There could also be a spot for tax-exempt municipal bond funds within the portfolios of middle-class and upper-middle-class American households in addition to for these within the upper-income group. I’ve about 15% of my fixed-income funds invested in municipal bonds. They could be appropriate in long-term after-tax accounts the place you need to scale back taxes. State-focused municipal bond funds might also scale back state revenue taxes. This text discusses 5 Lipper Municipal Bond classes with respect to growing yield whereas managing danger.

I personal Vanguard Tax-Exempt Bond Index ETF (VTEB), Constancy Tax-Free Bond (FTABX), Vanguard Excessive-Yield Tax-Exempt Inv (VWAHX), Vanguard Tax-Exempt Bond Index Admiral (VTEAX), and Constancy Intermediate Municipal Revenue (FLTMX) from the Municipal Basic & Insured Debt and Municipal Intermediate Debt classes. Observe that Vanguard Excessive-Yield Tax-Exempt Inv (VWAHX) is within the Municipal Basic & Insured Debt class and never the Municipal Excessive Yield class.

Tax Brackets For 2025

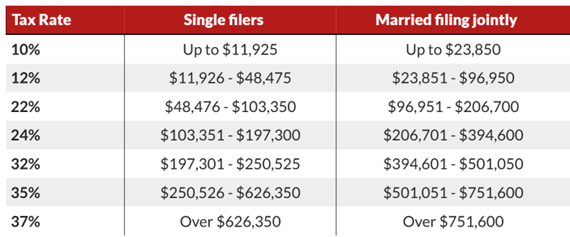

Daniel Bortz at AARP wrote Here Are the Federal Income Tax Brackets for 2025 with the next desk. The important thing brackets are having revenue ranges the place marginal tax charges bounce from 12% to 22% and from 24% to 32%. One more reason to personal municipal bonds is to carry them in a long-term account the place the revenue shouldn’t be wanted and also you need to maintain taxes low.

Desk #1: Federal Revenue Tax Brackets for 2025.

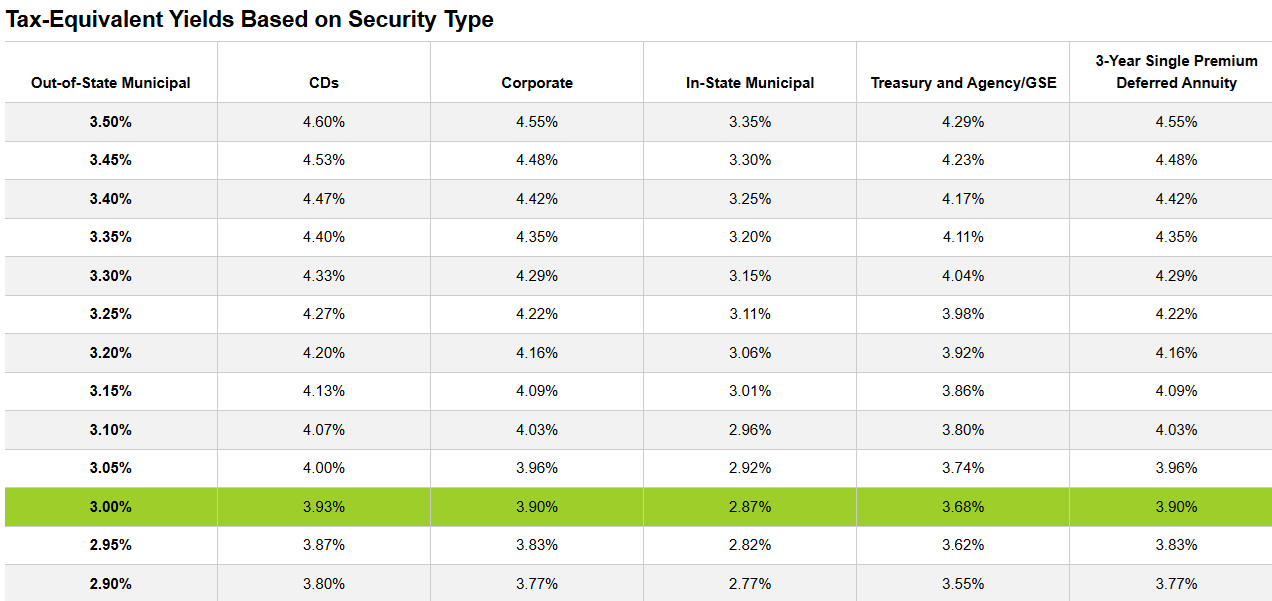

Constancy Tax Equal Yields Calculator

Constancy has a nifty Calculator for Fastened Revenue Taxable-Equal Yields for Particular person Bonds, CDs, & SPDAs. The hyperlink is offered here. The inexperienced shaded space is for an investor submitting taxes “Married Submitting Collectively” with $200,000 in family revenue and making 3% on an out-of-state municipal bond. The couple must make 3.68% on Treasury and Company bonds to be the equal of three% in tax-exempt yields. If I don’t want the revenue for a number of years in a specific account and the yields are shut, then I favor municipal bonds. For municipal bonds to be aggressive with Treasuries now, the couple would want to have a 3.5% yield on out-of-state municipal bonds which is doable.

Desk #2: Constancy Calculator for Fastened Revenue Taxable-Equal Yields

Lipper Classes with Excessive Yields and Low to Reasonable Danger

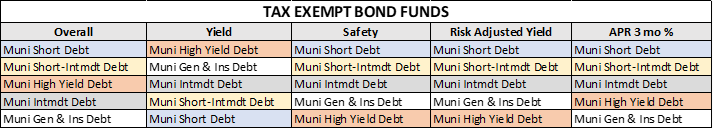

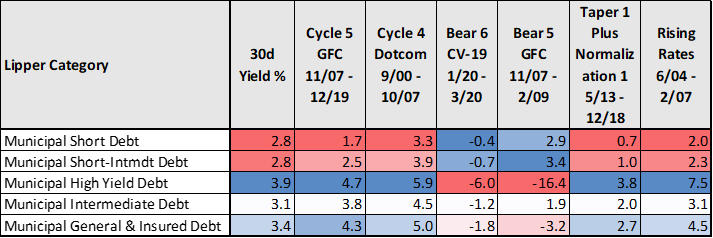

I created an “General” rating system to mix Danger, Yield, Return, High quality, Pattern, and Tax-Effectivity components into an general score. Desk #3 reveals the classes sorted by “General, Yield, Security, Danger Adjusted Yield, and Three-Month Return. Muni Excessive Yield debt is enticing for yield, however not for security. The classes could also be acceptable for various Funding Buckets for brief, intermediate, and long-term investing objectives.

Desk #3: Efficiency of Lipper Classes with Excessive Yields

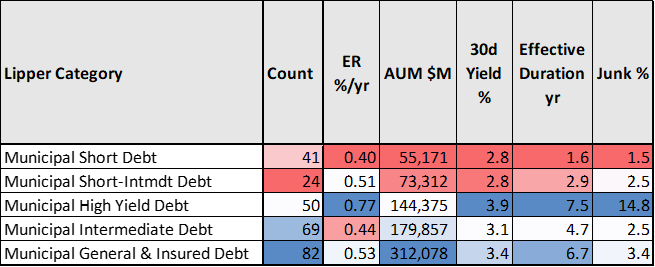

I extracted all mutual funds and exchange-traded funds utilizing the MFO Premium Fund Screener and Lipper world dataset. What Desk #4 tells us is that municipal quick and short-intermediate debt classes don’t have as excessive property beneath administration as the opposite classes which have greater yields and longer durations. Observe additionally that municipal high-yield debt has a decrease proportion invested in low-rated “Junk” debt than taxable high-yield debt.

Desk #4: Metrics for Lipper Classes with Excessive Yields

Desk #5 relies on the historical past of practically 300 mutual funds and exchange-traded funds. Municipal intermediate debt and municipal basic & insured debt have full cycle returns of 4% to five% and low drawdowns. These are the place the majority of my investments in municipal bonds are. Municipal high-yield debt has greater yields and full-cycle returns, but additionally greater drawdowns.

Desk #5: Efficiency of Lipper Classes with Excessive Yields

The Chosen Few

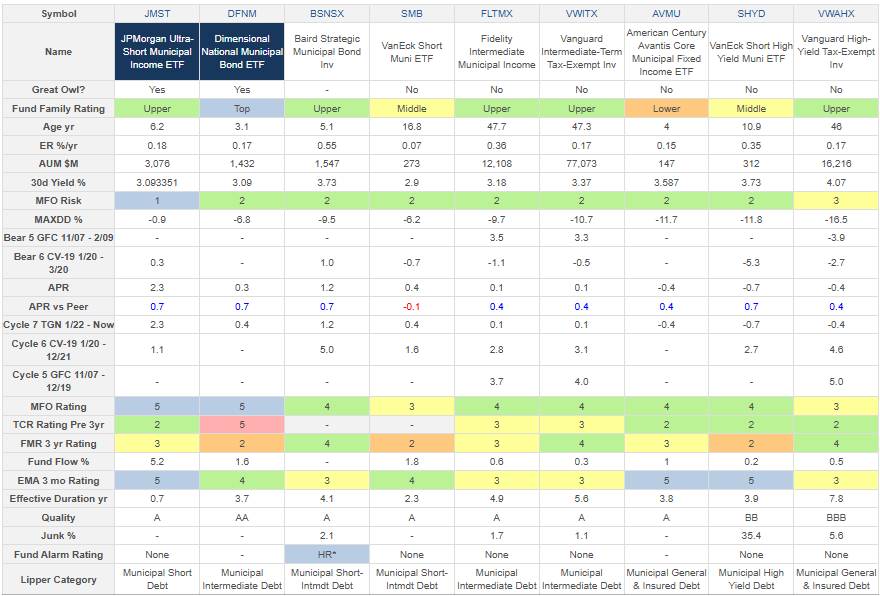

I chosen one fund, most fascinating to me as a reasonably conservative investor, from every of the 5 Lipper Classes coated within the article. They’re sorted loosely from decrease danger on the left with yields round 3% to greater danger on the best with yields round 4%.

Desk #6: Creator’s Choose Excessive Performing Funds Per Lipper Class (3-12 months Metrics)

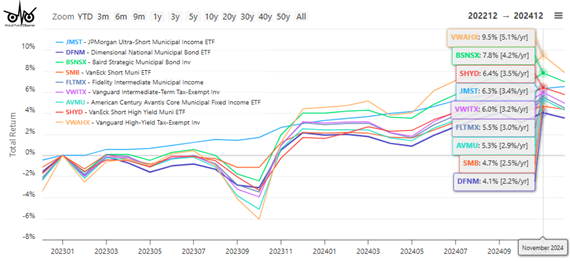

JPMorgan Extremely-Brief Municipal Revenue ETF (JMST) has averaged 3.4% for the previous two years with low volatility. Vanguard Excessive-Yield Tax-Exempt (VWAHX) has averaged 5.1% however with extra volatility.

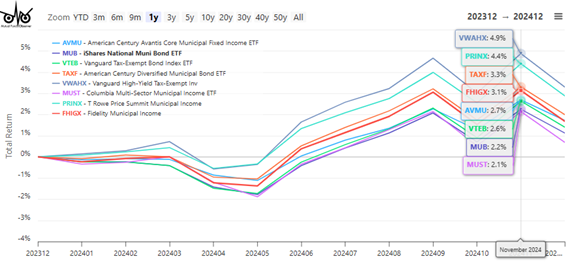

Determine #1: Creator’s Choose Excessive Performing Funds Per Lipper Class

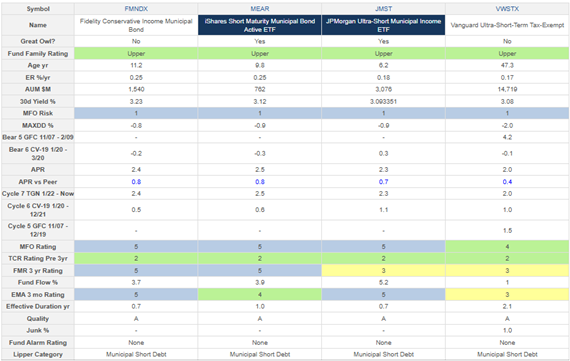

Municipal Brief Debt

Lipper U.S. Mutual Fund Classification Brief Municipal Debt Funds: Funds that spend money on municipal debt points with dollar-weighted common maturities of lower than three years.

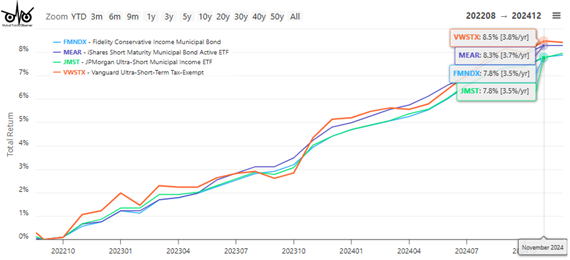

These are low-risk funds at present yielding over 3%. I favor MFO Nice Owl iShares Brief Maturity Municipal Bond Energetic ETF (MEAR).

Desk #7: Excessive-Performing Municipal Brief Debt Funds (3-12 months Metrics)

Determine #2: Excessive-Performing Municipal Brief Debt Funds (3-12 months Metrics)

Municipal Brief-Intermediate Debt

Lipper U.S. Mutual Fund Classification Brief-Intermediate Municipal Debt Funds: Funds that spend money on municipal debt points with dollar-weighted common maturities of 1 to 5 years.

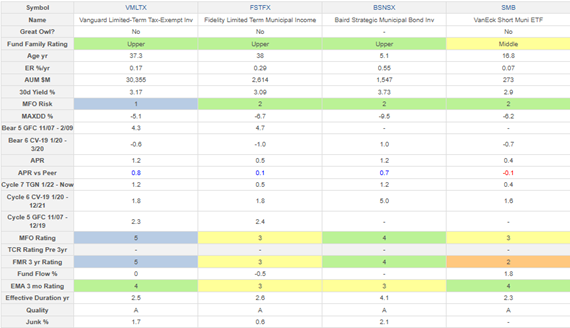

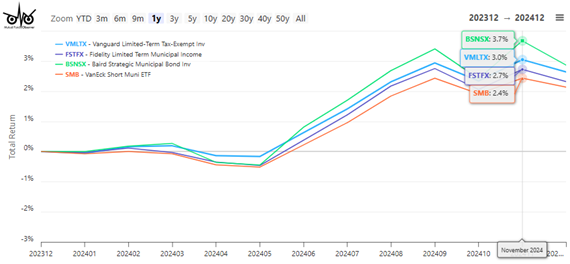

Municipal short-intermediate debt funds are a comparatively low-risk possibility since short-term charges are anticipated to say no over the following few years. Yields are typically above 3.0%.

Desk #8: Excessive-Performing Municipal Brief-Intermediate Debt Funds (3-12 months Metrics)

Determine #3: Excessive-Performing Municipal Brief-Intermediate Debt Funds

Municipal Intermediate Debt

Lipper U.S. Mutual Fund Classification Intermediate Municipal Debt Funds: Funds that spend money on municipal debt points with dollar-weighted common maturities of 5 to 10 years.

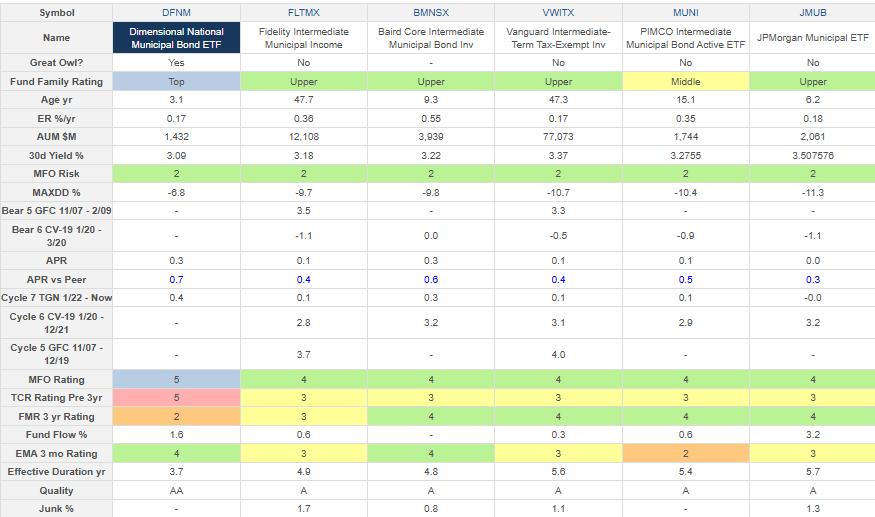

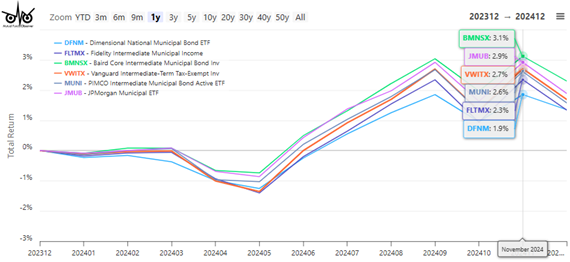

The high-performing municipal intermediate debt funds in Desk #9 have returned 2.0% to three.0% over the previous yr with a yield within the vary of three.0% to three.5%. Of the ETFs, I like JPMorgan Municipal ETF (JMUB) for its greater return and yield, though it had a drawdown of 11.3% over the previous three years. These searching for greater risk-adjusted returns could want Dimensional Nationwide Municipal Bond ETF (DFNM).

Desk #9: Excessive-Performing Municipal Intermediate Debt Funds (3-12 months Metrics)

Determine #4: Excessive-Performing Municipal Intermediate Debt Funds

Municipal Excessive Yield Debt

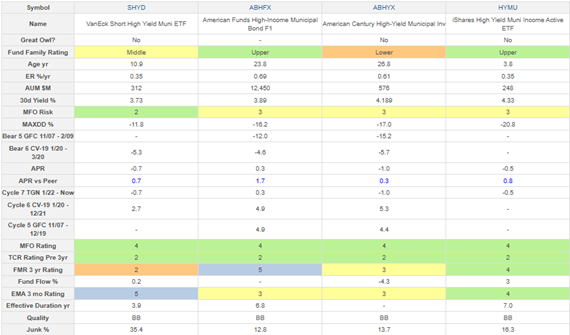

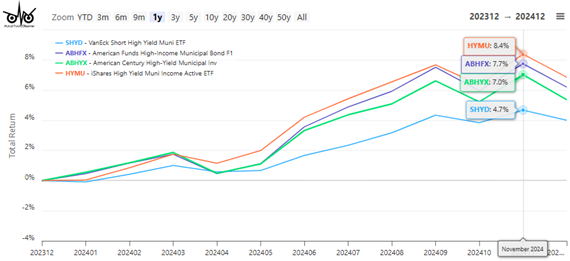

Lipper U.S. Mutual Fund Classification Excessive Yield Municipal Debt Funds: Funds that sometimes make investments 50% or extra of their property in municipal debt points rated BBB or much less.

Excessive-performing municipal high-yield debt funds have returned greater than 7.0% for the previous yr except VanEck Brief Excessive Muni ETF (SHYD). I favor SHYD as a lower-risk enterprise into municipal high-yield bonds. Excessive-yield funds could have a drawdown of 10% to twenty% throughout a serious bond downturn. They’ve had full cycle returns of 4.5% to five.0% and yield 3.7% to 4.3%.

Desk #10: Excessive Performing Municipal Excessive Yield Debt Funds (3-12 months Metrics)

Determine #5: Excessive Performing Municipal Excessive Yield Debt Funds

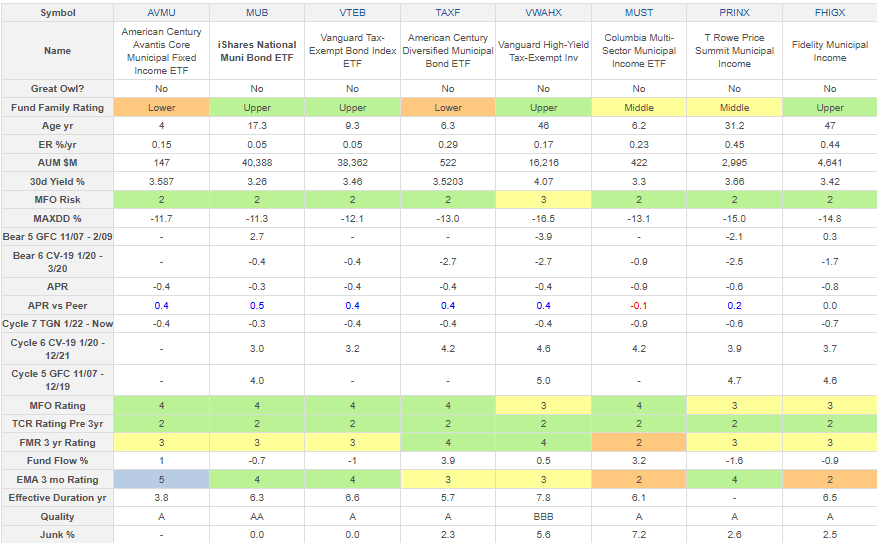

Municipal Basic & Insured Debt

Lipper U.S. Mutual Fund Classification Basic & Insured Municipal Debt Funds: Funds that both make investments primarily in municipal debt points rated within the prime three credit score rankings or make investments primarily in municipal debt points insured as to well timed fee.

I personal Vanguard Excessive-Yield Tax Exempt (VWAHX) within the basic & insured municipal debt class versus a fund within the high-yield municipal debt class. Whereas its drawdown throughout the previous three years matches these within the high-yield municipal debt class, its efficiency throughout the monetary disaster was significantly better. It has a yield of 4.1%.

Desk #11: Excessive-Performing Municipal Basic & Insured Funds (3-12 months Metrics)

Determine #6: Excessive-Performing Municipal Basic & Insured Funds

Closing

I’ve a unfastened goal of getting about 50% of my investments in Conventional IRAs, 25% in Roth IRAs, and 25% in after-tax accounts. Pensions, Social Safety, after-tax funding revenue, and withdrawals from Conventional IRAs are taxable revenue. Managing taxes is a part of my general funding technique. On account of researching this text, I’ve invested extra in taxable bonds with greater yields in some shorter-term accounts, and elevated danger primarily within the municipal basic & insured debt class in accounts that I managed to cross alongside as inheritance.

I can be assembly with a CPA later this yr to overview my tax administration technique. I’m a agency believer in utilizing Monetary Advisors.