Summary

This analysis article analyzes the efficiency of the lodge market in Baltimore for the trailing 4 quarters ending in Q3 2024, with a particular deal with key metrics reminiscent of occupancy, common charge (ADR), and income per accessible room (RevPAR). The report highlights the optimistic impression of the removing of roughly 2,500 lodge rooms from the downtown provide and discusses the potential for improved lodge efficiency in 2025. With robust progress in ADR and RevPAR regardless of some challenges available in the market, the evaluation suggests a strong outlook for town’s lodge sector as demand continues to strengthen, and lodge operators capitalize on lowered provide to push charges and improve occupancy.

Key Market Indicators for Trailing 4 Quarters (Ending Q3 2024)

As of Q3, CBRE has tracked that the downtown Baltimore submarket consisted of 9,143 rooms as proven beneath:

This total supply pre-dates the removal of several hotels from the market. Still, as shown above, the submarket is dominated by Upper-Priced hotels. The Upper-Priced hotel segment saw its RevPAR growth trail the Mid and Lower-Price categories in 2023; however, the most recent year-to-date period it realized the fastest rate of RevPAR growth. Through the 3rd quarter of 2024, the RevPAR of the Upper-Priced hotels increased by 13.2% over the same period in 2023. The submarket is outperforming the broader market as evidenced by the RevPAR penetration at 126% of the greater Baltimore market (as of year-to-date 2024).

Occupancy and Average Daily Rate (ADR)

According to the CBRE Hotel Horizons, Q3 2024, for the trailing four quarters ending in Q3 2024, Baltimore’s hotel market achieved an average occupancy rate of 65.8%. This level of occupancy represents a modest but steady recovery from the pandemic’s impacts, signaling a stabilization in demand across both leisure and business segments. The preliminary year-end 2024 figures suggest no additional occupancy gains. Thus while occupancy remains below pre-pandemic highs, it marks a healthy rebound and sets the stage for further growth in 2025.

The average daily rate (ADR) for hotels in Baltimore during this period stood at $132.29. This represents a notable 3.9% increase over the previous trailing four-quarter period ending Q3 2023. The improvement in ADR reflects growing consumer confidence, stronger demand, and a tightening of hotel supply, which together have enabled operators to command higher prices for rooms. Looking into 2025, several upscale hotel owners/managers are projecting increases of 5% to 10% in ADR as a byproduct of the constricted supply.

Revenue Per Available Room (RevPAR)

As a direct result of the increase in both occupancy and ADR, revenue per available room (RevPAR) saw a significant 6.7% increase, reaching a strong $87.05 in Q3 2024. The RevPAR growth underscores the positive economic conditions in Baltimore’s hospitality sector and demonstrates that hotels have successfully capitalized on higher rates while maintaining healthy occupancy levels. The expectation for 2025 therefore, is a modest increase in occupancy coupled with solid rate growth. The combination of these factors could lead to a double-digit RevPAR increase for the year.

The Impact of Hotel Room Removal on Supply and Demand

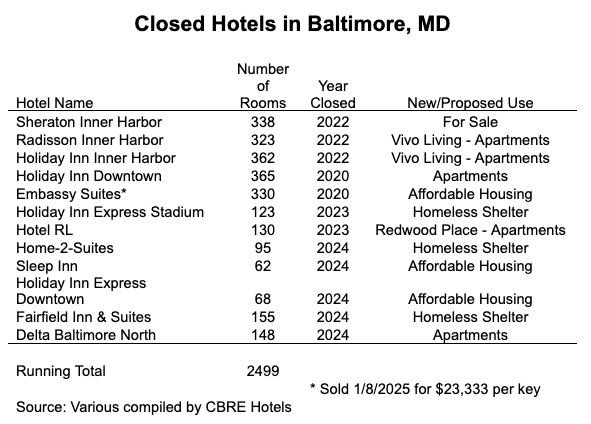

A significant factor influencing the performance of the hotel market in Baltimore has been the removal of approximately 2,500 hotel rooms from the downtown supply. This reduction in room inventory has created an environment of constrained supply, which has proven to be advantageous for hotels operating in the area. Among the hotels that have closed or been repositioned as alternative uses (such as homeless shelters or multi-family apartments) are the Holiday Inn Downtown, the Sheraton Inner Harbor, the Radisson and the Holiday Inn Inner Harbor. The following table lists the closed hotels.

Provide Discount and Fee Progress

The removing of those rooms has helped to cut back competitors within the downtown lodge market. With fewer rooms accessible, motels within the area have gained the flexibility to lift their charges with out the concern of serious demand leakage to competing properties. In consequence, the market has skilled upward strain on ADR, which has been mirrored within the reported 3.9% improve in common charge. Diminished provide, mixed with elevated demand from each vacationers and enterprise vacationers, has positioned Baltimore’s lodge sector to comprehend stronger returns on funding. There are 280 rooms below development inside two initiatives downtown. These greater rated motels embody the Hilton Backyard Inn Downtown and an impartial boutique property on the former Brager Gutman Division Retailer. Thus, whereas the general provide decreased by greater than 20% between 2020 and 2024, the brand new provide marks solely a 3.3% alternative of the misplaced stock. We don’t foresee further new development given the rising borrowing prices stemming from the rising spreads over US Treasuries over the previous month. Due to this fact, we anticipate that the brand new provide will probably be absorbed into the market and the present motels ought to see wholesome RevPAR enhancements over the subsequent two years.

Occupancy Ranges and the Provide-Demand Steadiness

Whereas occupancy ranges have elevated from the pandemic lows, they haven’t but totally recovered to pre-pandemic ranges. The lower within the variety of accessible lodge rooms, nevertheless, has helped to maintain occupancy ranges greater by tightening the competitors. The removing of greater than 2,500 rooms has successfully redistributed demand throughout a smaller pool of obtainable rooms, enabling these remaining motels to fill their properties at a better charge of occupancy.

Furthermore, with the continued evolution of the workforce panorama, together with an uptick in company journey and a rise in conferences and occasions as a part of post-pandemic restoration, the lowered provide coupled with robust demand is poised to push occupancy ranges greater, notably within the coming years.

Outlook for Baltimore’s Lodge Market in 2025

Demand Drivers for 2025

As we look ahead to 2025, a number of elements are anticipated to contribute to the continued progress of the lodge market in Baltimore:

- Enterprise and Company Journey: With companies adopting hybrid and versatile work fashions, there’s a renewed deal with in-person conferences, conventions, and company occasions. Baltimore’s proximity to main metropolitan areas like Washington, D.C., and its engaging downtown venues make it a first-rate location for such occasions. This might result in an uptick in company journey and better occupancy for motels.

- Tourism Restoration: Baltimore has seen a resurgence in tourism as vacationers are desperate to discover cultural points of interest, historic websites, and waterfront locations. As journey restrictions proceed to ease, town’s tourism sector is anticipated to expertise important progress, benefiting motels with elevated leisure journey.

-

Conventions and Main Occasions: Baltimore’s strategic place as a hub for conferences and conventions additionally positions its motels to learn from the inflow of eventgoers. With the current enlargement of occasion venues and elevated deal with creating engaging vacation spot experiences, lodge demand tied to conventions and large-scale occasions is anticipated to develop.

Based on Go to Baltimore, there are 87 occasions on the calendar for 2025 ranging in attendance from 275 to 75,000 individuals. These occasions are projected to generate 71,329 room nights within the downtown Baltimore market. The information reveals that for each 5 attendees there’s roughly one room night time generated. Moreover, these occasions will fill 23% of the accessible rooms within the downtown market over the course of the upcoming yr.

- Lengthy-Time period Provide Constraints: The removing of two,500 lodge rooms will seemingly proceed to exert strain on provide and help occupancy ranges at present properties. As demand rises in 2025, hoteliers available in the market ought to discover themselves higher positioned to push room charges additional whereas sustaining stable occupancy.

Strategic Alternatives for Lodge Operators

Because the market progresses into 2025, lodge operators in Baltimore could have a number of alternatives to capitalize on the evolving panorama:

- Fee Optimization: With the lowered provide and rising demand, motels ought to proceed to deal with charge optimization methods, utilizing dynamic pricing fashions to maximise ADR throughout peak demand durations, reminiscent of conventions, summer time tourism season, and vacation weekends.

- Enhanced Visitor Expertise: Given the aggressive nature of the market, offering an distinctive visitor expertise will probably be essential to sustaining excessive occupancy ranges. Inns can spend money on upgrades and providers that attraction to each leisure and enterprise vacationers, enhancing the general worth proposition.

- Sustainability and Wellness Tendencies: As sustainability turns into an more and more necessary issue for vacationers, motels in Baltimore can leverage environmentally-friendly practices and wellness-focused facilities as key differentiators. Capitalizing on the rising demand for eco-friendly journey choices can entice a rising base of acutely aware vacationers.

Conclusion

The Baltimore lodge market has proven robust resilience and progress within the trailing 4 quarters ending in Q3 2024, with a big uptick in each ADR and RevPAR. The removing of roughly 2,500 lodge rooms from the downtown provide has performed a essential position in making a extra favorable supply-demand steadiness, which has enabled operators to push charges and preserve stable occupancy ranges. Looking forward to 2025, the outlook for the lodge market in Baltimore stays optimistic, supported by robust demand drivers from enterprise journey, tourism, and occasions. The lowered provide, mixed with a continued restoration in demand, presents important alternatives for motels to additional capitalize on charge will increase and occupancy progress, positioning town’s hospitality sector for continued success within the years forward.