Goal and technique

The managers aspire to outperform the S&P 500 over significant time durations, whereas managing danger by mixing non-correlated belongings comparable to a discretionary world macro technique with a portfolio of US equities. The portfolio has two elements: a US fairness element, which is executed by shopping for low-cost ETFs, and a macro-driven Futures Buying and selling Technique. By way of rebalancing between these approaches, they hope to harness divergent efficiency drivers to create what they time period “Dynamic Alpha.” The fairness technique divides its investments between development, high-dividend, and broad market shares. The Future Buying and selling Technique, executed by a buying and selling adviser, supplies publicity to over 40 liquid markets with negligible return correlations to one another and the S&P 500.

Adviser

Dynamic Wealth Group, LLC, of Las Vegas, Nevada. The dad or mum company serves as a form of advisor-to-advisors, providing outsourced chief funding officer providers to monetary planners. The self-discipline was then embodied within the Dynamic Alpha Macro fund. As of April 2025, the agency had $150 million below administration and greater than two billion below advisement.

Managers

Bradley Barrie and David Johnson. Mr. Barrie has earned the CFP and ChFC certifications, is the agency’s CIO, and co-founder of the Dynamic Wealth Group. David Johnson, Managing Director and Chief Operations Officer, began his profession at NASA as a methods engineer on the House Shuttle program. Messrs. Barrie and Johnson have managed the fund since its inception. It’s their sole cost. Asim Ghaffar is an advisor for the futures-trading technique and is the founder and CIO of AG Capital, a world macro hedge fund primarily based in Boston, Massachusetts. That fund was established in 2014 and goals to ship engaging absolute returns with zero correlation to main asset lessons and different macro managers.

Technique capability and closure

Their present projection is that their technique can be constrained at a couple of billion in AUM, at which level they might seemingly soft-close the fund. That mentioned, their markets are all ultra-liquid, so that they’ll want to guage as the choice level approaches.

Administration’s stake within the fund

Lead supervisor Brad Barrie has invested over $1 million within the fund. David Johnson has invested $100,000 – $500,000.

Opening date

July 31, 2023, although Morningstar lists the managers’ begin as 07/02/23.

Minimal funding

$5000

Expense ratio

The reported web expense ratio is 1.98% on belongings for $150 million (as of 4/30/2025). That mentioned, the newest Semi-Annual Shareholder Report stories “1.73% is the Price paid as a proportion of a $10,000 funding” (12/30/2024), which portends a possible discount within the reported expense ratio when the prospectus is up to date in November.

Feedback

The Dynamic Alpha Macro Fund was launched in August 2023. The fund employs a particular twin technique strategy, allocating belongings roughly equally (50%/50%) between fairness securities and futures buying and selling methods. This mixture goals to ship returns which are minimally correlated to broader market actions by mixing non-correlated belongings.

The fairness securities element invests in exchange-traded funds (ETFs) that present low-cost broad market publicity, whereas the futures buying and selling technique entails lengthy and quick positions throughout numerous belongings, together with currencies, debt, equities, power, metals, and agricultural commodities. Extra particularly, the fairness allocation is split amongst development shares (roughly 40%), above-average dividend-paying shares (roughly 40%), and broad market shares (roughly 20%).

Efficiency Evaluation

The fund has finished effectively in its comparatively quick historical past. The fund was ranked because the #1 performing fund for 2024 within the Morningstar Macro Buying and selling class out of 60 funds, with a achieve of 18.4% towards its friends’ 6.5%. Within the Lipper rankings, it completed #3 of 45 in 2024. This achievement is especially notable given the difficult market atmosphere.

Slot in a Chaos-Resistant Portfolio

The fund’s twin technique strategy is particularly designed to supply smoother returns throughout market turbulence – a key consideration for a chaos-resistant portfolio. By combining fairness securities with futures buying and selling methods that may present non-correlated returns, DYMIX goals to ship a smoother investing expertise in comparison with equity-only methods.

For context, 2024 was a banner yr for U.S. shares, with the S&P 500 up greater than 23%. Nevertheless, beneath the floor, solely 19% of shares inside the S&P 500 really outperformed the index itself. This disparity highlights the significance of methods that may navigate selective market environments.

For traders in search of safety towards market volatility within the present atmosphere, notably given the political transitions and financial uncertainties, DYMIX affords a number of compelling attributes:

-

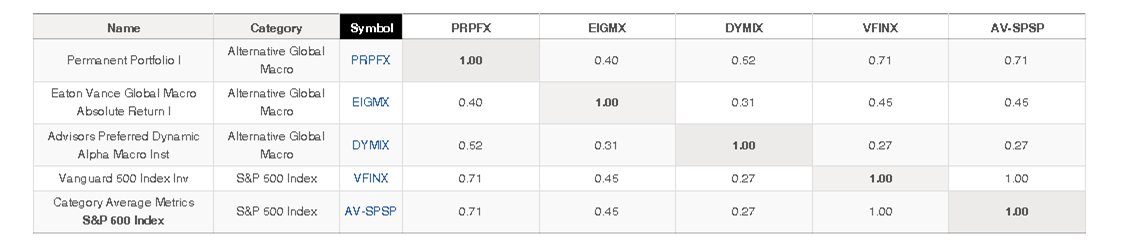

Diversification Past Conventional Property: The fund’s twin strategy supplies publicity to each equities and different methods by means of futures buying and selling, probably providing extra sturdy diversification than conventional inventory/bond portfolios. Mr. Barrie argues that “True diversification requires a number of drivers and a number of diversifiers, not simply one in every of every.” By MFO’s calculation, the fund’s since-inception (19 months) correlation with the S&P 500 has been 0.27.

19-month correlations between the very best Sharpe ratio World Macro funds and the S&P 500

-

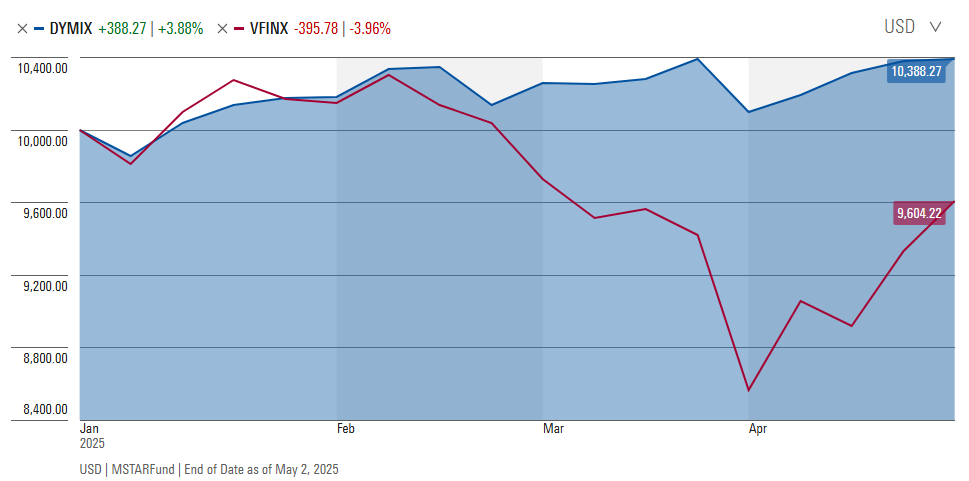

Lively Administration Throughout Volatility: The fund goals to function “an alpha creator and potential volatility buffer to conventional asset allocation methods.” In turbulent markets, this energetic strategy might present worth. That doesn’t contain single-direction bets or development following. Barrie argues, “Don’t have a crystal ball. Too many traders and advisors depend on hope or predictions; our strategy is to be ready for a variety of outcomes since just about something can occur.” That’s illustrated, we predict, by the fund’s efficiency over the primary 4 months of 2025.

-

Demonstrated Efficiency: The fund’s sturdy efficiency in 2024-25 suggests the technique can ship outcomes, although its monitor document stays comparatively quick. Its 18.4% APR since inception exceeds the S&P 500 and vastly exceeds its friends. The non-public fund, whose technique is mirrored within the futures buying and selling technique, has a powerful document stretching over greater than a decade.

Contemplating the hedge

Historically, hedge funds weren’t designed to be an investor’s core holding. They had been designed to enhance the core, to supply a level of safety in dangerous instances and a attainable increase to efficiency in good ones. The query is, how giant ought to the hedge be relative to the core? The recommendation generally given by monetary planners, pushed by affordable analysis, is to dedicate maybe 5 to 10% of a well-diversified portfolio to a hedge.

In Dynamic Alpha Macro, there’s basically a 50/50 break up between core and hedge. You may fairly ask, is that weight justifiable? Latest educational analysis endorses the chance. A hedge has two attainable roles in a portfolio: it reduces beta (that’s, dampens volatility and sure whole return) or it provides alpha (that’s, boosts whole long-term returns). The analysis that recommends limiting the hedge to a small sliver is pushed by the view that your hedges simply cut back beta. Holding money or short-term bonds in an fairness fund, for instance, would dampen volatility however would commerce off belongings that may produce excessive long-term returns (equities: 10% or so) for ones that will produce decrease returns (money / short-term bonds: 4% or so). That each one adjustments in case your hedge additionally provides alpha; researchers lately concluded {that a} hedge that provides 2% in alpha may obtain a weight as excessive as 100% of the portfolio (Gregory Brown, et al, “Optimal Hedge Fund Allocation,” SSRN, 31 Mar 2025).

To be clear: that’s not Dynamic Wealth’s intent. Nevertheless it does corroborate the choice to include a really giant, alpha-generating macro-driven element into the portfolio.

The “macro” half is vital to your evaluation of the fund. Many tremendous funds use a futures technique to execute a momentum or trend-following self-discipline; that’s, they’ve an algorithm for what’s labored lately and what hasn’t. They purchase the previous and dodge or quick the latter. A macro technique is distinct. They’re trying to exploit macro-level occasions (climbing demand for copper, coordinated central financial institution fee cuts, forex revaluation, or no matter) that function independently of the whims of the inventory market. Executed effectively, that generates market-independent alpha.

Nevertheless, a number of concerns ought to mood expectations:

- Restricted Observe Report: With lower than two years of historical past, the fund’s long-term efficiency by means of numerous market cycles stays unproven.

- Greater Bills: The above-average expense ratio will create a efficiency drag that have to be overcome by constantly superior administration. We’ve talked with the advisor about it, and so they’ve emphasised their dedication to cut back bills as belongings develop, which they’ve finished.

- Administration Experience: The administration workforce’s comparatively quick tenure with the fund means traders are inserting important religion of their potential to navigate complicated markets.

Backside Line

The Dynamic Alpha Macro Fund stands out as a promising software for constructing a chaos-resistant portfolio. Its dual-strategy strategy, sturdy current efficiency, and high trade rating make it worthy of consideration for traders wanting so as to add diversification and cut back reliance on conventional markets. Warning is warranted resulting from its quick historical past, however its construction and outcomes to this point point out it may play a precious position as a part of a broader, thoughtfully diversified funding technique. Because the markets turn out to be much less sure, the necessity for chaos managers grows.