When you’re fascinated by private finance, you in all probability know who Dave Ramsey is. When you don’t know, he’s a tv and radio persona (and creator) who preaches a “frequent sense” method to getting out of debt and creating wealth. His plan is constructed round seven “Child Steps” which are designed to guide you to monetary freedom. He calls it the “Complete Cash Makeover.” Dave is a grasp motivator who is superb at getting individuals fired as much as do one thing about their funds, and his recommendation is mostly easy sufficient that most individuals can perceive what he’s saying. Now that the economic system is slowing, I see an increasing number of individuals turning to Dave for assist.

Nevertheless, there’s one drawback that I’ve seen with Dave and his system. I’ve identified many, many individuals who’ve tried his system and failed as a result of they develop into pissed off, offended and customarily sad. Why? As a result of when you actually wish to observe Dave’s plan the way in which he teaches it, there is no such thing as a leeway, no room for particular person circumstances to consider. The Complete Cash Makeover is lots like a really restrictive weight-reduction plan that severely limits your decisions and results in revolt. Sure, some persons are profitable, however many others fall off the cash weight-reduction plan that’s the Complete Cash Makeover.

Dave Ramsey’s Child Steps

When you learn Dave’s books and hearken to his applications, he’s adamant that you just observe his seven Child Steps in precisely the order that they’re written, and you could not transfer on to the subsequent step till the primary is accomplished. Whereas this makes for an orderly method and is nice for individuals who crave group, it could actually trigger some issues. Simply to assessment, the Child Steps are:

1. $1,000 to start out an Emergency Fund

2. Repay all debt utilizing the Debt Snowball

3. 3 to six months of bills in financial savings

4. Make investments 15% of family earnings into Roth IRAs and pre-tax retirement

5. Faculty funding for youngsters

6. Repay dwelling early

7. Construct wealth and provides. Put money into mutual funds and actual property

In line with Dave, till you have got all of your debt paid off, you shouldn’t be saving for retirement. However this ignores the worth that compounding curiosity brings over time. Even when you’re funneling most of your cash to debt funds, any little bit that you could put in direction of retirement will develop a lot bigger sooner or later. His concept for a $1,000 emergency fund isn’t dangerous, however nowadays $1,000 isn’t going to cowl many emergencies. You want a much bigger fund than that, however you’ll be able to’t begin constructing it till all debt is paid off. Till then, you probably have an enormous emergency it’s going to need to go on a bank card, placing you additional within the gap.

Is Dave Ramsey’s Recommendation Too Restrictive?

Why can’t there be a compromise between directing massive sums of cash to debt, but additionally placing some in financial savings and towards retirement? Identical to a crash weight-reduction plan is a shortsighted method to shedding weight, Dave’s plan is a shortsighted method to getting management of your funds. His plan focuses an excessive amount of on getting the debt down as quick as attainable with out trying on the bigger life that you could additionally put together for. Paying down debt is a high quality aim, however there are different contingencies you might want to put together for, as effectively.

Dave’s steps additionally go away no room for enjoyable or pointless purchases. He calls it getting “gazelle intense,” nevertheless it’s like telling somebody on a weight-reduction plan that they’ll by no means have chocolate. In fact, deprivation solely makes you need it extra and might result in bingeing when the restrictions develop into an excessive amount of. Telling somebody that they’ll’t go on trip or out to eat on occasion is sure to result in revolt finally. Both that or it could result in despair, which is simply as counterproductive to profitable monetary administration. That’s to not say that you might want to go on a swanky resort trip or to a 5 star restaurant, however his recommendation ignores the truth that there are cheaper alternate options that can provide you a break from the tedium of debt discount whereas not breaking the financial institution. Identical to a weight-reduction plan requires you to surrender all “dangerous” meals, Dave’s plan requires you to place off “dwelling” till you attain step seven, which may take years. It’s essential to pay down debt and construct for the long run, nevertheless it’s additionally essential to get some worth out of right this moment.

Moderation Might Be Higher Than Gazelle Intense

His recommendation additionally ignores the truth that individuals need to study moderation. Identical to those that overeat, over spenders need to study to stay in the actual world. They need to discover ways to spend and save sparsely. Dave’s steps don’t educate individuals the way to stay sparsely. You might be instructed from the start to easily cease spending, however what occurs once you attain step seven and you’ve got constructed some wealth? With out figuring out the way to spend reasonably, how lengthy do you suppose will probably be earlier than that wealth is gone? His plan does nothing to show habits modification. With out that, long run success is iffy at finest. As with a dieter, long run success can solely be achieved when the causes and triggers of spending are recognized and handled.

Some individuals find yourself feeling like failures on Dave’s plan and quit. Once more, take a look at the weight-reduction plan analogy. Dieters could also be going alongside nice, after which at some point they break down and eat a cheeseburger and fries. Then they determine they’ve already screwed up the plan, so why hassle to maintain attempting. This occurs to many individuals who strive Dave’s plan. They’re going alongside nice after which they break down and purchase a designer purse (see the revolt talked about above). Then they determine that they’ve blown it, so why not get the footwear to match. They resolve to do higher tomorrow, nevertheless it spirals uncontrolled till they’re again the place they began. Then they’re left feeling like a failure as a result of they couldn’t adhere to this inflexible plan and are extra reluctant to strive once more. In spite of everything, who desires to really feel like a failure? Dave doesn’t educate you the way to cease the spiral, take care of the guilt of screwing up, after which get again on monitor. A extra versatile, real-world plan takes under consideration the truth that all of us screw up and reveals us the way to get again on monitor.

In what’s the nice irony of Dave’s mannequin, he often advocates that you just purchase his books, pay to attend his seminars, or pay to hitch his web site. Whereas I perceive that the person is a enterprise, he’s taking benefit of individuals’s desperation to get out of debt. Identical to diets that promise you that when you purchase their meals or books or medication you’ll shed weight, Dave advocates (in a refined, grasp marketer’s means) that when you purchase his stuff, you’ll lose the debt sooner. The easy truth is, with diets or cash recommendation, the extra you shell out, the likelier you’re to stop when it turns into too costly. Some individuals say, “The heck with this. It’s costing an excessive amount of and I’m not getting something out of it, so I stop.” Then, not solely are they nonetheless in a monetary or dietary mess, it’s worse due to the additional cash spent.

Dave’s Plan Works, However Typically You Want To Modify It

Dave teaches some good issues, however his plan is simply too restrictive to achieve success for all individuals. Sure, some individuals do very effectively beneath inflexible restrictions and if that is you, I say, “Nice!” Nevertheless, the those that I’ve identified who’ve succeeded on his plan have taken the fundamental steps after which modified them to swimsuit their very own wants and life conditions.

I’d encourage you, when you’re fascinated by attempting his plan, that you just modify it to fit your personal wants and targets. Be taught his child steps, but additionally know what is going to allow you to achieve success. Tweak the plan till you discover a solution to work it that works for you. You don’t need to observe him phrase for phrase. The Dave police aren’t going to cart you away when you go your individual means. You may transfer up and down the steps as you might want to, going again to an earlier one when you fall off the wagon, or leaping forward if one thing is extra essential to you. With out modification of Dave’s plan, you may find yourself like a pissed off dieter who provides up on the plan as a result of it finally ends up costing an excessive amount of and doesn’t consider the way in which you actually stay. Susan Powter, the health skilled, used to scream, “Modify, Modify, Modify,” throughout each exercise. It’s good recommendation, each for diets and monetary planning.

And don’t spend cash for supplies. You’ll find his books free of charge on the library, his present airs on the Fox Enterprise channel, and there are a number of free web sites which are devoted to his strategies. Some church buildings supply his courses free of charge.

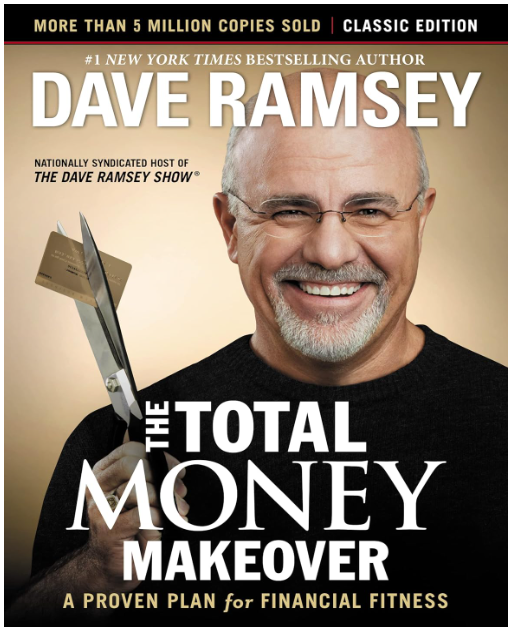

Lastly, when you aren’t scouring the online to get Dave Ramsey’s perception, contemplate shopping for a duplicate of Dave Ramsey’s The Total Money Makeover

Lastly, when you aren’t scouring the online to get Dave Ramsey’s perception, contemplate shopping for a duplicate of Dave Ramsey’s The Total Money Makeover. The ebook is a mixture instructional information, inspirational teaching handbook and self examine workbook. The ebook has offered one thing like 5 million copies – so it’s broadly learn and very talked-about. Get a duplicate right this moment.

Jennifer Derrick is a contract author, novelist and kids’s ebook creator. When she’s not writing Jennifer enjoys working marathons, taking part in tennis, boardgames and studying just about every thing she will be able to get her palms on. You may study extra about Jennifer at: https://jenniferderrick.com/.