New to CRE market evaluation? This newbie’s information walks you thru understanding the basics, accumulating knowledge, and making knowledgeable choices.

Think about you’re handing over $2,000 per sq. foot simply to lease an workplace area. Sound loopy? Effectively, it could be. That’s simply actual life on the earth’s most sought-after industrial actual property (CRE) markets, the place the very best areas demand loopy costs. So, why all of the hype? Entry to expertise, cash, and big alternative.

However leaping into these crazily aggressive waters means you want greater than only a boatload of money. It takes severe planning, and in-depth “market information”. So, let’s clear up a vital factor: What world spot is the “it” place, and what drives all this craziness? Let’s dive in.

What Makes a CRE Market “Costly”?

After we say “costly” in CRE, it’s not simply concerning the price ticket; there’s quite a bit to it. We gotta look past what it prices at first look to see how superior will probably be for its market worth. Listed below are metrics so we will see simply how overpriced all of it is, and according to Paperhouses data these metrics are legitimate.

“Value per sq. foot (PSF)” is the large one each for purchasing and renting. Principally, divide by property dimension. One sells for $2,500,000 with a 5,000 sqft dimension. Thus, it has $500 PSF worth. Greater PSF charges = dearer.

Previous PSF, “capitalization charges (cap charges)” & “yield” are essential. To search out, divide by Web revenue by worth. You can see property income potential. Low cap charges equal excessive values, making it dearer, and “yield” reveals how nicely the funding performs by way of numerous revenue streams. In the end, in case you take into account it “costly” is your threat.

The Reigning Champion: At the moment Most Costly Market

Get this: It’s mid-2025, and there may be one clear spot: “Hong Kong”. Sure, Hong Kong! New York Metropolis and London at all times put up their numbers however it nonetheless stands to be: restricted land, intense demand, and standing as an superior world spot.

Knowledge has recorded prime workplace rents have exceeded over $250 PSF over the yr. In different phrases, if you need premium properties, it’ll value over $5,000 per sqft. Sources have reported shifts. Hong Kong has lasting wealth and demand.

Completely different sectors inside HK are extra dear than others. Need a retail spot? It prices greater than workplace spots. Yow will discover dear industrial properties with decrease values. However all this income, mixed, means Hong Kong stays dominant as the primary market!

Elements Driving Excessive Costs

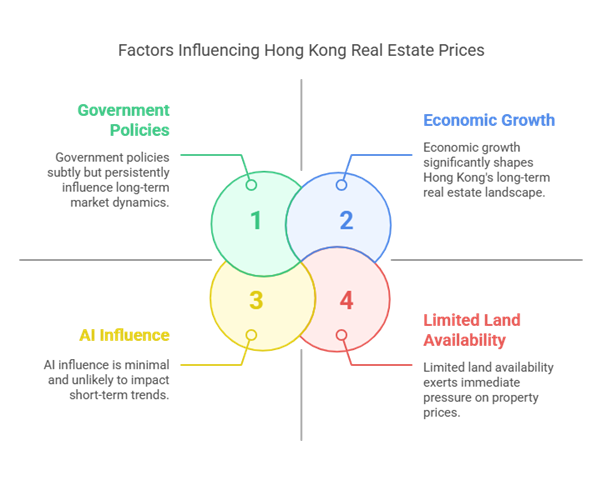

Many interwoven influences put Hong Kong in a dominant place. “Restricted Land availability” is big. With little area to construct, there’s intense strain for present properties.

Now take into account “financial development”. It’s China’s gateway! Hong Kong is a serious worldwide place that makes firms demand retail and workplace locations. International funding enhances it. Hong Kong has good insurance policies, stability, and charges that make them engaging across the globe.

Plus, “authorities insurance policies” like its enterprise surroundings, put planning, and creating restrictions. Rates of interest closely impression affordability and funding, particularly on condition that US foreign money has affected the Hong Kong market.

It’s unlikely that AI will have an effect on something within the brief time period. House is proscribed! Thesisdriven notes transformations in Actual Property because of AI. It might have an effect on what areas are engaging, or drive costs up. However, limitedness mixed with monetary technique and science will flip enterprise.

Contenders and Shut Runners-Up

Hong Kong sits on the prime, many world cities nonetheless rank excessive alongside costly industrial actual property markets. “New York Metropolis” and “London” have been and can proceed to be dominant, resulting from their state as enterprise hubs.

NYC has industries that flourish as do firms. NY just isn’t as engaging for buyers due to working prices and excessive taxes. London has connectivity with massive sector advantages however Brexit brings instability.

Rising markets and new cities like Tokyo and Singapore will flourish with international funding. To see these markets bloom can create dangers and harm dominance in immediately’s market.

Alternatives and Challenges for Traders

If you happen to need huge markets and excessive worth, many excessive rewards and drawbacks can happen for RE buyers. Excessive returns are clearly a giant draw. There could be good capital and basic stability!

Clearly:

Downsides present dangers as overvaluation harms worth to properties, based on Paperhouses knowledge. Preserve an eye fixed out for potential huge points occurring. Institutional buyers are growing so deal securing comes at a value.

Capital is what is required. These markets wish to be vital with upfront funding and that’s intimidating. Deep understanding of dynamics assist.

The right way to Navigate Costly CRE Markets (My Knowledgeable Recommendation)

I’ve discovered classes from navigating Excessive Degree property! Success with this implies investing and rewarding.

Primary: All the time get the specifics proper! Due Dilligence is essential. To be clear, discover agreements and search for a protracted sustainable future for tenants! Be sure to go for issues and get reviews that analyze agreements. I as soon as nearly ignored a major lengthy lease time period change and that may lose out on growing future hire.

Quantity two, unlock worth and “determine undervalued property and attain untapped” potential! You must discover strategic worth and envision {the marketplace}. Renovations could make values enhance, otherwise you issue value-based-pricing bowtiedparrotfish.substack.com.

Plus, negotiate a deal, and have an eye fixed out for locating funding and financing from others. You need to preserve a excessive value! Work with Brokers/Traders and take into consideration being financed past financial institution charges and you may finally win and take your work to the skies.

The Way forward for Costly CRE Markets

You possibly can be aware and regulate potential shifts, as all the things revolves round tech progress. If you happen to get these elements it will probably additionally assist form future values of properties.

There could be rising emphasis which might additionally lead to modifications as proven in ecommerce. Tech and alter will probably be a number one issue to contemplate later as nicely.

If that may be carried out, CRE might shift as nicely whereas nonetheless preserving these values however search for tech and adapt!

Conclusion

If you already know the market and you might be enterprise savvy, then markets and technique can do you justice on what goes across the markets. Make huge strikes and see how values shift. Take your targets forward and strategize and make one thing that matches for you! If that’s of use for you and also you wish to see success and large values in CRE, seek the advice of an expert!

Discover a House-Based mostly Enterprise to Begin-Up >>> Hundreds of Business Listings.