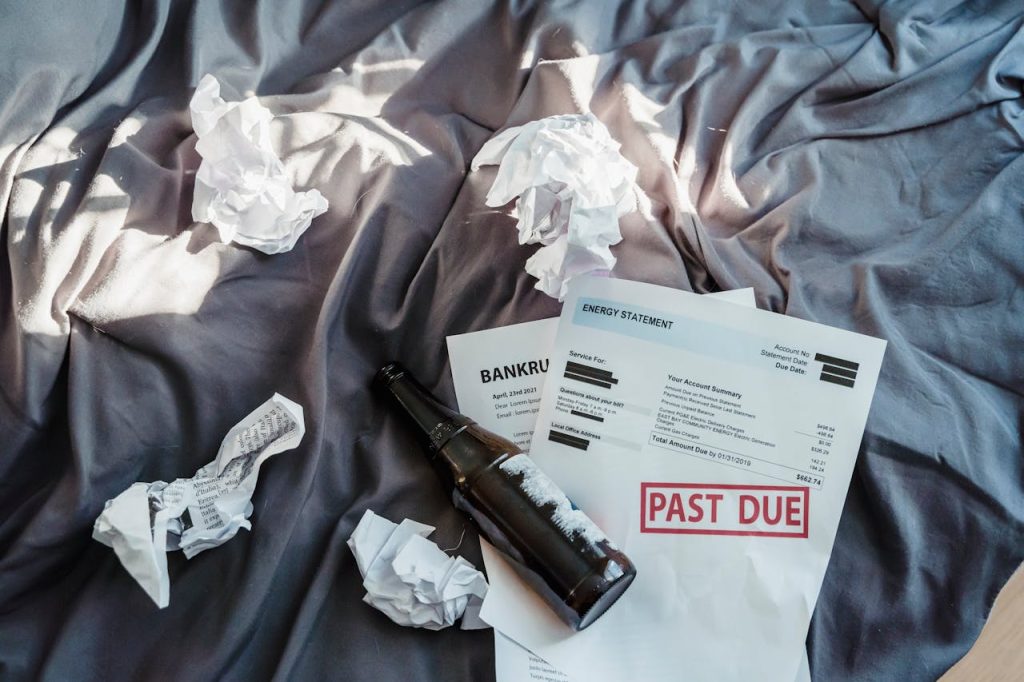

Picture Supply: pexels.com

Monetary struggles in relationships not often have a single perpetrator. When my husband and I had been drowning in debt, I initially pointed fingers at his spending habits. It wasn’t till we confronted our monetary actuality collectively that I acknowledged my very own contribution to our cash troubles. This journey of shared accountability remodeled not simply our funds, however our relationship. Should you’re battling debt as a pair, understanding how each companions contribute to monetary issues is step one towards lasting options.

1. The Blame Recreation Solves Nothing

When monetary stress hits, in search of somebody guilty is pure. I spent months criticizing my husband’s Amazon purchases and lunch outings whereas conveniently ignoring my very own procuring habits. This blame-shifting created a poisonous atmosphere the place productive monetary discussions grew to become not possible.

Analysis reveals that financial disagreements are among the many strongest predictors of divorce. The longer we stayed within the blame cycle, the extra our relationship deteriorated alongside our credit score rating.

The turning level got here after we stopped asking “who brought on this?” and began asking “how will we repair this collectively?” This shift from accusation to collaboration modified every thing.

2. My Hidden Monetary Sabotage

Whereas I criticized my husband’s seen purchases, my very own monetary sabotage operated extra subtly. I used to be the family “saver,” however my strategy was essentially flawed.

I’d set unrealistic budgets that had been not possible to take care of, making a cycle of failure and frustration. I’d impulsively switch cash to financial savings, leaving our checking account dangerously low and forcing us to make use of bank cards for necessities. My behavior of hiding small purchases that added to vital quantities was most damaging.

In line with monetary psychologist Dr. Brad Klontz, this conduct sample—known as “monetary infidelity”—impacts almost 41% of American adults who admit to hiding purchases, accounts, or money owed from their companions.

Recognizing these behaviors was humbling however obligatory. My “accountable saver” identification was partially a facade hiding my very own monetary dysfunction.

3. The Emotional Roots of Overspending

Our spending habits weren’t nearly poor impulse management—they had been emotional coping mechanisms. My husband shopped when careworn at work, whereas I made “deal with” purchases when feeling underappreciated.

We started monitoring not simply what we spent but additionally why we spent it. This emotional spending diary revealed patterns we’d by no means seen earlier than. My husband’s greatest purchases coincided with troublesome work initiatives, whereas mine clustered round occasions I felt overwhelmed by family tasks.

Understanding these emotional triggers didn’t instantly cease the conduct however made the invisible seen. We might now acknowledge weak moments and develop more healthy coping methods that didn’t contain our bank cards.

4. Communication Breakdown Led to Monetary Breakdown

Our monetary communication consisted primarily of accusations (“You spent how a lot?”) or avoidance (“Let’s not discuss cash now”). Neither strategy served us nicely.

We established weekly “cash dates”—judgment-free conversations about our funds. These structured discussions remodeled cash from a relationship landmine right into a shared mission. We used easy instruments like shared budgeting apps and a visual debt paydown chart on our fridge.

The transparency was initially uncomfortable however in the end liberating. Once we stopped hiding monetary info from one another, we found options we’d by no means thought of earlier than.

5. Shared Objectives Created Shared Motivation

Particular person willpower usually falters, however shared dedication creates highly effective momentum. We changed obscure aspirations (“let’s get out of debt”) with particular, significant targets tied to our values.

Our first main purpose—saving for a modest household trip with out utilizing credit score—gave us one thing optimistic to work towards relatively than simply the damaging expertise of debt discount. This shift from deprivation to aspiration made sustainable change doable.

We’d remind one another of our shared targets when tempted by pointless purchases. This wasn’t about policing one another however supporting our mutual priorities.

6. The Partnership Precept Modified All the things

Probably the most transformative realization was that monetary well being in a relationship isn’t about excellent particular person conduct—it’s about complementary partnership.

My detail-oriented nature made me wonderful at monitoring bills, whereas my husband’s creativity helped us discover new revenue streams. As an alternative of attempting to make one another excellent with cash, we leveraged our completely different strengths.

This partnership precept prolonged past simply us. We joined a monetary help group the place {couples} shared methods and accountability. This group strategy accelerated our progress and offered emotional help throughout setbacks.

The Freedom of Shared Accountability

Accepting my function in our debt was initially painful however in the end releasing. When each companions acknowledge their contributions to monetary issues, the trail ahead turns into clearer and extra collaborative.

Our debt didn’t disappear in a single day, however our strategy to it essentially modified. We stopped seeing cash as a battleground and began viewing it as a shared device for constructing the life we needed collectively. The blame that after dominated our monetary discussions has been changed with mutual help and shared victories.

Has monetary blame ever created distance in your relationship? How did you progress previous it to seek out options collectively?

Learn Extra

Debt Consolidation Loan: How Do They Work and Its Benefits

6 Ways to Manage Student Loan Debt

(Visited 7 occasions, 1 visits as we speak)

Latrice is a devoted skilled with a wealthy background in social work, complemented by an Affiliate Diploma within the area. Her journey has been uniquely formed by the rewarding expertise of being a stay-at-home mother to her two youngsters, aged 13 and 5. This function has not solely been a testomony to her dedication to household however has additionally offered her with invaluable life classes and insights.

As a mom, Latrice has embraced the chance to coach her youngsters on important life abilities, with a particular give attention to monetary literacy, the nuances of life, and the significance of internal peace.