On October 14, 2024, Virtus Funding Companions launched Virtus KAR Mid-Cap ETF (KMID). It targets “U.S. mid-cap corporations with sturdy aggressive benefits, glorious administration, decrease monetary threat, and powerful progress trajectories” promoting at “enticing” valuations. The fund is managed by Jon Christensen and Craig Stone who additionally handle the five-star, $2.9 billion Virtus KAR Mid-Cap Core Fund. The ETF, like its sibling, will maintain 25-35 shares with a low annual turnover.

The fund has two points of interest.

First, mid-caps are fascinating and underrepresented in most portfolios. (It’s the traditional “center baby” downside.) Virtus notes:

Positioned within the fairness candy spot between faster-growing small caps and less-volatile giant caps, mid-caps symbolize a beautiful funding alternative. Mid-sized corporations are at a important juncture within the enterprise lifecycle, having efficiently transitioned from the make-or-break small-cap section. Although not as mature as giant caps, mid-caps usually have established enterprise fashions, entry to capital, and skilled administration groups—placing them in place for additional progress.

Regardless of their enticing attributes, mid-caps are lacking from many investor portfolios. Mid-caps make up 24% of the whole U.S. market cap, but account for simply 11% of U.S. fairness fund belongings.

Over the long run, mid-caps have delivered sturdy returns relative to small caps and enormous caps, with decrease volatility than small caps.

Mid-caps obtain much less consideration from Wall Avenue analysts and commerce at a decrease quantity than large-cap shares. These market inefficiencies translate into a chance for an lively supervisor like KAR so as to add worth to the inventory choice course of by in search of out what they think about to be the best high quality mid-sized companies with the strongest progress prospects.

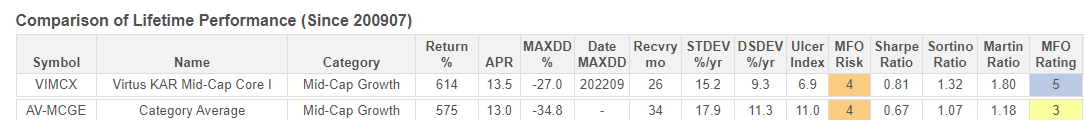

By Virtus’s calculation, higher-quality midcaps outperform lower-quality ones by way of each larger whole returns (12.2% APR versus 10.4%) and decrease volatility (15.3% commonplace deviation versus 18.5%). The KAR managers have executed the technique with appreciable and constant success since its launch.

At base, they’ve generated larger whole returns with smaller drawdowns and considerably decrease volatility than their friends, giving them considerably larger risk-adjusted scores throughout the board.

Second, this ETF offers you entry to a profitable technique for a far lower cost.

Mid-Cap Core Fund, four-star fund, “A” shares: 1.20% e.r.

Mid-Cap Core Fund, five-star fund, institutional: 0.95% e.r.

Mid-Cap ETF: 0.80% e.r.

It’s uncommon to be supplied a one-third-off sale on entry to a demonstrably profitable technique. People focused on shifting a bit away from large-cap progress mania may need to think about this selection.