With the excessive volatility over tariffs, uncertainty, and considerations over the independence of the Federal Reserve, elements of this text could also be old-fashioned inside hours of finishing it. How does one make investments on this atmosphere? I’ve up to date my Funding System to replicate my present technique. Briefly, it’s arrange as a conventional 60% inventory/40% bond portfolio inside a variety of 55% to 65% shares based mostly on my funding mannequin. I set the mannequin as much as make small quarterly changes based mostly on volatility-adjusted momentum and a shift between worldwide and home development based mostly on valuations and momentum.

In April, I looked for and located that I can obtain the month-to-month returns for the lifetime of a fund within the MFO Premium fund screener and the Lipper world dataset. I started creating funding fashions over a decade in the past utilizing knowledge largely accessible on the St. Louis Federal Reserve Database (FRED). Utilizing precise fund knowledge from MFO is a large enchancment. The target of the mannequin is to maximise the returns on investments since 1995, given my constraints. There’s quite a lot of knowledge at FRED that covers this time interval, and I need an “all-weather” strategy with low turnover. I modified the Funding Mannequin in April to make use of historic knowledge on 4 fairness funds and 7 fastened revenue funds.

The Funds

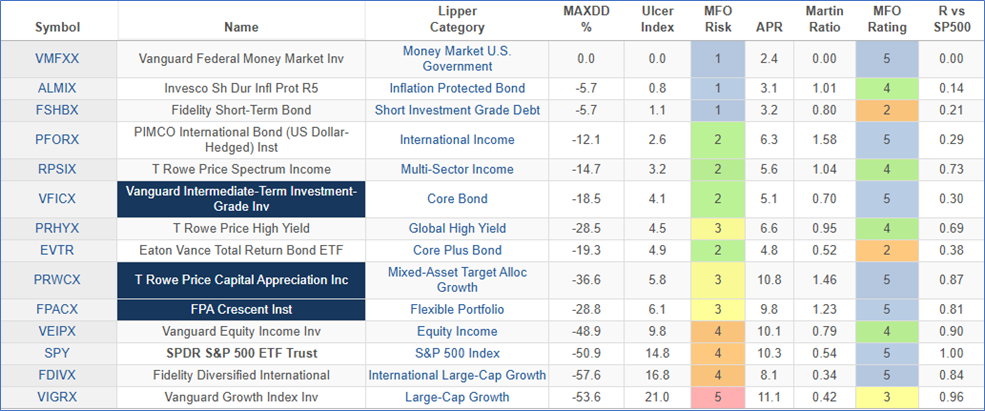

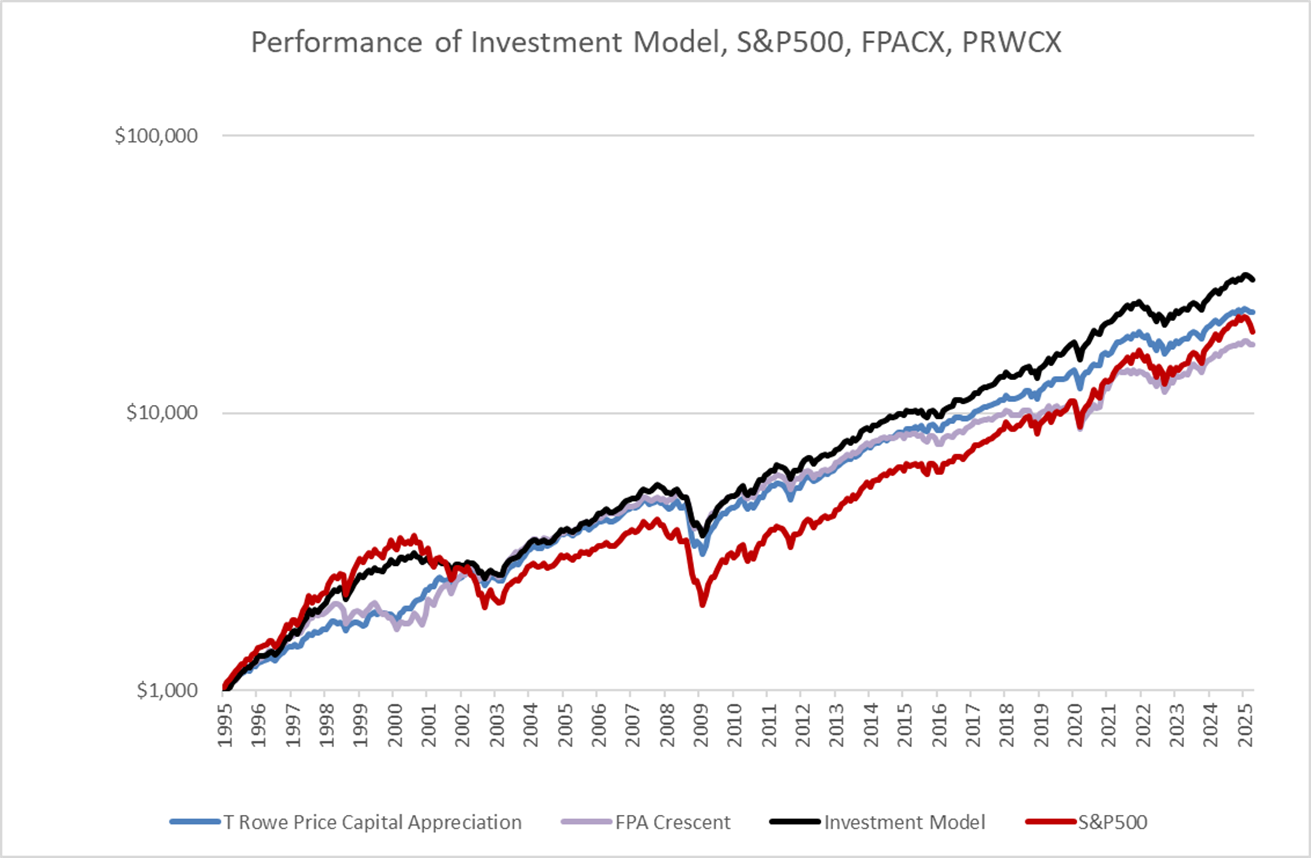

The twelve funds that I included within the Funding Mannequin are proven in Desk #1 together with two glorious mixed-asset funds for a baseline: T Rowe Value Capital Appreciation Earnings (PRWCX) and FPA Crescent (FPACX). Discover that the SPDR S&P 500 ETF (SPY) returned 10.3% over the previous thirty years whereas PRWCX and FPACX have aggressive returns of 10.8% and 9.8%, respectively. The funds have been chosen that may neatly match right into a Bucket Method. The bond choice contains riskier bond funds which have a low correlation to shares and are much less dangerous than shares. The funds have been chosen to maximise the return within the Mannequin whereas sustaining a low turnover philosophy.

Desk #1: Funds In Funding Mannequin – Thirty Yr Metrics

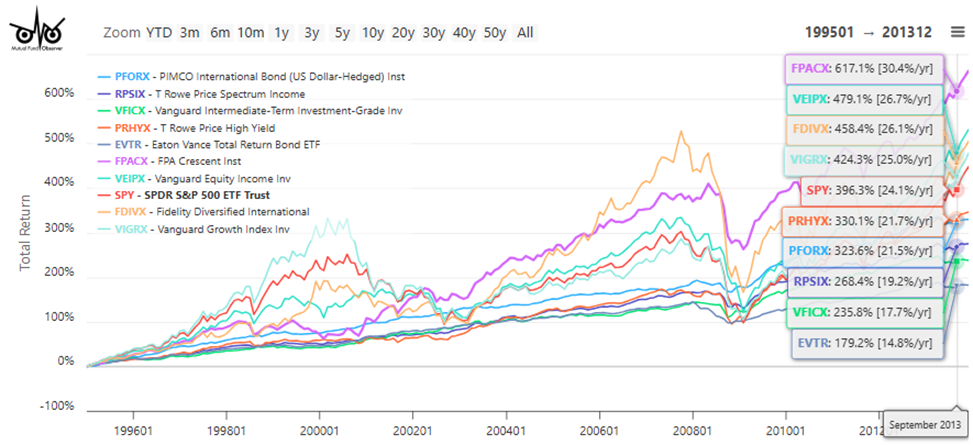

In the course of the time interval from 1995 to 2013, many mixed-asset funds outperformed the S&P 500 for a number of causes. First, bonds outperformed shares through the two main bear markets, and worldwide shares outperformed home shares over lengthy durations of time, particularly as home equities turned overvalued through the Housing Bubble.

Determine #1: Funds In Funding Mannequin – Whole Return 1995 – 2013

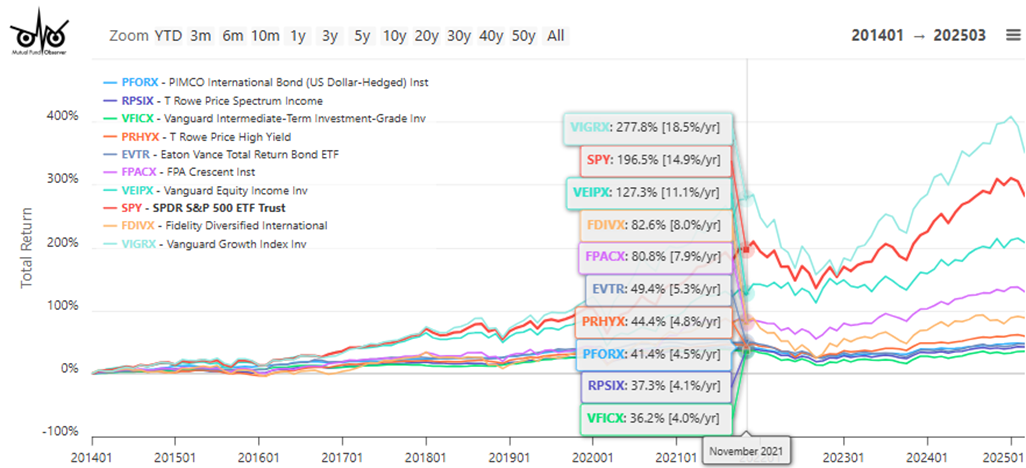

In the course of the time interval from 2014 to 2025, Quantitative Easing and straightforward financial coverage suppressed bond yields, and valuations of home equities turned overvalued. Worldwide equities have underperformed. In consequence, mixed-asset funds have carried out worse than the S&P 500.

Determine #2: Funds In Funding Mannequin – Whole Return 2014 – 2025

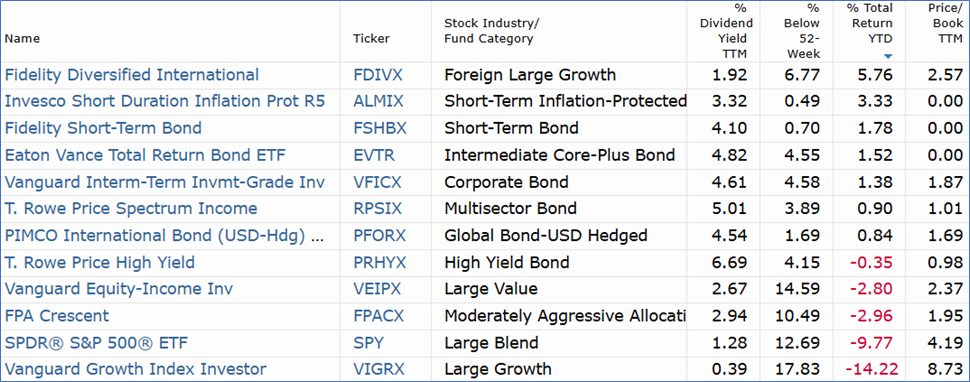

At first of the 12 months, home shares have been extremely valued. The S&P 500 was down virtually ten % year-to-date (as of April 22nd) in comparison with international massive development, which rose practically 6% this 12 months. The worth-to-book worth of the S&P 500 continues to be excessive in comparison with worldwide shares.

Desk #2: Funds In Funding Mannequin – Yr-To-Date Efficiency

Portfolio Allocation and Efficiency

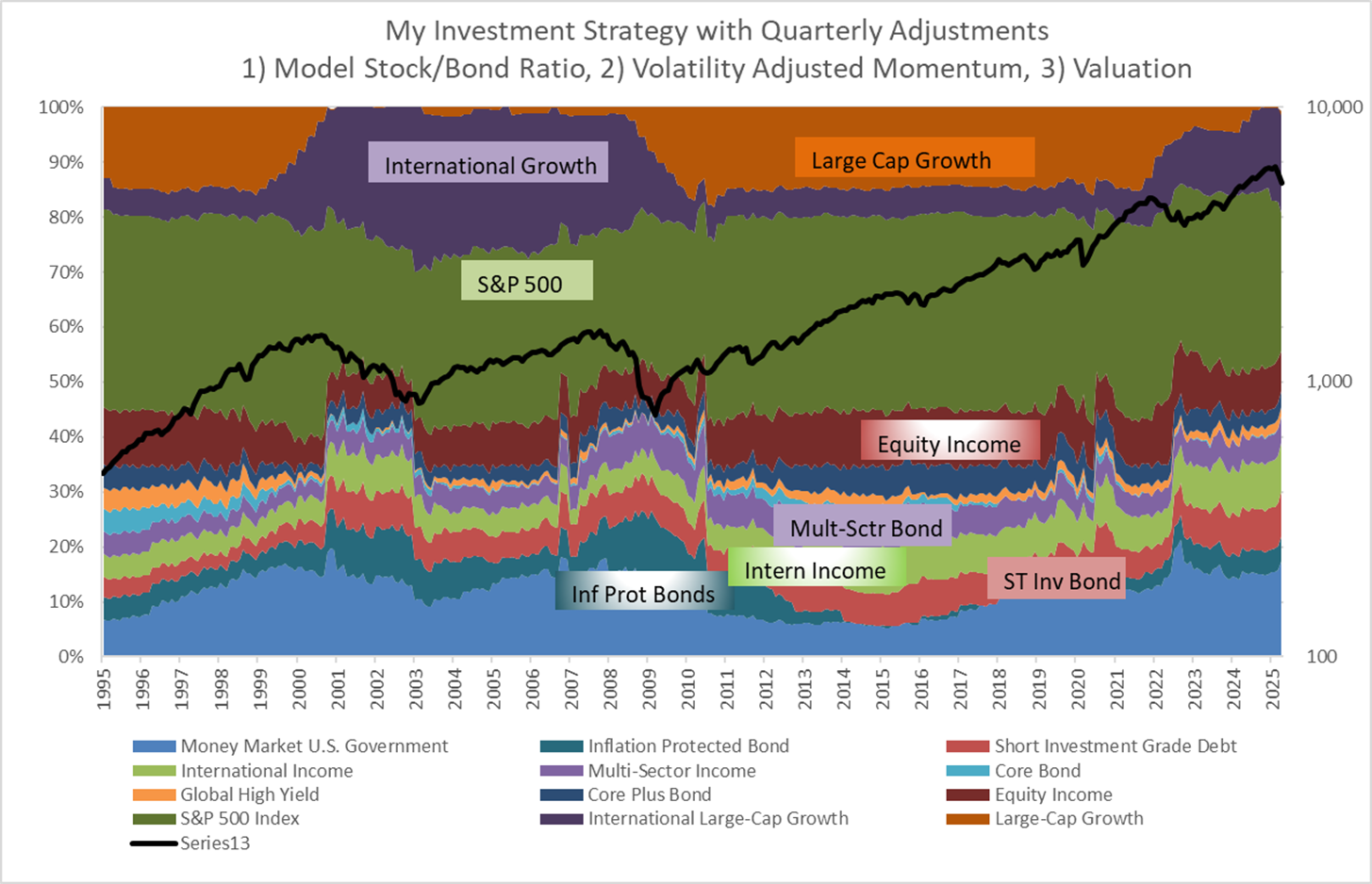

The funding mannequin makes use of financial and monetary indicators for the previous thirty years to “nowcast” present market circumstances. My funding technique is to comply with a conventional portfolio of funds with 60% allotted to shares inside a variety of 55% to 65%, and 1) make changes quarterly for two% of the portfolio based mostly on quarterly returns adjusted for volatility, 2) shifting as much as 5% of fairness between home and worldwide development funds based mostly on valuations and momentum, and three) utilizing the Funding Mannequin calculated inventory to bond ratio for “danger on – danger off”. The allocations over the previous thirty years are proven in Determine #3.

The Funding Mannequin likes money, which I’ve capped at 15%. Cash markets carried out “much less badly” than many bond funds throughout Quantitative Easing, and bond efficiency worsened beginning in 2022. Money shouldn’t be trash. Not too long ago, inflation-protected bonds have been performing effectively, as have short-term investment-grade and worldwide bond funds. On the fairness facet, I restrict the allocation to home development shares to fifteen% of the portfolio. The mannequin started shifting allocations to worldwide shares as valuations elevated, regardless that home development was outperforming, however worldwide shares have carried out exceptionally effectively in 2025.

Determine #3: Funding Mannequin Allocations

My goal is to study from how completely different methods work and never unrealistically optimize a back-tested technique. I’ve the benefit of thirty years of financial knowledge accessible on the St Louis Federal Reserve (FRED) database, hindsight on valuations, and precise fund efficiency. The Funding Mannequin returned 11.6% APR over the thirty years in comparison with 10.3% for SPDR S&P 500 ETF (SPY), 10.8% for T Rowe Value Capital Appreciation Earnings (PRWCX), and 9.8% for FPA Crescent (FPACX).

Determine #4: Funding Mannequin Whole Return vs S&P500, FPACX, PRCWX

There are 13 combined asset funds which have returned 9% or extra over the previous thirty years through the time when the S&P 500 returned 10.3%. All of them have the next risk-adjusted return as measured by the Martin Ratio than the S&P 500. Many of the combined asset funds outperformed the S&P 500 through the 1995 to 2013 time interval, whereas the S&P 500 outperformed since 2014.

My Evaluation

The Funding Mannequin has advisable a risk-off allocation of 55% because the center of 2022. I let the winners run, and the allocation rose to 65% by the top of final 12 months. As I described beforehand, I made withdrawals to refill short-term Funding Buckets and decreased ris,okay reducing allocations under 60% previous to inauguration day. What drove this weak point when the market rose by twenty % over the previous two years?

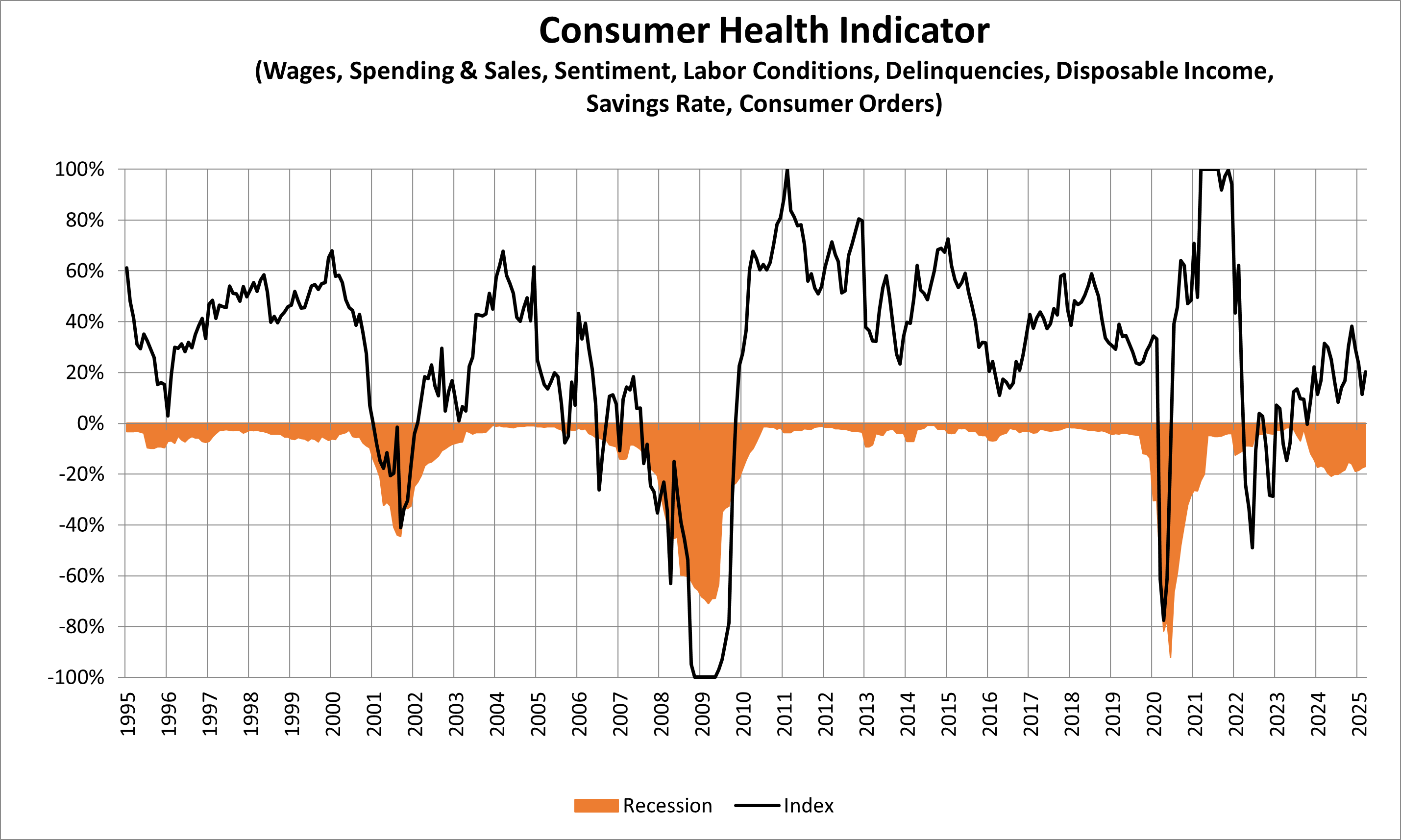

The Funding Mannequin consists of over thirty essential indicators which might be composed of over 100 sub-indicators. Let’s check out just a few of those. Practically 70% of the gross home product is shopper spending. My Client Well being Indicator, proven in Determine #5, estimates the patron’s capacity to spend sooner or later. It’s based mostly on Wages, Spending, Client Sentiment, Labor Situations, Credit score Delinquencies, Disposable Earnings, Financial savings Charges, and Consumable Orders. The place acceptable, these are adjusted for inflation. The Client is working out of breath. About two-thirds of households reside paycheck to paycheck, and about half of those don’t have sufficient financial savings to cowl three months of residing bills. Social developments like “Below-Consumption Core” and “Don’t Purchase 2025” replicate the need to chop again on spending and save extra.

Determine #5: Client Well being

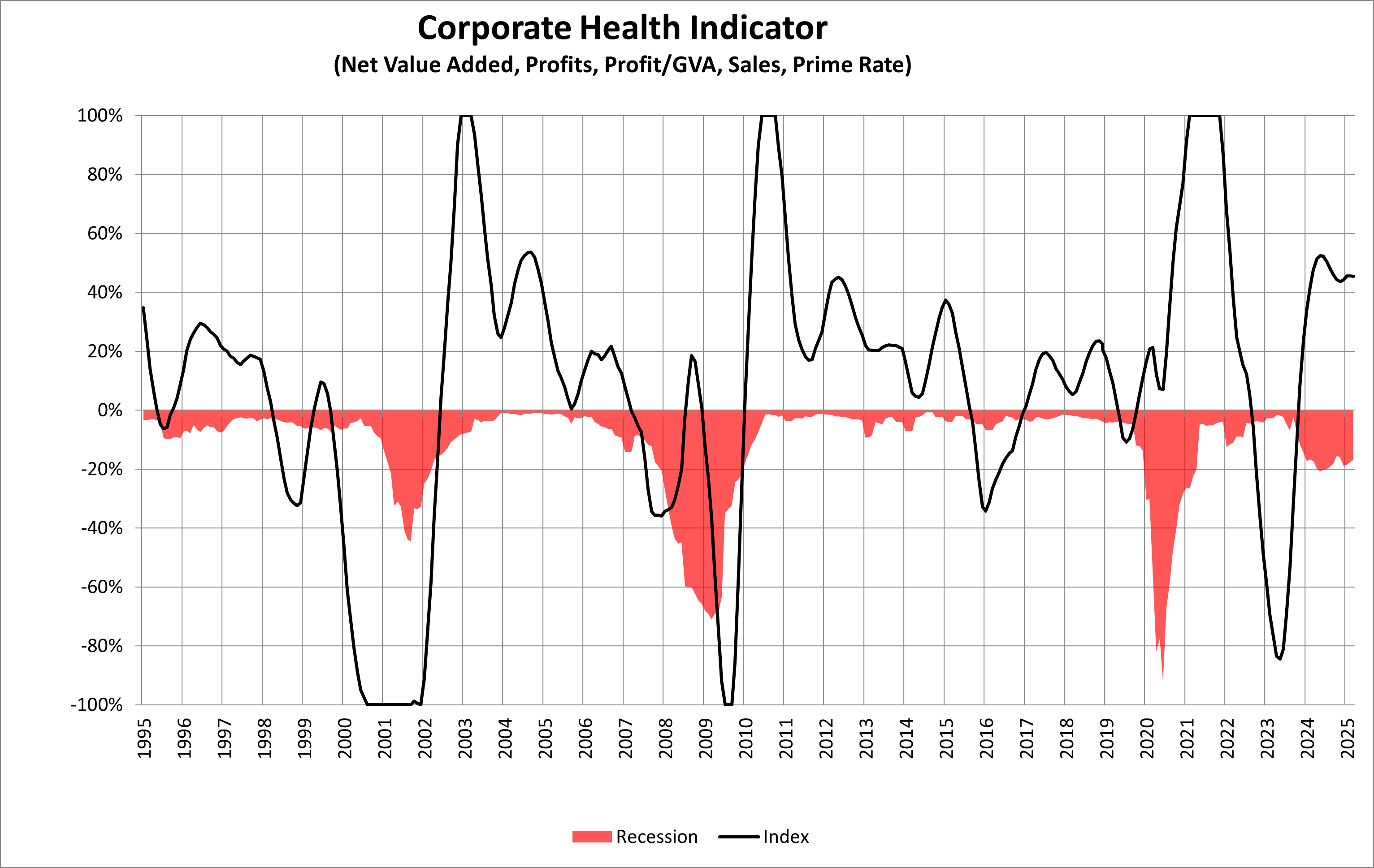

Determine #6 is my Company Well being Indicator, which is a composite of Internet Worth Added (a measure of contribution to the financial system after depreciation), Income, Gross sales, and the Prime Price. The place acceptable, these are adjusted for inflation. Rising tariffs will produce winners and losers, however a slowing financial system will negatively affect most companies.

Determine #6: Company Well being

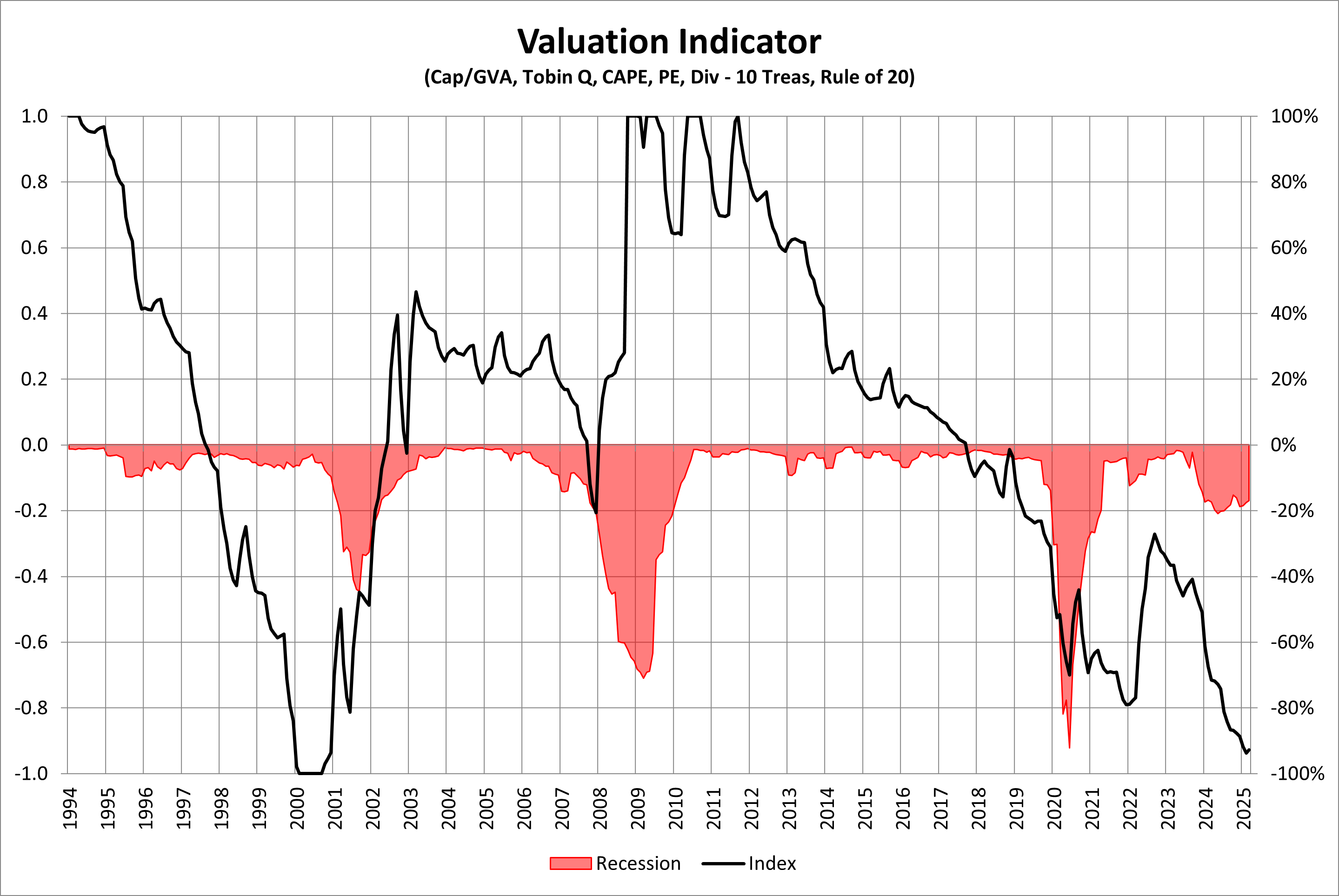

In Determine #7, I composite a half dozen measures of valuation to conclude that previous to the market correction, equities rivaled the Know-how Bubble for top valuations. They’re nonetheless extremely valued regardless of the present market correction.

Determine #7: Fairness Valuation

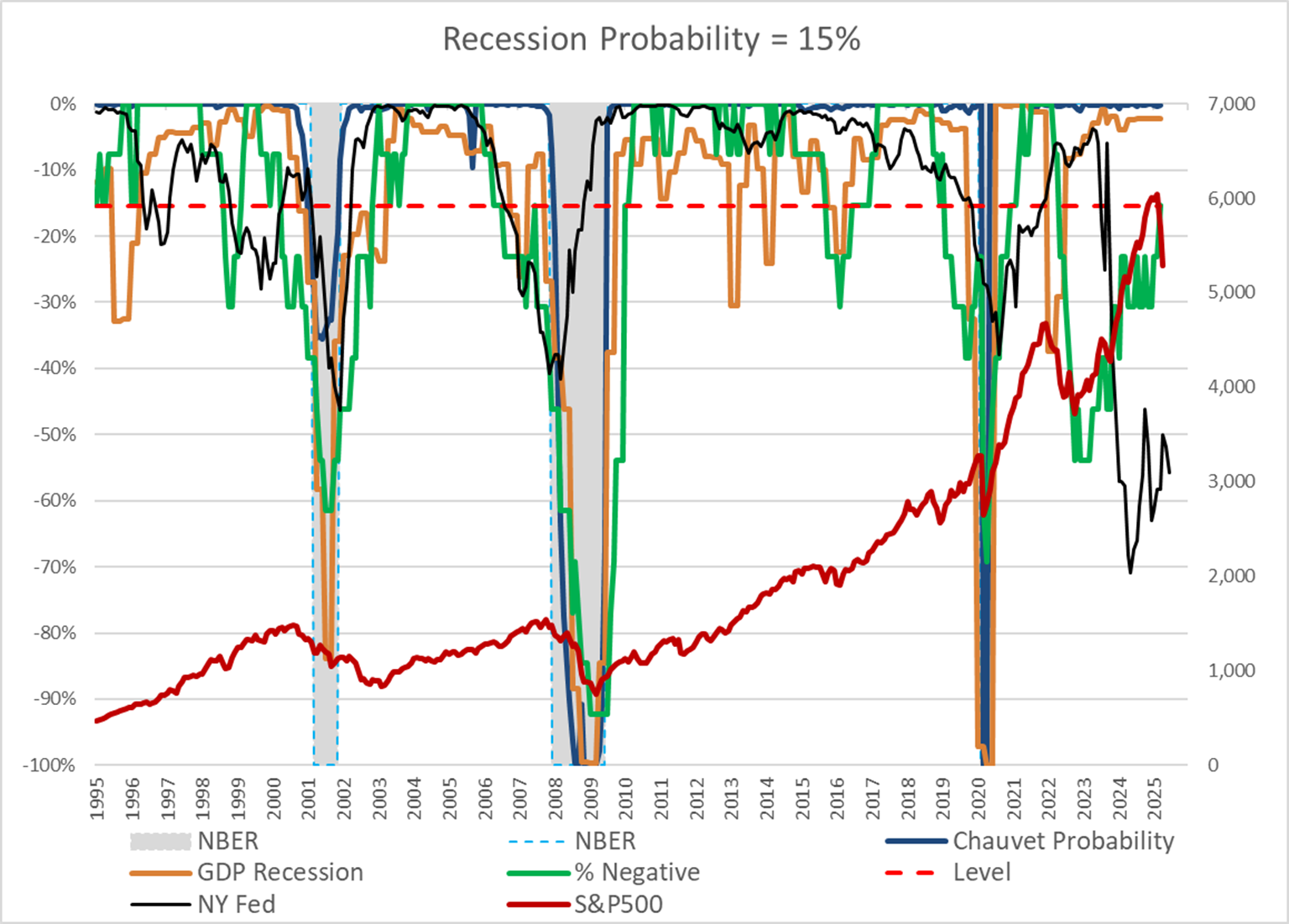

Determine #8 exhibits my Recession Indicator. I constructed it to provide advance warning of recessions. The likelihood of a recession (inexperienced line) has been falling steadily since 2022. The New York Federal Reserve recession likelihood based mostly on the yield curve (black line) stays above 50%. Information impacted by tariffs and uncertainty will trickle in over the course of the 12 months, and I count on the recession likelihood to rise considerably.

Determine #8: Recession Indicator

Closing

The Funding Mannequin is an efficient guideline for the way I need to make investments; nonetheless, there have been quite a lot of improvements in funds, the web, and instruments. I take advantage of Monetary Advisors at Constancy and Vanguard to handle over half of my funding, which is generally within the average to larger danger accounts. I handle largely the extra conservative accounts for revenue. My total portfolio has related allocations to the varieties of funds within the Funding Mannequin, however not the identical funds.

I see similarities to the stagflation of the Nineteen Seventies as a result of tariffs improve inflation and the uncertainties related to provide chain disruptions. I imagine that much less authorities spending and fewer laws will return us nearer to post-World Warfare II inventory market conduct, with extra frequent and hopefully much less extreme recessions. The 1995-2013 funding atmosphere will probably be extra consultant of the subsequent decade than the 2014-2025 interval.

Excessive valuations are nonetheless a headwind for home fairness returns. Worldwide buyers have pulled cash from US markets, preserving yields excessive on US 10-year Treasuries. The rising nationwide debt will are inclined to preserve rates of interest larger for longer. Credit score spreads on high-yield bonds are rising. Uncertainty is in-built till July 8th when the ninety-day pause on tariffs ends, or is prolonged, or commerce offers are reached, or contemporary calls for are added, or…

Following the Mannequin Portfolio, I intend to extend allocations to short-term investment-grade and inflation-protected bond funds over the course of the 12 months. As for the uncertainty within the markets, my Funding Buckets for the Quick- and Intermediate-term are strong with little volatility. I made main changes previous to inauguration day and have made just a few adjustments because of tariffs or volatility. I’ll use volatility-adjusted momentum to regulate allocations for the remainder of the 12 months with a deal with making certain the soundness of withdrawals. I stay danger off.