Payroll giving is an more and more common effort that permits workers to contribute on to charitable causes via computerized deductions from their paychecks. For nonprofits, this presents a singular alternative to faucet into the philanthropic spirit of corporations’ workers.

Serious about discovering how your individual nonprofit can achieve this? We’ll cowl every little thing it’s essential learn about payroll giving right here.

This consists of:

By leveraging worker assist via payroll giving, organizations can drive significant change whereas concurrently enriching the office tradition. Learn on to learn the way.

What’s Payroll Giving?

Payroll giving is a charitable contribution methodology that permits workers of taking part corporations to donate a portion of their wage on to nonprofit organizations via computerized deductions from their paychecks regularly.

This method simplifies the donation course of, making it straightforward for workers to assist causes they care about without having to handle separate transactions or giving efforts. In the meantime, organizations obtain extra assist and assets via the applications, permitting them to make a bigger influence of their respective missions.

Usually, corporations’ workers can select how a lot they need to contribute and choose the supposed recipient from a listing of accredited charities or organizations. The donations are then collected by the employer and forwarded to the chosen nonprofits, typically in response to a month-to-month or quarterly construction.

What Are the Advantages of Payroll Giving for Nonprofits?

Based on payroll giving statistics from Double the Donation, almost 6 million U.S. workers donate via payroll giving applications. That’s greater than $173 million annually, which is a giant chunk of funding that may make a major influence on nonprofits like yours.

Right here’s how:

1. Payroll Giving Creates a Dependable Supply of Revenue

Payroll giving offers nonprofits with constant, recurring donations, enabling them to plan extra successfully and allocate assets effectively. This predictable revenue stream helps organizations maintain ongoing applications, fund new initiatives, and handle operational prices with higher stability.

With common contributions arriving all year long, nonprofits can fear much less about fluctuating funding and focus extra on reaching their mission.

2. Payroll Giving Encourages Lengthy-Time period Donor Relationships

Payroll giving fosters a tradition of sustained giving, as donors decide to contributing a portion of their wage regularly. This long-term dedication builds deeper connections between donors and the causes they assist, leading to increased donor retention charges.

3. Payroll Giving Reduces Administrative Overhead

Since payroll donations are mechanically deducted from an worker’s paycheck, nonprofits typically face decrease administrative burdens in comparison with processing particular person one-time items. These automated programs scale back the necessity for intensive follow-up, knowledge entry, or fee monitoring, permitting nonprofits to allocate extra assets to their applications and outreach efforts.

4. Payroll Giving Amplifies Donations By way of Matching Packages

Many employers supply matching gift programs alongside payroll giving, doubling and even tripling the influence of workers’ contributions. For nonprofits, which means each greenback donated via payroll giving has the potential to go even additional, maximizing the general influence of this system.

Selling these matching alternatives encourages extra workers to take part, making a win-win for donors, corporations, and nonprofits alike.

5. Payroll Giving Strengthens Company Partnerships

Payroll giving applications typically function a bridge between nonprofits and company companions, enhancing collaboration and fostering goodwill. By supporting these initiatives, corporations reveal their dedication to Corporate Social Responsibility (or CSR), whereas nonprofits achieve helpful allies in spreading consciousness and rising their donor base.

These partnerships can result in extra assist, akin to sponsorships, volunteer applications, or in-kind donations, too.

6. Payroll Giving Expands Donor Attain

Office giving applications introduce nonprofits to new audiences they won’t in any other case attain. Staff who take part in payroll giving could not have beforehand donated however are motivated by the comfort and encouragement of their employer’s program. Over time, these people may even turn into passionate supporters and advocates for the nonprofit’s mission.

7. Payroll Giving Supplies a Aggressive Edge

For nonprofits searching for to face out within the crowded fundraising panorama, payroll giving affords a singular benefit. The streamlined, hassle-free nature of those applications makes them interesting to donors and provides nonprofits an edge in retaining long-term assist. Moreover, providing payroll giving as an choice indicators that the group is revolutionary and aligned with fashionable fundraising and company partnership practices.

How Does Payroll Giving Profit Firms + Staff?

Payroll giving applications additionally profit each corporations and workers in a number of significant methods, enhancing office tradition, worker satisfaction, and group influence.

Right here’s a breakdown of the advantages:

Advantages for Firms

- Enhanced Company Social Duty (CSR) Profile

Payroll giving demonstrates an organization’s dedication to supporting communities and aligns with CSR initiatives, enhancing the corporate’s popularity and attraction to socially aware stakeholders. - Improved Worker Engagement and Retention

Staff worth alternatives to contribute to causes they care about, and payroll giving applications make it straightforward. This boosts morale, engagement, and loyalty, decreasing turnover charges. - Strengthened Neighborhood Ties

By enabling workers to assist native or world causes, corporations foster stronger relationships with the group, creating goodwill and unleashing the potential for brand new partnerships.

Advantages for Staff

- Comfort in Giving

Payroll giving permits workers to donate immediately from their paycheck, making the method seamless and eliminating the necessity for separate transactions. - Elevated Giving Energy

Many corporations supply matching present applications that amplify worker donations, maximizing the influence of their contributions with out extra price to the worker. - Tax Effectivity

Payroll donations are sometimes pre-tax, decreasing the taxable revenue for workers whereas making certain their chosen charity receives the total donation quantity. - Empowerment and Goal

Staff really feel extra linked to their firm and their chosen causes, fostering a way of delight and goal of their work.

All in all, payroll giving creates a win-win state of affairs for corporations and workers, constructing a constructive office setting whereas driving vital social influence. It enhances private success for workers and strengthens the corporate’s function as a group chief.

What Does the Payroll Giving Course of Look Like?

The payroll giving course of is designed to make charitable contributions easy, seamless, and impactful for each workers and employers.

Right here’s a step-by-step breakdown of the way it usually works:

1. Program Setup by Employer

If an organization is all for growing a payroll giving program, step one is usually to pick a payroll giving supplier to facilitate and streamline the method. From there, it’s time to outline insurance policies and set up particular tips for this system. This could embody worker and nonprofit eligibility, frequency of deductions, and whether or not they’ll supply matching items or different incentives.

Then, the corporate begins selling this system and educating its workforce concerning the giving alternative via onboarding, inside communications, and varied promotional campaigns to maximise participation.

2. Worker Enrollment

workers can then resolve to enroll within the payroll giving program by choosing a charity they want to assist, typically from a listing of registered organizations. Staff resolve how a lot they need to contribute per paycheck, typically with the choice to set a set quantity or a share of their wage.

This a part of the method is often finished by finishing a easy enrollment kind or on-line course of, authorizing the employer to mechanically deduct the accredited quantity immediately from the person’s paychecks going ahead.

3. Payroll Deductions

As soon as enrolled, the desired donation quantity is mechanically deducted from the worker’s paycheck, typically pre-tax (although this will rely on native tips and rules).

Deductions are typically mirrored on workers’ pay stubs, offering a transparent document for transparency and tax functions.

4. Funds Distribution

Lastly, donors’ using corporations—or their giving platforms—consolidate all worker donations. From there, funds are distributed to the chosen nonprofits on a daily schedule (e.g., month-to-month or quarterly), making certain well timed supply.

8 Firms Providing Payroll Giving Packages

For the very best outcomes, nonprofits must be aware of corporations providing payroll giving applications. In spite of everything, these initiatives will enable organizations to considerably improve their fundraising methods, as they supply a dependable supply of funding via recurring, employer-sponsored donations.

Whereas we will’t listing all of them, we now have chosen just a few examples of well-known corporations with payroll giving alternatives to highlight under. These embody:

In search of much more examples of corporations with payroll giving applications—together with different giving alternatives? Contemplate investing in a office giving database like Double the Donation!

Ideas for Rising Assist By way of Payroll Giving

Rising assist via payroll giving requires strategic planning and efficient communication along with your viewers. Listed here are some greatest practices to boost participation and engagement:

Pre-register for corporations’ giving portals.

To maximise the potential of payroll giving, nonprofits ought to guarantee their group is listed and up-to-date in companies’ workplace giving portals. In spite of everything, many companies use platforms like Benevity or CyberGrants to handle worker giving applications. By pre-registering, nonprofits make it simpler for workers to pick their group and begin donating.

- Greatest Practices for Pre-registration:

- Confirm eligibility and full all required certifications.

- Present detailed, compelling descriptions of your mission and applications.

- Frequently replace contact and fee particulars to keep away from disruptions.

Pre-registration reduces limitations for donors and ensures that workers can simply discover and assist your group. It additionally demonstrates professionalism and preparedness, enhancing your credibility with each corporations and their workers.

Concentrate on the advantages and influence of payroll giving.

Speaking the advantages and real-world influence of payroll giving is essential for partaking potential donors. Subsequently, it’s a good suggestion to focus on how payroll giving simplifies contributions and amplifies their influence, particularly when paired with different applications, like matching items.

Share tangible examples of how payroll giving has reworked your applications, supported your beneficiaries, or helped obtain particular objectives. Use metrics, pictures, or movies to make the influence relatable and actual. And don’t overlook the facility of a donor story or testimonial, both.

Present unique incentives for payroll giving donors.

Encouraging donors to decide to payroll giving could be simpler when unique perks are supplied. A majority of these incentives make donors really feel valued and appreciated whereas fostering a way of group amongst supporters.

Listed here are just a few concepts you may take into account:

- Early entry to occasion tickets or particular donor-only occasions.

- Personalised thank-you messages or recognition in newsletters and annual reviews.

- Branded merchandise, akin to tote baggage, T-shirts, or mugs, for payroll donors.

- Unique updates or behind-the-scenes content material about your applications.

Optimistic incentives create a constructive suggestions loop, the place donors really feel rewarded for his or her generosity, rising their probability of staying dedicated to your group long-term. Plus, it may be simply what on-the-fence supporters must make the primary leap and enroll in this system!

See it in Motion: Nonprofits Selling Payroll Giving Nicely

Many nonprofits have established efficient methods for selling payroll giving alternatives, showcasing revolutionary methods to have interaction workers and companies alike. Listed here are just a few examples of organizations that are likely to excel on this space:

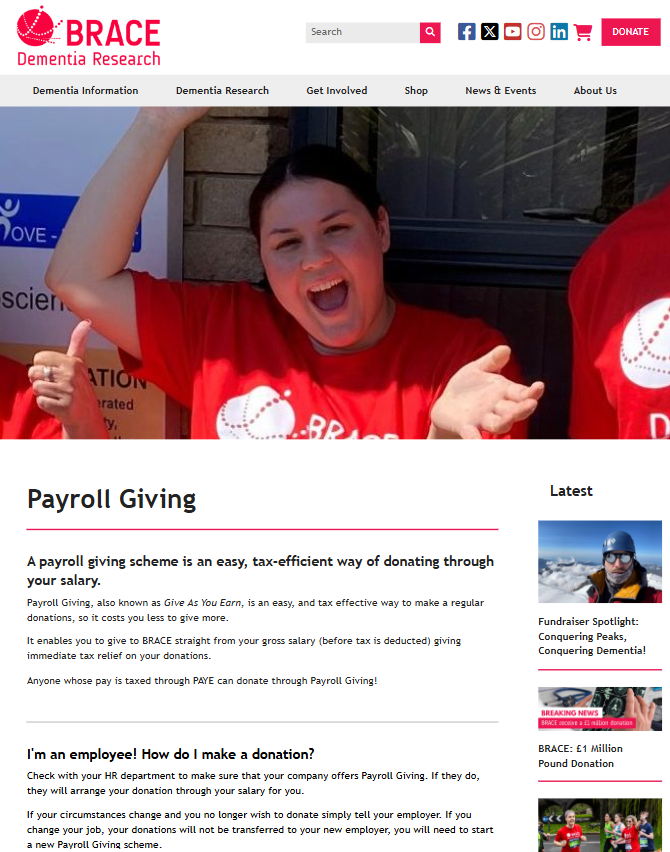

BRACE Dementia Analysis

BRACE Dementia Analysis is a well being and medical group devoted to funding analysis into Alzheimer’s illness and different types of dementia. So as to garner assist via the applications, BRACE has established a devoted Payroll Giving landing page on its web site.

This useful resource offers detailed details about payroll giving applications, how donors can become involved, and extra. Plus, they even present quite a lot of employer assets, together with postcards, flyers, and a step-by-step program creation walkthrough.

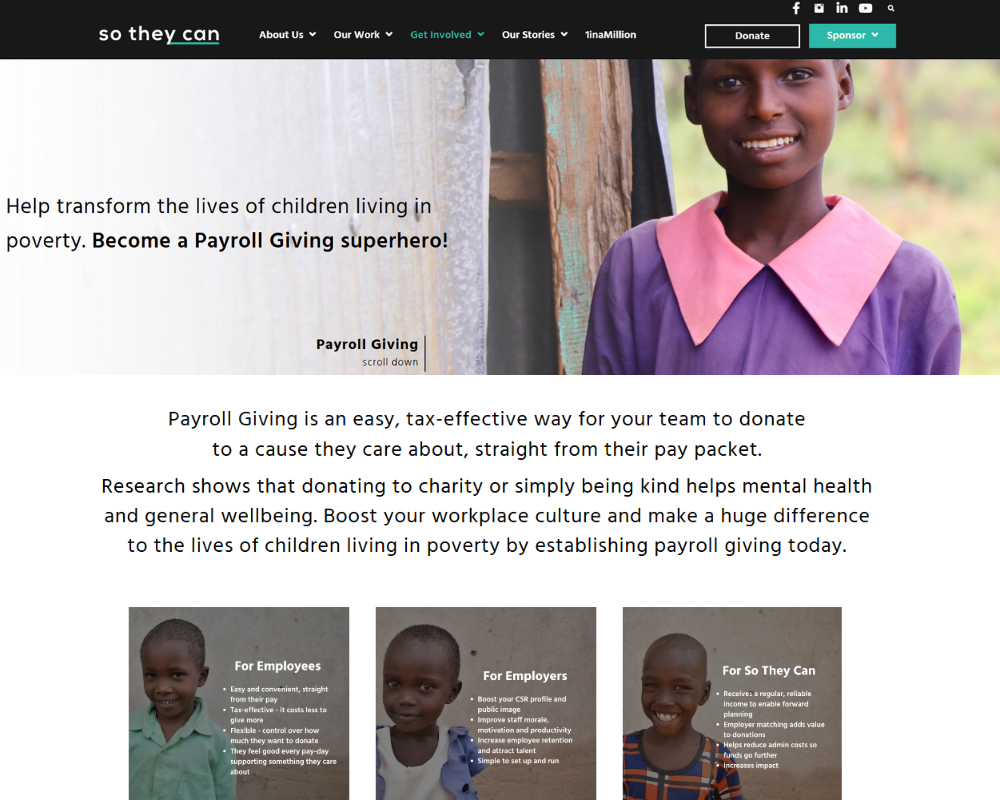

So They Can

So They Can is a global NGO targeted on training and empowerment tasks in East Africa. This nonprofit has additionally constructed a devoted Payroll Giving page on its web site, encouraging donors to turn into “Payroll Giving superheroes” by partaking within the applications.

One factor that makes the web page stand out is its deal with the advantages of payroll giving for workers, employers, and the group itself.

Water Assist

WaterAid is a world group working to offer clear water, respectable bogs, and good hygiene in growing nations. The nonprofit highlights payroll deduction items as a number one method for donors to make a distinction, and it does so particularly with the Payroll Giving landing page under.

The group’s FAQ part additionally calls out one other type of office giving that usually goes hand-in-hand with payroll giving: matching items. It even hyperlinks to the nonprofit’s workplace giving database tool for donors to simply uncover their eligibility for a match.

WWF

WWF, also called the World Wildlife Fund, is a global conservation group targeted on preserving the world’s most susceptible species and ecosystems. So as to drive assist via payroll giving donations, WWF has established the following page devoted to the applications:

The web page additionally hyperlinks to a video that additional explains the payroll giving alternative, empowering donors and firms alike to study extra and become involved with the applications. They usually actually deal with the tax advantages, too—driving the concept that a $5 month-to-month donation will price not more than $4!

CLEFT

CLEFT is a charity devoted to funding analysis and remedy for cleft lip and palate situations. So as to achieve assist via payroll giving applications, the group has taken to social media to make its appeals.

This instance Fb put up demonstrates the widespread advantages of getting concerned with payroll giving, together with offering the steps a donor might take to get arrange.

Sands

Sands, the Stillbirth and Neonatal Loss of life Charity, is a UK-based group supporting anybody affected by the dying of a child and selling analysis to scale back the lack of infants’ lives. The nonprofit lately celebrated Payroll Giving Month with the next put up to its social media feeds:

This enables followers to study extra concerning the payroll giving alternative and even offers context for these whose workplaces are usually not presently arrange for the applications.

Kawartha Lakes Meals Supply

Kawartha Lakes Meals Supply (or KLFS) is a not-for-profit distribution heart supplying meals and private care gadgets to member organizations within the Metropolis of Kawartha Lakes. Because the group goals to boost extra via payroll giving applications, the workforce shared the next social media put up to boost consciousness:

This outlines the payroll giving alternative and encourages donors to get in touch with their payroll departments to get arrange.

Wrapping Up & Further Sources

Payroll giving stands out as a strong and environment friendly method for nonprofits to harness worker contributions and create a long-lasting influence on their causes. By facilitating easy donations immediately from supporters’ paychecks, organizations can construct a dependable funding stream that helps their missions and applications.

Finally, payroll giving represents a win-win state of affairs. It allows workers to make significant contributions whereas empowering nonprofits to do greater than ever earlier than. By embracing this collaborative strategy, each events can work collectively to create constructive change.

Serious about studying extra about office giving alternatives and past? Try these really useful assets to maintain studying: