Low earnings dwelling might be fairly difficult, particularly if you’re in search of ways to save money on a decent funds. However with a little bit little bit of creativity and planning, you may study the right way to funds cash and be pleased with a low-income dwelling.

No matter your monetary targets are, to repay the mortgage on your own home, paying off a debt, or simply begin investing, it is advisable create a funds. You can’t simply preserve spending cash because it comes.

Even with a low earnings of say $ 500 per 30 days, you may efficiently funds and enhance your monetary place. Make it possible for the complete household is in whereas creating the funds.

As well as, see that you simply get out of debt first earlier than you begin making a funds. There are a lot of methods for the right way to get out of debt on a low earnings.

Tip: For one, you can begin hustling and look out for tactics to earn more cash on the aspect with side gigs.

8 Methods to Efficiently Finances Your Cash on a Low Revenue

#1. Monitoring Spending

The best way to make a funds? Earlier than you put together a funds, monitor your spending for just a few months. Hold all receipts to know the place you might be spending. You can also make use of monitoring software program after which study areas the place you can begin making cuts.

Tip1: Really, you don’t need to manually monitor down each burger you’ve. Simply use a single debit card or bank card. The know-how will deal with the monitoring.

Tip 2: Use bank cards for requirements and a debit card for leisure, journey and different areas the place you are inclined to spend greater than crucial.

Should Learn – How to Use a Credit Card Responsibly – Tips and Advice

#2. The best way to Make a Finances Plan? Make it a Household Affair

Just remember to and your partner shares the identical monetary targets. Contain your kids as properly. They could be into costly soccer or music classes. Inform them precisely how a lot such actions value and the quantity that you’re able to allocate for these. Determine which exercise stays and which must go.

#3. Making a Adequate Finances

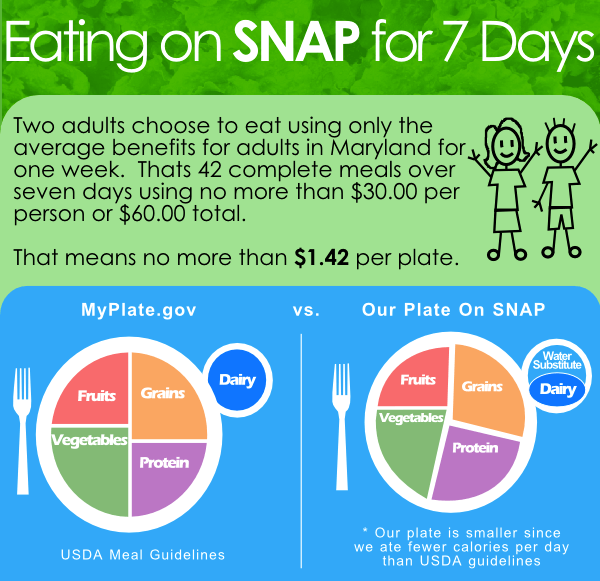

The best way to create a funds plan? Some payments are associated to utilities, housing, meals and transportation that you simply simply can not keep away from. Whereas making an attempt to funds your cash, ensure that there’s sufficient cash allotted for these bills. In any other case, you’ll solely find yourself utilizing the cash positioned for different gadgets.

Whereas in search of funds assist, you may lower down the cash allotted for unpredictable gadgets, like a trip; items; house enhancements and so forth. Use on-line budgeting instruments like Mint as a funds supervisor to create your funds.

#4. Trimming and Slicing

As a part of budgeting suggestions for low earnings households, attempt eliminating a few of these fancy luxuries in your life. As an example, if you happen to discover that you’ve a flowery plan in your cellular phone, you may change it.

Do you usually purchase takeaway meals? When planning a low earnings funds, why not herald your lunch from house. Are you making undesirable health club membership funds or cable funds that you simply don’t even use?

You could possibly simply do with out that morning latte whereas dwelling on a funds. Hold housing prices low, at round 25% of the take house quantity and even much less. These are vital points of funds tips.

However whereas making a funds plan, don’t deprive your self of each little enjoyment in life or you’ll lose the motivation very quickly in any respect. You don’t need to nix every little thing that you simply get pleasure from. Simply go for extra reasonably priced choices.

#5. Creating Funds for Emergencies

You want a small cushion of financial savings to fall again in an emergency, as a part of dwelling on a low earnings suggestions. This could possibly be anyplace round 3 to six months of bills. As an example, you would face an sudden automobile restore. Or, God forbid, you would lose your job.

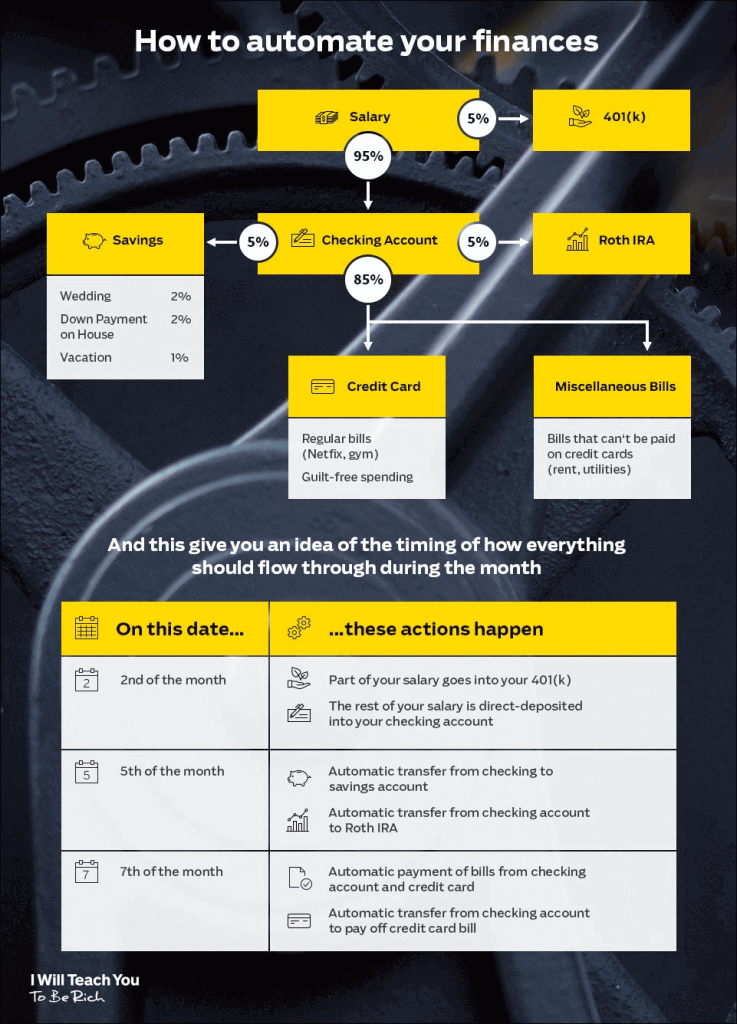

Determine how a lot you wish to save after which use computerized switch of your cash to the emergency financial savings account.

#6. Frugal Practices – Greatest Solution to Finances Cash

Be frugal however don’t let it change into so irritating. This is rather like weight-reduction plan. When you pressure an excessive amount of, you’ll solely find yourself dishonest.

- Minimize cable and different companies that you simply don’t actually use, as a part of dwelling on a low earnings suggestions.

- Negotiate for decrease charges.

- Make changes to scale back electrical energy payments.

- Go for picnics within the native park, the seaside, and different free occasions.

- Don’t purchase on a whim and attempt to get a reimbursement whereas purchasing by utilizing Ebates.

- Go in for used clothes, automobiles, electronics. Ebay is nice for getting some killer offers.

#7. Zero Sum Finances

If you wish to reside wealthy on a small earnings, give every greenback of your earnings a job, so that you simply don’t waste a single greenback of your earnings. The purpose of a zero sum funds is to succeed in zero on the finish of the month. However this solely works in case you have an excellent financial savings cushion.

Your earnings minus your expenditure have to be equal to zero. When you discover that you’ve $400 left on the finish of the month, inform it the place to go. It could possibly be to repay a debt, for investing, emergency financial savings and many others.

Additionally Learn – 12 Powerful Ways to Get Your Financial Life in Order

#8. Automated Financial savings

When you’re in search of a low earnings funds planner, just be sure you automate financial savings like paying into 401k, investments and so forth. You will have the very best of intentions, however someday you discover that you simply don’t have sufficient left over for financial savings after paying your payments.

Hyperlink your checking account along with your financial savings account. Make it possible for the designated a part of the paycheck is routinely deposited in your financial savings account instantly. When you’re paid on a weekly foundation, ensure that the cash is routinely transferred into the financial savings account.

Tip: Probably the most difficult side is that you shouldn’t contact this cash, until there’s an emergency.

Final Phrase

It may be extraordinarily tough to reside on a small earnings and likewise create emergency funds, retirement funds and many others. Step one try to be taking is to get management over your money owed. Calculate your dwelling prices utilizing a funds planner.

This gives you a transparent image of your place, your earnings, spending and what it can save you. As well as, you’ll study whether or not you’ll be able to reside inside your means and the place it is advisable make cuts and trims in your life-style.

You may even attempt to increase your income after which management the quantity that goes out. All it will put you in control of your cash, as an alternative of permitting the cash to manage you. Now that you simply get that, you may confidently take your first step in direction of attaining your monetary targets.