Every month, I replace my rating system for the thousand or so funds that I observe utilizing the MFO Premium fund screener and Lipper world dataset. I then examine the funds that I personal to the trending funds to see if I need to make any adjustments. I comply with a diversified conventional portfolio method with over half managed by Constancy and Vanguard. On this article, I take a look at the Lipper Classes and highest ranked funds for bonds, combined property, and equities.

Bond Funds

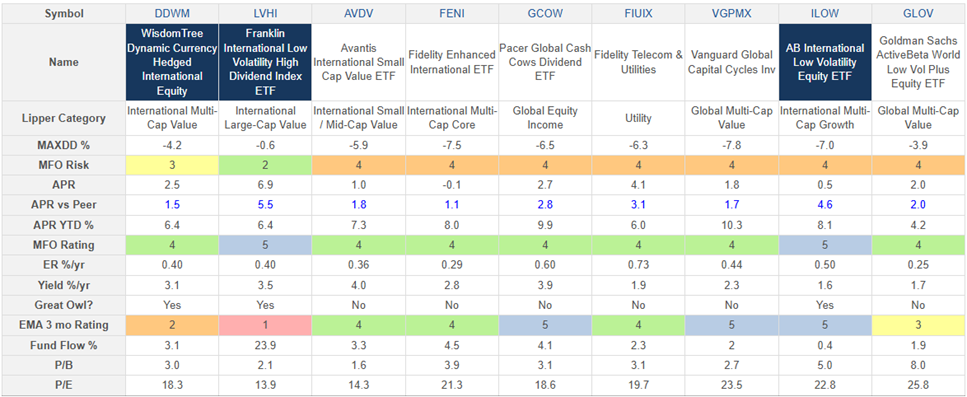

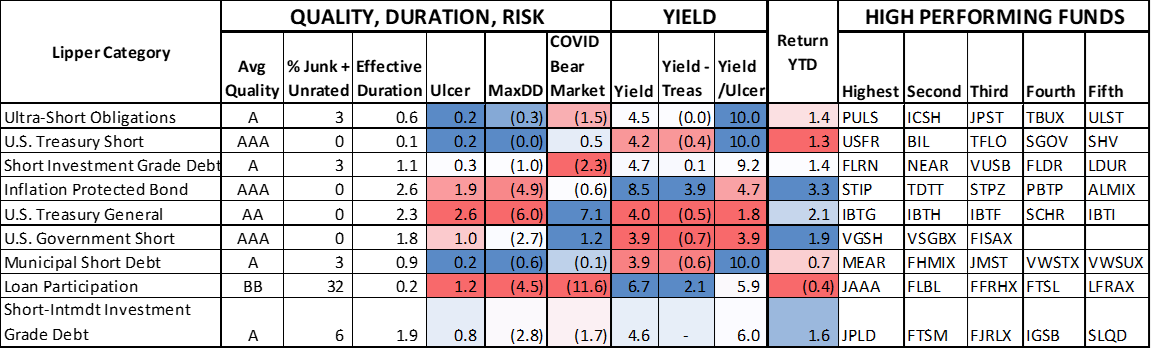

Bond funds are ranked primarily based upon 1) three-year risk-adjusted returns (Martin Ratio), 2) short-term returns and momentum, 2) threat (drawdowns and Ulcer Index), 3) bond high quality, and 4) yields, amongst different metrics. The funds in Desk #1 are ordered from the best ranked Lipper Class to the bottom, together with the 5 highest ranked funds. Over half of the investments in bonds that I handle are in bond ladders. I’m happy with the efficiency of my funds; nevertheless, high-yield funds which are supposed for earnings have had barely unfavourable returns year-to-date. Over the course of the subsequent few months, I’ll consider buying and selling Constancy Capital & Revenue (FAGIX) for a short-term or inflation-protected bond fund.

Desk #1: Prime Ranked Lipper Bond Classes and Highest Ranked Funds – Three Yr Metrics

Supply: Creator Utilizing MFO Premium fund screener and Lipper world dataset with YTD Returns from Morningstar as of April twenty second

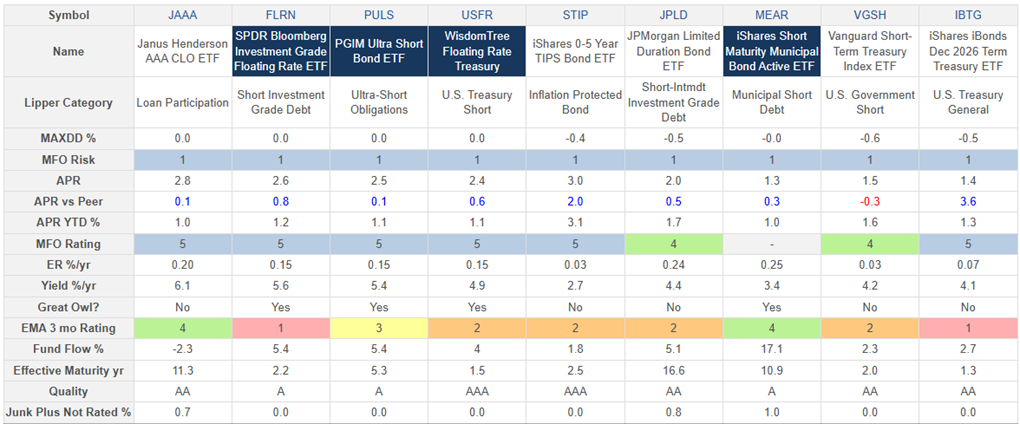

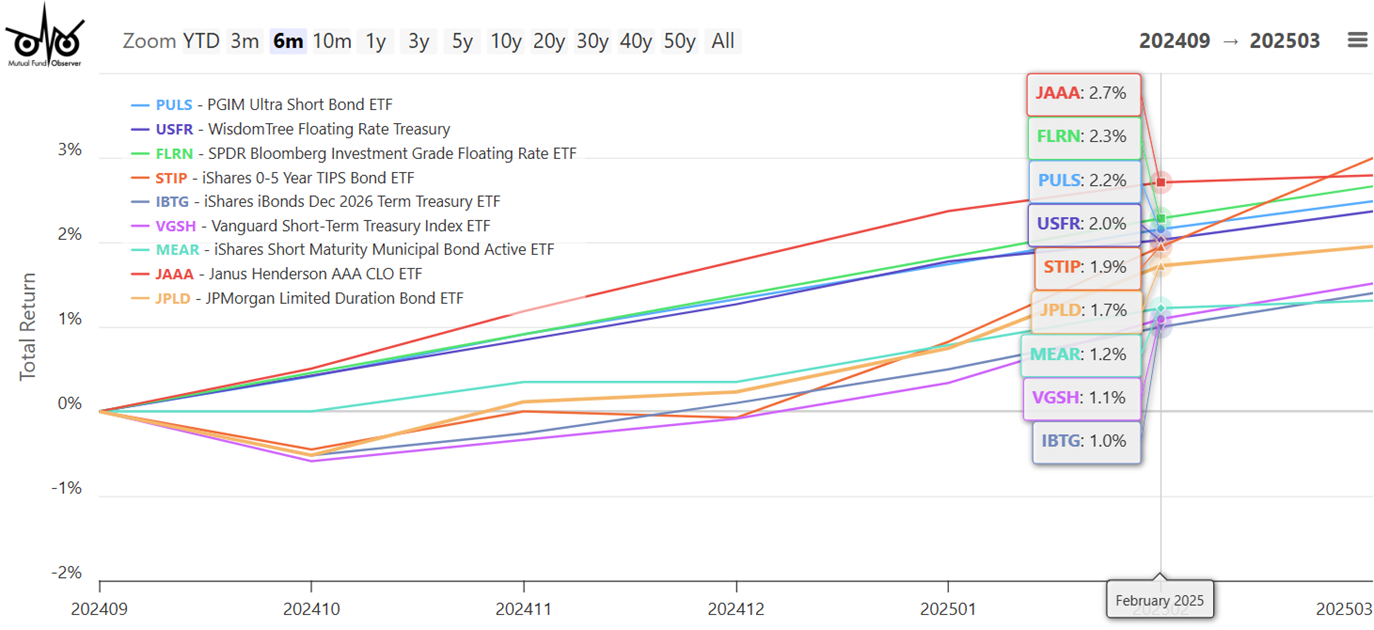

In Desk #2, I show a snapshot of the highest-ranked fund in every of the above 9 Lipper Classes. Word that IBTG within the U.S. Treasury Basic Class is the iShares iBond Dec 2026 Time period Treasury ETF, which is a fund designed for bond ladders. I wrote about these funds in “ETF Bond Ladders” final month. Determine #1 reveals the whole return of those funds since Inauguration Day.

Desk #2: Highest-Ranked Bond Funds – Metrics For Six Months

Determine #1: Whole Return of Highest-Ranked Bond Funds Since Inauguration Day

Blended Asset Funds

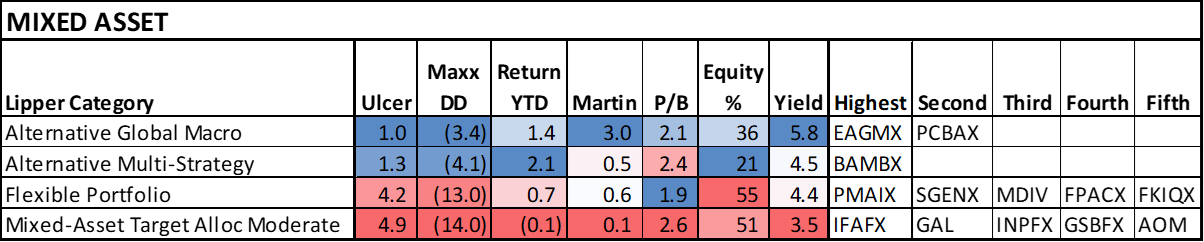

Blended-asset funds are ranked primarily based upon 1) three-year risk-adjusted returns (Martin Ratio), 2) short-term returns and momentum, 3) threat (drawdowns and Ulcer Index), 4) valuation, and 5) yields. Blended-asset funds are nice for a buy-and-hold technique and letting knowledgeable supervisor make the funding choices. The downside in retirement could also be that you’ve much less management over withdrawals as a result of you’ll be able to’t withdraw from sure classes when they’re performing effectively.

Desk #3 reveals the Lipper Blended-Asset Classes that I rank the best, together with the 5 funds with the best rank. Various world macro and different multi-strategy are likely to have increased expense ratios. I’ll think about shopping for one as a “Threat Off” diversifier. In a “Threat On” setting, I’ll think about including a versatile portfolio fund in accounts that I handle.

Desk #3: Prime-Ranked Lipper Blended-Asset Classes and Highest Ranked Funds – Three-Yr Metrics

Supply: Creator Utilizing MFO Premium fund screener and Lipper world dataset with YTD Returns from Morningstar as of April twenty second

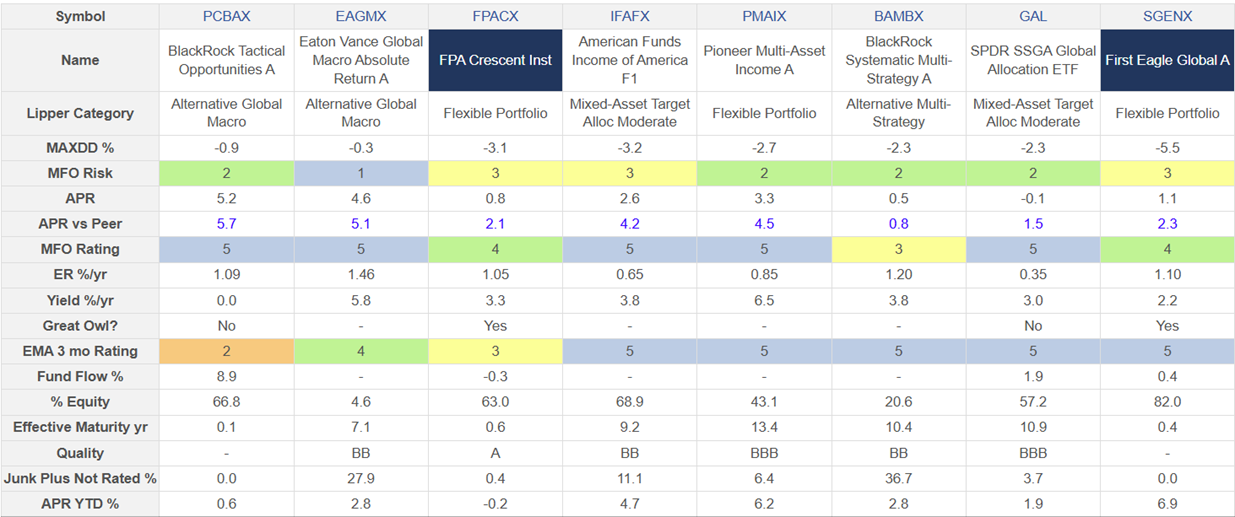

Desk #4 reveals a snapshot of the best ranked fund in every Lipper Class, together with just a few different well-known funds.

Desk #4: Chosen Excessive-Performing Blended-Asset Funds – Metrics For Six Months

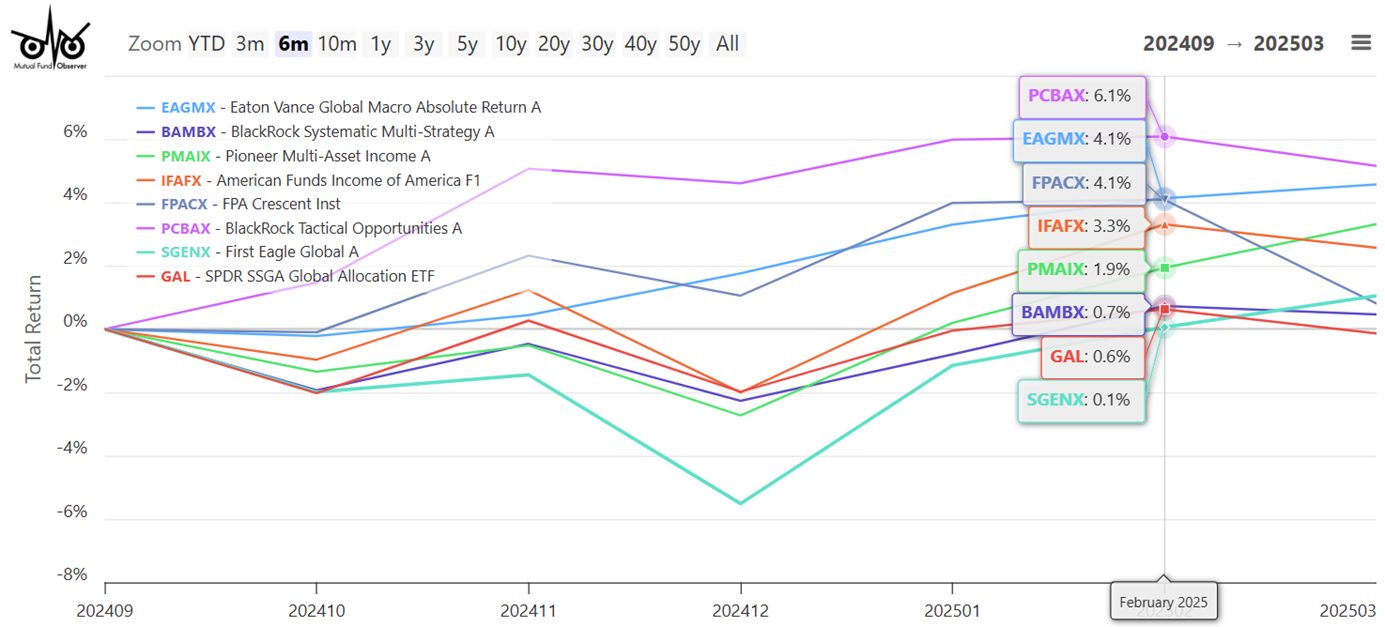

I just like the return profile of the Eaton Vance World Macro Absolute Return (EAGMX) fund as proven in Determine #2.

Determine #2: Whole Return of Chosen Excessive Performing Blended-Asset Funds Since Inauguration Day

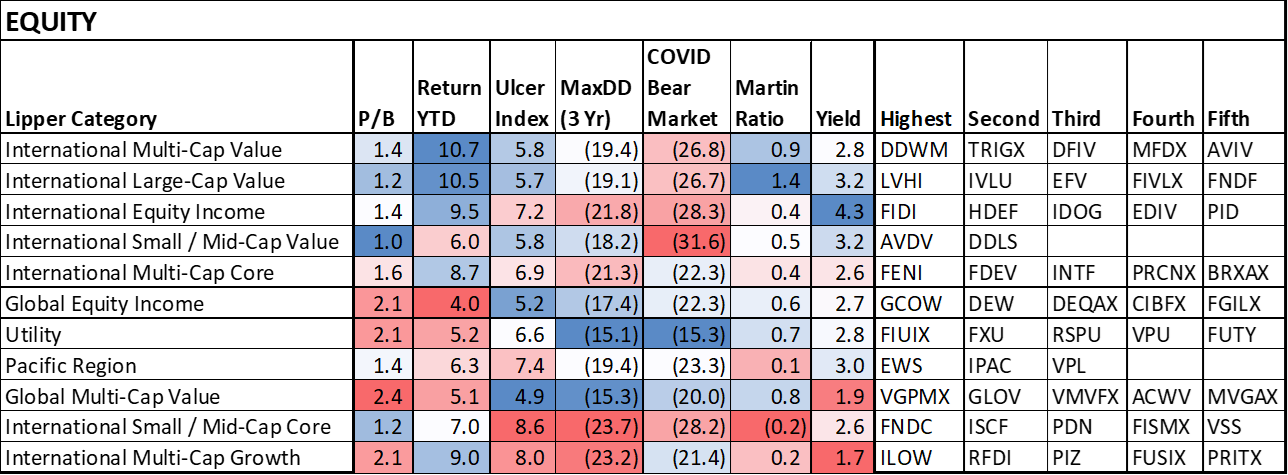

Fairness Funds

I rank fairness funds primarily based upon 1) three-year risk-adjusted returns (Martin Ratio), 2) short-term returns and momentum, 3) threat (drawdowns and Ulcer Index), and 4) valuations. Virtually the entire highest ranked Lipper Fairness Classes are worldwide or world. The returns are robust for the 12 months in mild of the uncertainty.

Desk #5: Prime Ranked Lipper Fairness Classes and Highest Ranked Funds – Three Yr Metrics

Supply: Creator Utilizing MFO Premium fund screener and Lipper world dataset with YTD Returns from Morningstar as of April twenty second

Desk #6: Chosen Excessive-Performing Fairness Funds – Metrics for Six Months

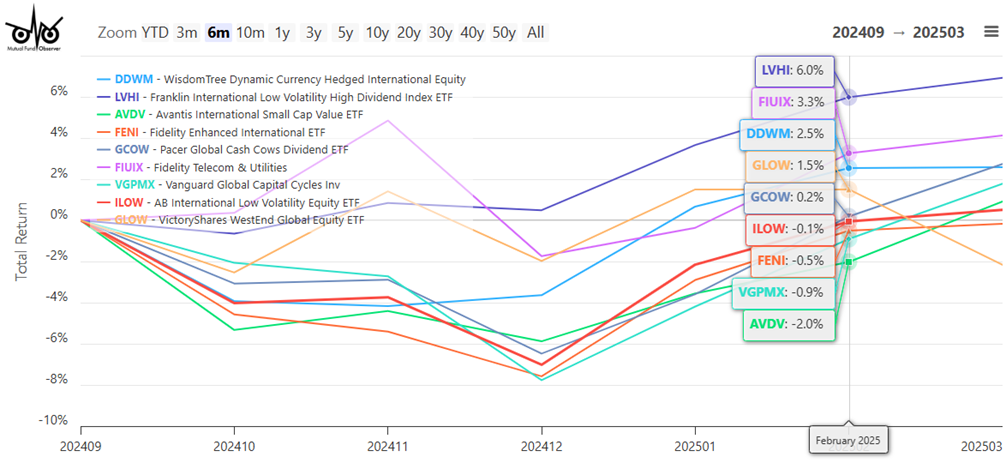

Determine #3: Whole Return of Chosen Excessive-Performing Fairness Funds Since Inauguration Day

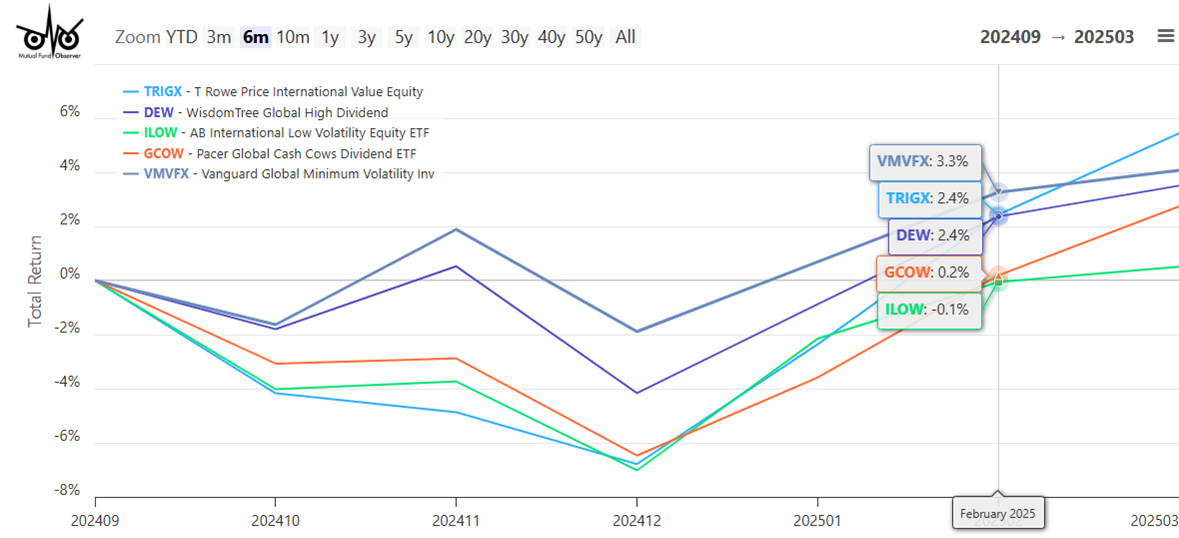

Because the mud from the commerce conflict settles, I’ll in all probability be out there for a tax-efficient worldwide or world fairness fund. My quick listing is proven in Determine #4.

Determine #4: Excessive-Performing Tax-Environment friendly Worldwide Fairness Funds

Closing

I consider that the impression of tariffs will start to indicate up extra clearly in June as a result of imports affected by tariffs will attain the cabinets in Might. A recession gained’t turn into evident except the uncertainty spreads to enterprise investments and worldwide commerce worsens, together with shocks to produce chains. The longer the uncertainty lasts, the upper the likelihood of a recession shall be.

Tariffs are a regressive tax on lower-income households who spend most of their earnings on fundamental wants. Cuts to Federal applications that help the poor will enhance the monetary stress on these households. I favor fiscal duty and slowing the rise of the nationwide debt in a well-thought-out bipartisan method.

My rating system is at the moment oriented to focus on funds that can do effectively in market downturns. I stay threat off and focus extra on having a dependable money circulation from mounted earnings for the subsequent 5 to 10 years.