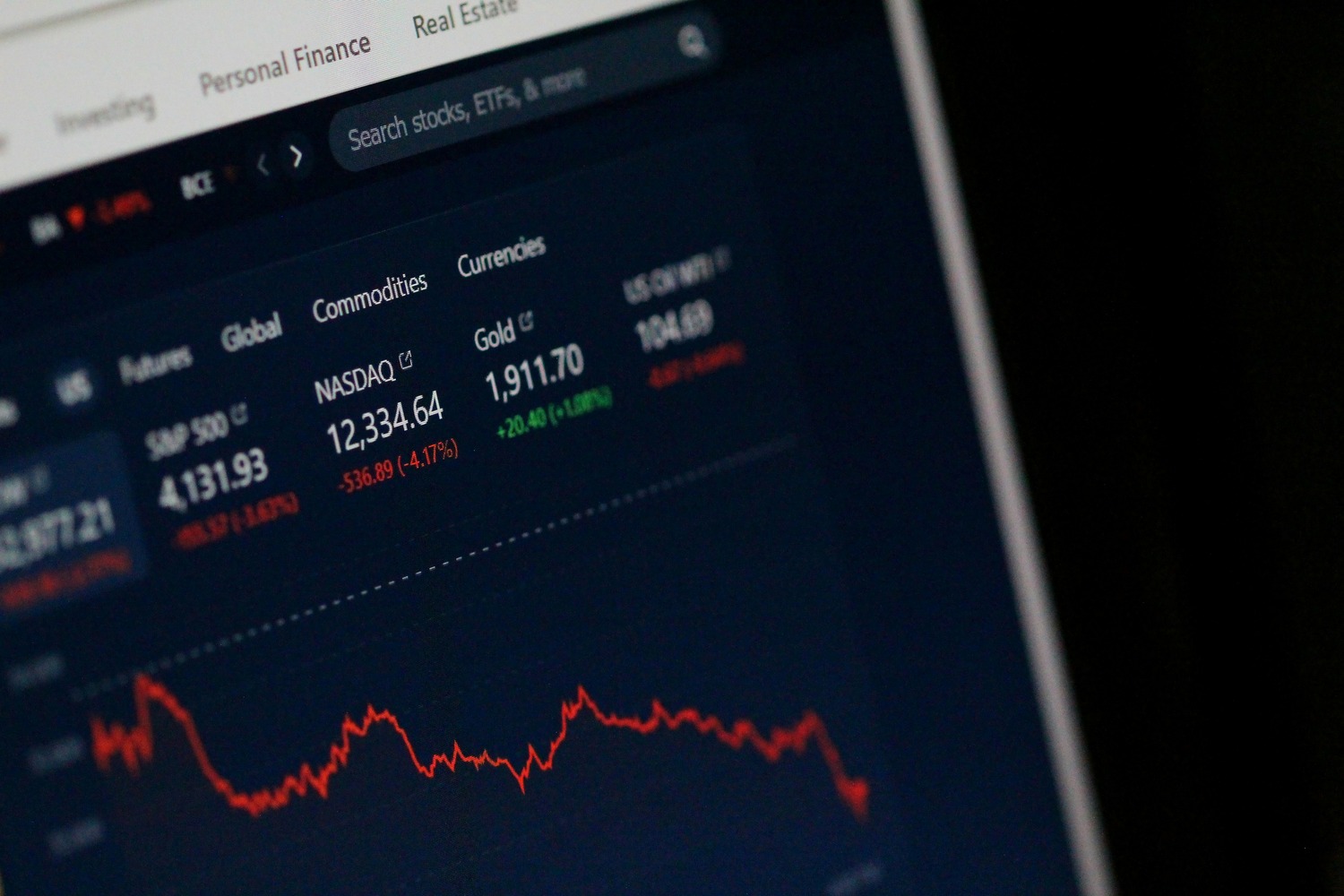

In contrast to actual property, stocks require little ongoing effort. When you’re in, there’s no leaky roof to repair or tenant drama to handle. Additionally they include a protracted historical past of robust returns. Traditionally, the S&P 500 has returned a median of seven–10% yearly after inflation. However this doesn’t imply it’s a clean trip. The inventory market is emotionally turbulent. Costs swing wildly resulting from components usually outdoors your management—geopolitical occasions, rates of interest, market sentiment—and that volatility is just too demanding for some.

How 2025 Is Altering the Sport

Each markets will likely be evolving rapidly in 2025. In lots of areas, actual property has skilled main shifts resulting from excessive rates of interest, diminished affordability, and rising property taxes. This has made money circulate more durable to realize for brand new buyers until they purchase in undervalued markets or pivot to short-term leases, which include their very own regulatory and upkeep complications.

In the meantime, the inventory market has recovered from current downturns and stays accessible to on a regular basis buyers due to apps and platforms that permit fractional shares and automatic investing. However with that accessibility comes danger: too many buyers try to time the market, chase meme shares, or observe developments as an alternative of constructing a long-term technique.

The Capital Entry Barrier

One vital distinction lies in obstacles to entry. Shopping for a rental property normally requires a big down cost, good credit score, and the flexibility to qualify for a mortgage. In distinction, you possibly can start investing within the inventory market with only a few {dollars}. For individuals who don’t have giant sums of capital, shares often is the solely sensible option to begin constructing wealth. That mentioned, actual property gives tax benefits that shares sometimes don’t—reminiscent of depreciation, 1031 exchanges, and mortgage curiosity deductions. These could make a large distinction in your internet returns over time, particularly for those who’re working at scale or holding properties for many years.

Danger: What Type Are You Actually Taking?

It’s additionally essential to contemplate your danger profile and emotional response to loss. Actual property tends to be much less risky on the floor as a result of costs don’t change minute-to-minute like shares do. This will create the phantasm of stability. However actual property carries its personal form of danger—market downturns, property harm, lawsuits, dangerous tenants, and rate of interest spikes can all erode your funding. In the meantime, inventory buyers should study to tolerate paper losses. One dangerous yr out there can wipe out years of positive factors for those who panic-sell. However those that keep the course are usually rewarded over the long term.

Time and Effort: Energetic vs. Passive Investing

One other neglected issue is time and vitality. Actual property, until outsourced to a property supervisor, is like working a small enterprise. You’ll have to cope with upkeep, authorized paperwork, tenant screening, and emergency calls. Shares, as soon as your portfolio is ready up, require little or no consideration until you’re actively buying and selling, which isn’t advisable for most individuals anyway. Passive index investing, for instance, may be arrange as soon as and left alone, other than occasional rebalancing. That makes it best for individuals who need to construct wealth with out sacrificing their nights and weekends.

Diversification and Management

What about diversification? Actual property buyers usually focus loads of capital into one or two properties. If one thing goes unsuitable with the native market or the roof, you could possibly face a serious loss. Inventory buyers can unfold danger throughout complete sectors and economies, decreasing the probabilities that one occasion sinks their complete portfolio. Nevertheless, the flip facet is management. Stockholders don’t get to enhance the enterprise they’ve invested in.

Actual property buyers can enhance the worth of their belongings by way of renovations, higher administration, and hire optimization. In that sense, actual property permits for extra hands-on wealth-building, whereas shares are extra hands-off and depending on broader market forces.

The Smartest Technique May Be a Combine

In the end, the very best reply to the actual property vs. shares debate is usually this: do each for those who can. There’s no rule that claims you need to choose one. In actual fact, the wealthiest people usually diversify throughout each asset courses to stability danger and capitalize on several types of progress.

You would possibly begin with shares to construct capital rapidly after which shift to actual property after you have sufficient for a down cost. Otherwise you would possibly spend money on actual property first and use the money circulate to fund your Roth IRA or taxable brokerage account. One grows steadily within the background, the opposite supplies extra direct, leveraged earnings for those who’re keen to place within the work.

Know Your self Earlier than You Select

So, the place do you have to construct wealth? The reply depends upon your earnings, time availability, consolation with danger, and long-term targets. Actual property would possibly swimsuit you higher for those who like stability, management, and tangible belongings. The inventory market might be your greatest good friend for those who desire liquidity, automation, and diversification. And for those who’re critical about reaching monetary independence, the neatest transfer may be to grasp each worlds—strategically, patiently, and with a plan that matches your distinctive life.

Are you constructing wealth with actual property, shares, or a mixture of each? What’s labored or failed for you to date?

Learn Extra:

12 Investing Traditions Wall Street Hopes You’ll Follow Forever

Simple Steps to Financial Independence: How Smart Investing Can Build Your Wealth

Riley is an Arizona native with over 9 years of writing expertise. From private finance to journey to digital advertising and marketing to popular culture, she’s written about every thing underneath the solar. When she’s not writing, she’s spending her time outdoors, studying, or cuddling together with her two corgis.