A younger woman the place I volunteer requested me once I began saving. I began saving as a toddler, however had no cash saved till almost thirty years later once I began down a “secure” profession path after graduating with an engineering diploma and an MBA. I described to her that Constancy’s guideline is to have one 12 months’s revenue saved by age 30 and 10 occasions your revenue by the point you retire. The following query was, “How do you defend your financial savings from extreme corrections in retirement?” I defined that inflation is the silent threat of being too conservative and described goal date funds as maybe being ultimate for somebody beginning out in financial savings when the each day challenges of dwelling and work life weigh heavy on time necessities.

Overview of Secular Markets

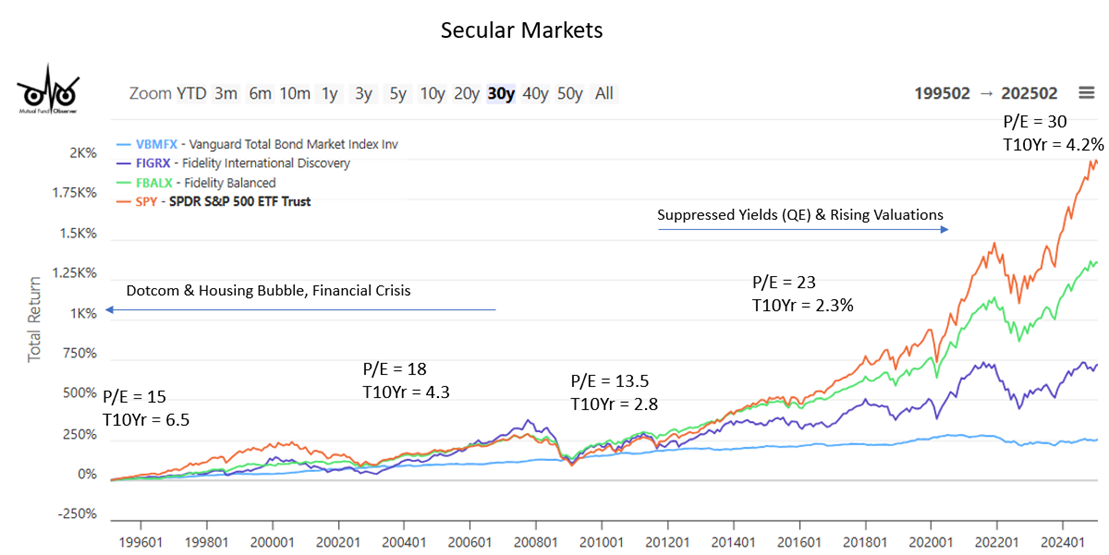

Secular markets can play a significant position in your success as an investor over your lifetime. Determine #1 exhibits the returns for the previous thirty years for the S&P 500 (SPY), Vanguard Complete Bond Market fund (VBMFX), Constancy Worldwide Uncover fund (FIGRX), and Constancy Balanced fund (FBALX). The plain conclusion is that the S&P 500 has outperformed the opposite asset lessons by a big margin, however it could be a poor assumption to imagine that this holds true for the following ten or twenty years.

Determine #1: Fairness and Bond Markets with Valuations and 10-12 months Treasury Yields

Three of an important components for future returns are beginning valuations and yields, together with inflation. Ed Easterling is the founding father of Crestmont Research and writer of Unexpected Returns: Understanding Secular Stock and Probable Outcomes: Secular Stock Market Insights, which give unimaginable perception into the connection of those components. For these excited about long-term tendencies for the inventory market, I like to recommend studying Mr. Easterling’s The P/E Report: Annual Review Of The Price/Earnings Ratio. He concludes that the “inventory market’s valuation stays too elevated for an prolonged interval of above-average returns.” He describes that this may increasingly happen “both by a major decline over a shorter interval or by a minimal decline over an extended interval.”

Secular Markets 1995 – 2012

NOTE: Throughout the 1995 to 2012 interval, actual GDP averaged 2.6% yearly. The inhabitants progress price declined from 1.2% in 1995 to 0.73% in 2012. Inhabitants progress is a key driver of financial progress.

Discover in Determine #1 above that the Constancy Balanced fund (FBALX) carried out in addition to the S&P 500 for the primary twenty years. Why? For the primary twenty years, the price-to-earnings ratio (P/E) hovered across the long-term median outdoors of recessions of about 15 aside from the 1997 to 2002 run-up within the Dotcom bubble, which reached 34. Secondly, an investor might make respectable returns in bonds. The Vanguard Complete Bond Market fund (VBMFX) had a mean annualized return of about 6.5% from 1995 by means of 2022. The Constancy Balanced fund (FBALX) did in addition to the S&P 500 as a result of shares and bonds are inversely associated, and when shares decline, bonds usually go up. Additionally, discover that worldwide shares carried out in addition to the S&P 500 all through most of this time interval. A diversified portfolio would have carried out properly.

Secular Markets 2012+

NOTE: From 2013 to 2024, actual GDP grew at an annualized price of two.5% yearly. Inhabitants progress fell to 0.59% throughout this time interval.

The Nice Monetary Disaster of 2008/2009 modified the market surroundings with Quantitative Easing that the Federal Reserve started in 2008 and the Troubled Asset Reduction Program (TARP) that Congress handed in 2009. They served their objective to avert a significant melancholy by offering stability and stimulus. Nonetheless, continued simple financial coverage and extra stimulus throughout the COVID recession have suppressed bond yields for many of the previous fifteen years. The P/E ratio has risen to shut to 30, which is close to the costly ranges of the Dotcom years. Quantitative Tightening, a recovering financial system, and Inflation have pushed bond yields again as much as regular ranges.

The Federal deficit has risen from 2.5% of gross home product (GDP) in 1995 to over 6% final 12 months. This precipitated the Federal debt to rise from 65% of GDP to 122% now. That is unsustainable.

Present Funding Setting

The Federal Reserve launched its March 19, 2025, FOMC Projections by which the median estimates of actual GDP are 1.7% to 1.8% for 2025 by means of 2027 and 1.8% for the longer run. Inflation for Private Consumption Expenditures is estimated to fall to 2.2% in 2026 and attain the baseline of two.0% in 2027. The Federal Funds price is estimated to fall step by step to three.1 in 2027 and be 3.0% in the long term. After all, tariffs add uncertainty to forecasts.

Davide Barbuscia studies in “Moody’s Says US Fiscal Strength On Course For Continued Decline” at Reuters that “the U.S.’ fiscal power is on observe for a continued multi-year decline as finances deficits widen and debt turns into much less inexpensive.” Moody’s says that debt affordability is weaker than for different extremely rated sovereigns. Based on Moody’s, persistently excessive tariffs are prone to hinder progress.

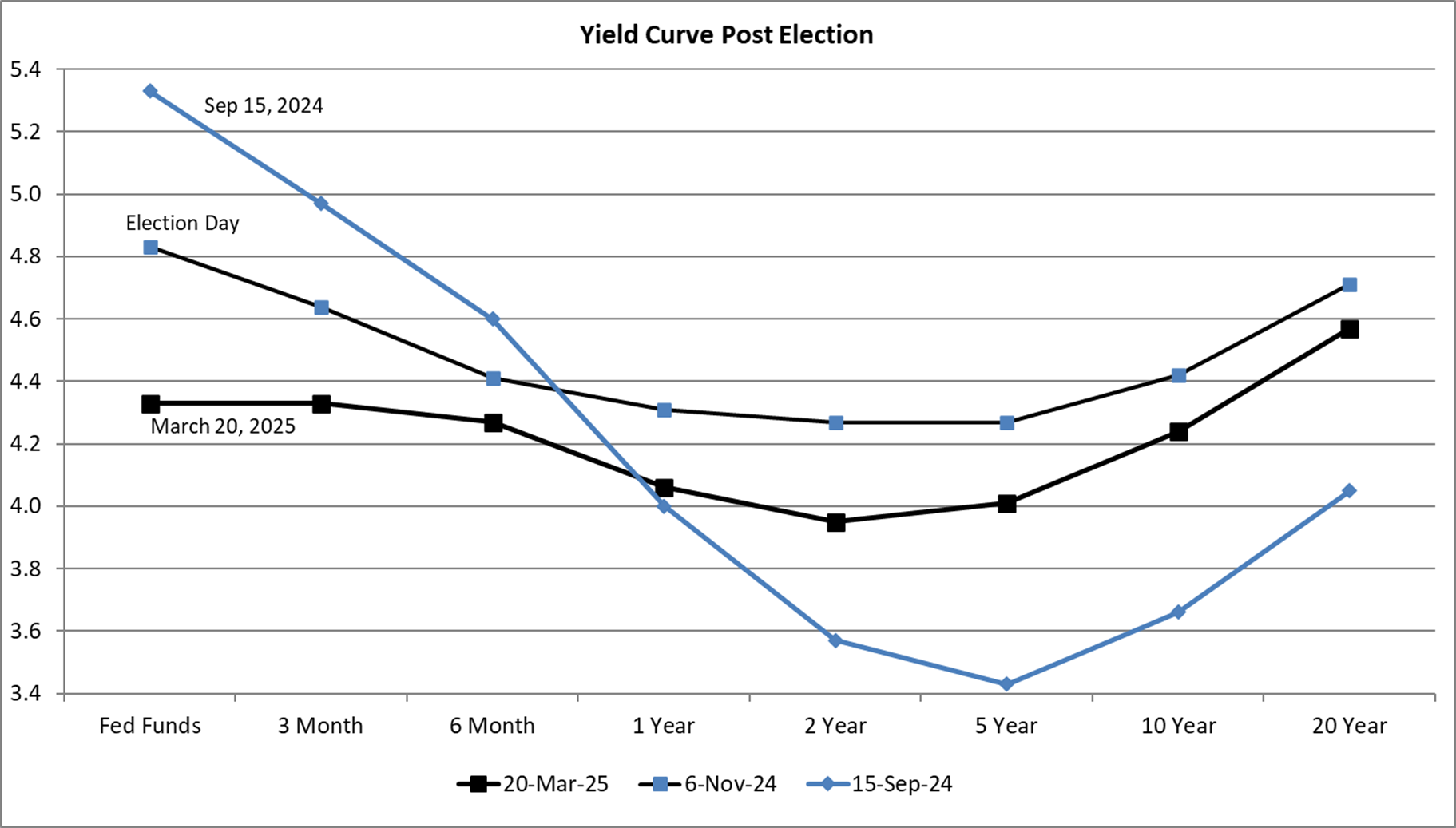

An inverted yield curve is when long-term charges are decrease than short-term charges. It makes it more durable for banks to lend cash, which greases the wheels of business. An inverted yield curve has been a dependable indicator of recessions. Determine #2 exhibits the inverted yield curve in September earlier than the Federal Reserve lowered short-term rates of interest. The yield curve on Election Day recommended that traders thought the Federal Reserve would possibly obtain a “smooth touchdown” and keep away from a recession. Components of the present yield curve have inverted as traders are actually involved about tariffs rising inflation and that the financial system is slowing.

Determine #2: Treasury Yield Curves – Previous Six Months

Desk #1 incorporates Lipper Bond Classes that I put in my long-term funding bucket technique. Intermediate yields have been falling, so bonds with longer durations have returned 2% to three% over the previous three months. Yields are largely over 4%, offering revenue for retirees.

Desk #1: Funding Bucket #3 – Bonds with Writer’s High-Rated Funds

Supply: Writer utilizing MFO Premium fund screener and Lipper international dataset; Morningstar for three-month return as of March twenty first

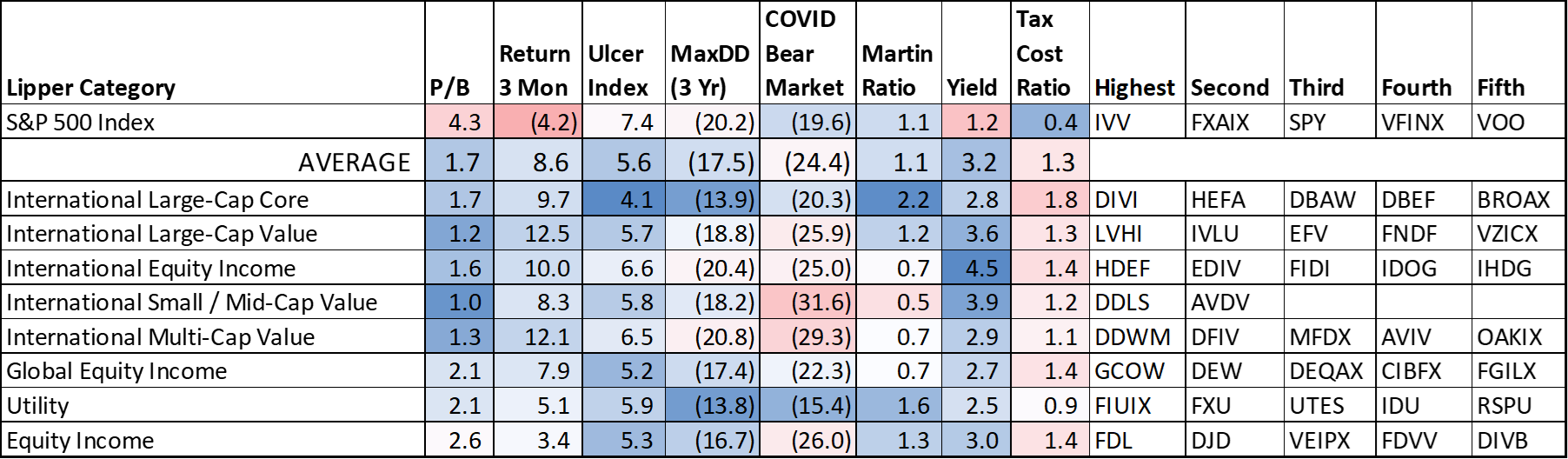

Desk #2 exhibits what I name Tier One Lipper fairness classes with low Value-to-Guide (P/B) valuations, decrease threat (Ulcer Index), and better yields in comparison with the S&P 500 as of March 21st. The S&P 500 is down 4.2% for the previous three months however has corrected about 10% from its February excessive. Worldwide fairness funds have returned 8% to 13% over the previous three months. The P/B is lower than half of the S&P 500, and yields are two to 3 occasions that of the S&P 500. Buybacks for US corporations have contributed to decrease yields within the US as a result of capital positive factors are usually taxed at decrease charges than abnormal dividends. Rising worldwide fairness funds have lowered the impression of the S&P 500 falling in diversified portfolios.

Desk #2: Lipper Fairness Classes with Low Valuations, Decrease Danger, and Excessive Yields

Supply: Writer utilizing MFO Premium fund screener and Lipper international dataset; Morningstar for three-month return as of March twenty first

The Coming Decade(s)

The Congressional Finances Workplace revealed Projections of Deficits and Debt Under Alternative Scenarios for the Budget and Interest Rates final month which analyzed the case the place provisions of the 2017 tax act that modified the person revenue tax are prolonged indefinitely, together with decrease statutory tax charges, the adjustments to allowable deductions, the bigger youngster tax credit score, the 20 % deduction for sure enterprise revenue, and the revenue ranges at which the choice minimal tax takes impact. They conclude that if the 2017 Tax Act is prolonged, “Major deficits over the primary decade of the projection interval (fiscal years 2025 to 2034) are about $4 trillion bigger. By 2054, the first deficit equals 3.7 % of GDP, 1.5 proportion factors greater than in CBO’s prolonged baseline.”

Inflation is an increase in costs for items and providers. Tariffs are a tax on importers, which undoubtedly can be handed on to customers. Tariffs are a one-time improve in costs to the next degree. The impression is greater long-term costs till provide chains have time to at the very least partially modify. Economists attribute the commerce deficit to a excessive price of home consumption and a low financial savings price. Excessive labor charges within the US in comparison with growing international locations and mobility of expertise have additionally contributed to the deficit. Growing tariffs doesn’t tackle these components.

Blended Asset Funds

Blended-Asset (MA) funds put money into a number of asset lessons, together with shares and bonds, and will embody worldwide equities. I like them for youthful traders who desire a skilled supervisor to pick out investments and rebalance. In retirement, I like having extra management over withdrawal methods and solely having a small quantity invested in MA funds.

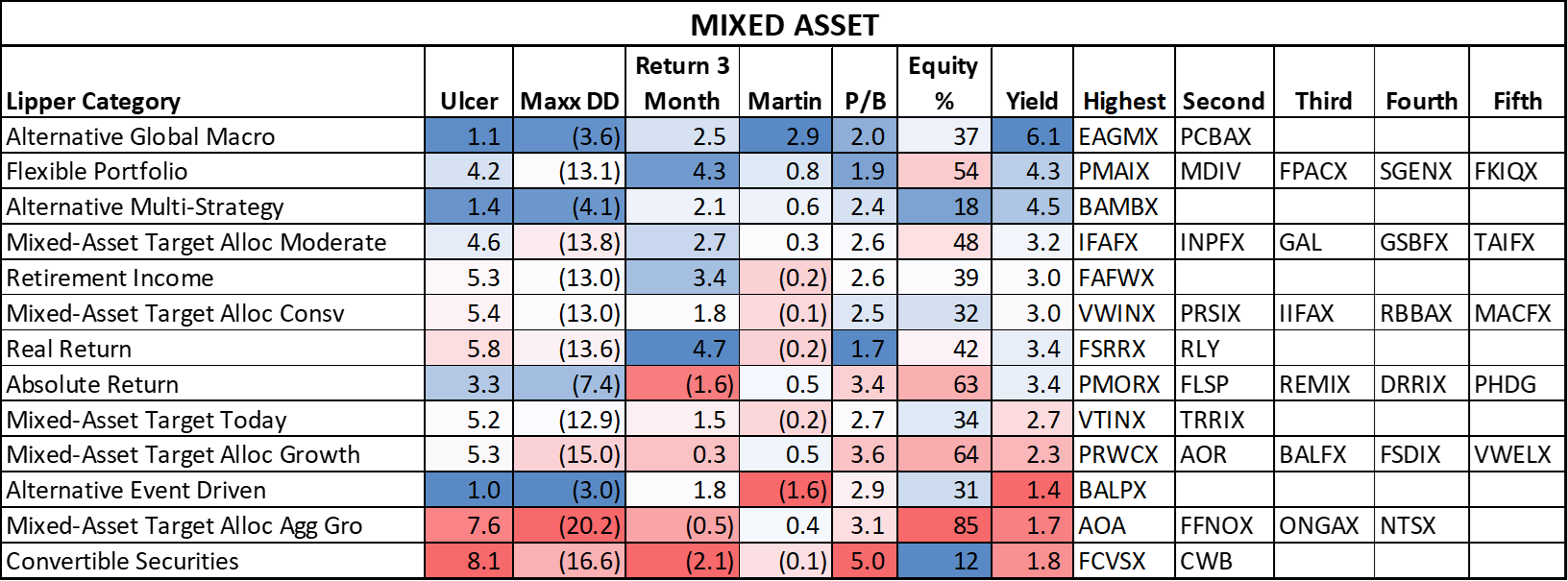

Desk #3 incorporates a subset of the mixed-asset funds that I observe. The return over the previous three months exhibits how they’re performing now, however I believe it additionally offers a glimpse into the long run. I anticipate funds with decrease valuations, worldwide publicity, greater allocations to bonds, and better yields to outperform on a risk-adjusted foundation.

Desk #3: Blended Asset Funds with Writer’s High-Rated Funds

Supply: Writer utilizing MFO Premium fund screener and Lipper international dataset; Morningstar for three-month return as of March twenty first

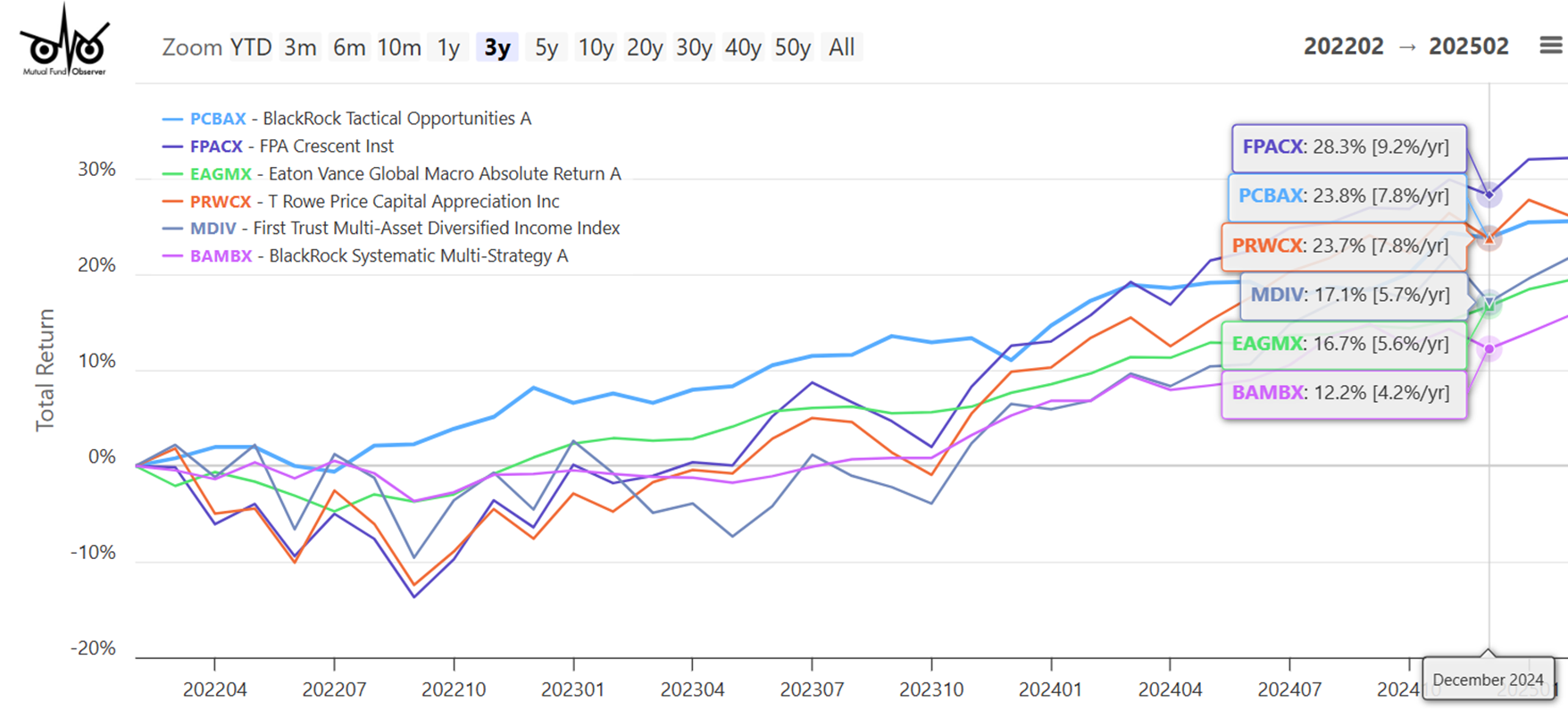

Determine #3 exhibits the three-year efficiency of chosen funds. Beneath are proven some attention-grabbing prospects. I’ll watch the markets for the following few months earlier than making any selections. At first look, BlackRock Tactical Alternatives (PCBAX) and Eaton Vance World Macro Absolute Return (EAGMX) enchantment to me. Each can be found at Constancy with out transaction charges and with the load waived.

Determine #3: Chosen Blended-Asset Funds

Closing

What has propelled the US inventory markets greater over the previous a number of years is straightforward financial coverage, Federal stimulus, and rising valuations. I imagine that uncertainty is taking its toll on traders and customers. A diversified portfolio with bonds and worldwide equities ought to carry out properly within the coming decade due to favorable valuations internationally and normalized bond yields.