Understanding danger is crucial to efficient investing and cash administration. The best way funding danger is perceived and dealt with has a pervasive affect on funding efficiency. Therefore, it could be helpful to develop a holistic understanding of how funding danger works. Allow us to now take a look at solutions to a few of the mostly requested questions on funding danger. The solutions would give us a practical understanding of funding danger.

In regards to the creator: Akshay holds an MBA in Finance from Nice Japanese Administration College, Bangalore. His web site is akshaynayakria.com. His articles on private finance and investing could be accessed right here: akshaynayakria.com/blog. Akshay is a part of freefincal’s list of curated flat-fee only SEBI registered investment advisors and fee-only India*

* Fee-only India is a casual affiliation of pure fee-only monetary advisors. Launched in September 2017, it helps join traders with SEBI-registered funding advisors with out battle of curiosity. Dr M Pattabiraman is without doubt one of the founder-patrons of fee-only India.

What Is Danger? Each incident that occurs round us could be termed as an occasion. All occasions have a variety of attainable outcomes. However solely a type of outcomes would really happen for every occasion. Danger is solely the likelihood {that a} destructive final result happens to an occasion from the set of attainable outcomes. For example, assume a person eats chaat at their favorite roadside chaat stall. They take pleasure in their meal and go residence with their style buds happy. This occasion might give rise to the next attainable outcomes :

- They continue to be wholesome just a few days after the meal

- They develop an upset abdomen just a few days after the meal

On this case danger is the likelihood that final result B materialises in the actual world after the occasion, which is the person consuming chaat from the roadside stall. Adverse outcomes kind part of the set of attainable outcomes for all occasions. Due to this fact each single occasion comes with a level of danger constructed into it.

Allow us to now perceive how the idea of danger applies to investing. Investing our cash in a specific asset represents an occasion. There may be one explicit destructive final result to this occasion that impacts traders greater than others. It’s the everlasting lack of their invested capital. Funding danger is due to this fact symbolised by the likelihood of the everlasting lack of the cash parked in a specific funding. Each funding carries a sure likelihood of everlasting lack of capital. Every funding due to this fact comes with an inherent diploma of danger. Investments the place the danger of everlasting loss is low are broadly termed as low danger investments. And investments the place the likelihood of everlasting loss is excessive are broadly termed as excessive danger investments.

The place Does Danger Come From? Each occasion has a variety of attainable outcomes. Some outcomes are constructive whereas others are destructive. However the precise results of the occasion can’t be forecasted precisely and persistently prematurely. It is because we have no idea which explicit final result will happen from inside the vary on a specific event. That is additionally true with regard to our investments.

After we make an funding, the result from making the funding is unsure. There isn’t any method to precisely and persistently predict whether or not the Funding would become worthwhile prematurely. This uncertainty is without doubt one of the main sources of danger. The world we stay in is fairly predictable more often than not, however not all the time. Due to this fact there are occasions after we might not even know the complete vary of attainable outcomes to an occasion.

Most of us are normally cognisant of outcomes which might be extremely prone to occur. We might even be cognisant of outcomes which might be moderately prone to occur. However only a few of us (if any) are cognisant of outcomes which might be extremely unlikely to occur, however may. Such outcomes are known as tail occasions (occasions corresponding to the worldwide monetary disaster, COVID – 19 as an example). Such occasions have a pervasive and lasting affect on markets and our investments. Being inadequately ready for such occasions is due to this fact one other main supply of danger.

Does A Constructive Final result To An Occasion Indicate The Absence Of Danger In The Occasion?

The quick reply isn’t any. The inherent danger of an occasion is unbiased of the result. Take the occasion of a batsman batting on a inexperienced pitch. There’s a packed slip cordon. The bowler bowls a tempting ball simply outdoors the off stump. The batsman goes for a canopy drive. However the ball takes the surface edge and goes between the slips for a boundary.

Right here the result is constructive for the batsman (scoring a boundary). However that doesn’t imply that there was no danger within the shot he performed. If the batsman had been to play the identical shot to the same ball once more, there’s a materials probability of him getting caught within the slips. Allow us to now perceive how this is applicable to investing and cash administration.

Take investing in penny shares as an example. Penny shares are normally obtainable at significantly low valuations. It is because most penny shares have weak fundamentals. This makes investing in them a dangerous proposition. Allow us to say an investor takes up a concentrated place in a penny inventory throughout a bull market. He realises a bumper revenue on the inventory when he sells it a 12 months later.

Incomes the bumper revenue represents a constructive final result for the investor. However there was no change within the elementary soundness of the inventory over the course of the 12 months. Due to this fact the diploma of danger inherent to the inventory is identical. It’s only as a result of the investor was collaborating in a bull market that the gamble paid off. However they might not be as fortunate in the event that they had been to repeat such a big gamble on one other event. Due to this fact a constructive final result to an occasion doesn’t suggest the absence of danger. It merely means not one of the attainable destructive outcomes to that occasion occurred on that specific event. Additionally, a constructive final result achieved on the again of a flawed course of shouldn’t be indicative of talent. It implies that luck was the predominant pressure at play moderately than talent.

Is Volatility A Measure Of Danger?

Academicians and funding theorists use volatility as a measure of danger. It is because volatility can simply be quantified utilizing mathematical formulae. However danger is summary in nature. Something that’s summary can’t be reliably quantified. That is no completely different in the case of danger. The inherent danger of an occasion can’t be quantified both prematurely or in hindsight. Volatility is a symptom of danger. In different phrases volatility is solely an indicator of the presence of danger.

How Are Danger And Asset High quality Associated?

Asset high quality refers back to the elementary soundness of a specific funding. There’s a moderately robust correlation between danger and asset high quality. However danger shouldn’t be straight a perform of asset high quality. In different phrases, the elemental soundness of an funding doesn’t all the time outline how dangerous it’s. A essentially sound funding can be dangerous whether it is acquired at an exorbitant value. The perfect instance of that is that of shopping for bluechip shares on the peak of a bull market. The underlying firm could also be essentially sound. However the market value of its inventory could also be too excessive to justify the diploma of its elementary soundness.

However, an funding that’s essentially unsound can generally be low cost sufficient to be secure. The perfect instance of this could be excessive yield bonds. These are additionally known as junk bonds. Excessive yield bonds would usually signify dangerous investments. However each every so often there could also be bonds the place the value understates the elemental soundness of the corporate issuing the bond. Traders with a discerning eye might be able to determine and choose such bonds. Ultimately the bond markets will take cognisance of the particular fundamentals of the bond. This could convey the market value of the bonds in step with their fundamentals. Those that purchased the bonds at understated costs would revenue in such a scenario.

This factors to a really clear inference. No asset is essentially sound sufficient to justify being a smart funding at any value. And only a few belongings can be so essentially unsound that they might signify a nasty funding no matter their value. This exhibits that danger shouldn’t be essentially born from the standard of the belongings that we purchase. It’s born from the value we pay for the asset high quality that we get.

How Are Danger And Return Associated?

The overall notion of the connection between danger and return is that taking increased danger ends in increased returns. This relationship could be represented graphically as proven within the graphic under. The horizontal axis represents the diploma of danger taken over time. The vertical axis represents the return earned over a time frame.

The upward sloping line implies a constructive and linear relationship between danger and return. However such an understanding of the connection between danger and return is totally flawed. It is because if investing in riskier belongings meant getting a better return, there would basically be no danger. There’s a extra mature method to perceive the connection between danger and return. Some investments provide a better anticipated return than others. However the precise return delivered could also be decrease than than the anticipated return. And that’s the place the danger comes from.

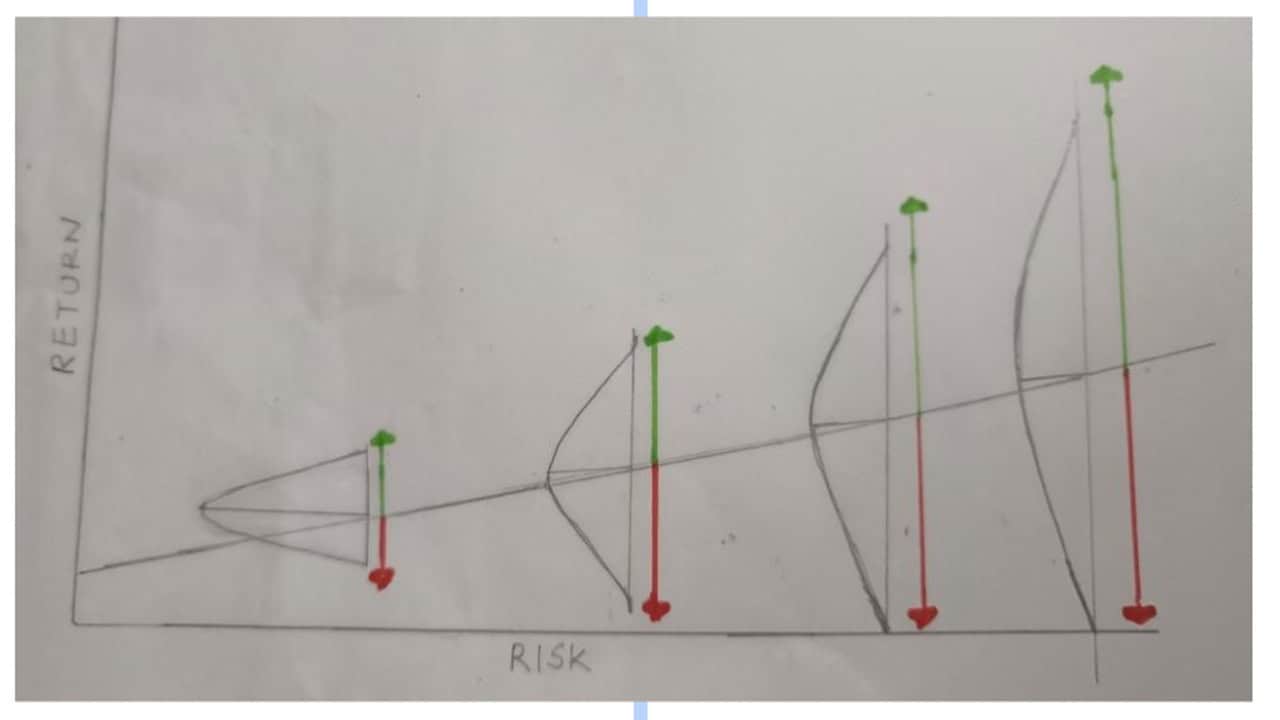

Understanding the connection between danger and return by way of occasions and attainable outcomes can also be vital. The vary of attainable outcomes for an occasion can sometimes be represented utilizing a bell-shaped curve (regular distribution). Constructive outcomes fall on the correct aspect of the bell-shaped curve, and destructive outcomes fall on the left aspect. When the bell-shaped curve pertaining to a specific occasion is superimposed on the risk-return graph given above, we get the resultant graph, as proven under.

Discover that as we transfer increased on the risk-return line, the width of the bottom of the bell-shaped curve will increase. This means a wider vary of attainable outcomes to an occasion over longer time horizons. It additionally signifies that the constructive outcomes to an occasion are progressively extra rewarding over time. That is mirrored by the growing size of the inexperienced line to the correct of every bell curve. It additionally signifies that the destructive outcomes to an occasion are progressively extra extreme over time. That is mirrored by the growing size of the pink line to the left of every bell curve. So our possibilities of incomes a constructive return are higher over longer time horizons. However the vary and severity of dangers we’re uncovered to are additionally larger. And that’s the place the danger comes from for traders.

What Is The Nature Of Danger?

Danger is counterintuitive. Danger stays low when most individuals are aware of its presence. Danger is heightened when most individuals understand that there isn’t any danger. Allow us to take a look at a few examples to substantiate this level.

In a specific city within the Netherlands, an experiment was carried out as a part of a research on highway security. All site visitors indicators within the city had been shut down. All highway security indicators had been taken down. All highway markings had been erased. This could ideally have led to a rise in highway accidents. However it really diminished the variety of highway accidents. The absence of highway security aids mechanically made individuals extra cognisant of the potential of accidents. This noticed them make a aware choice to drive extra fastidiously. And it naturally diminished the prevalence of accidents. Comparable measures had been later applied in the UK. These can learn extra about it within the article linked right here : The Removal Of Road Markings Is To Be Celebrated. We Are Safer Without Them – Simon Jenkins

However, take into account the case of dangerous out of doors actions like mountaineering or snowboarding. Higher security gear is continually developed for hikers and skiers. This could ideally scale back the variety of injurious or deadly accidents related to these actions. However it really doesn’t contribute in the direction of reducing the danger of accidents. The provision of higher high quality gear might lull hikers and skiers right into a false sense of safety. This encourages them to strive riskier issues when mountaineering or snowboarding. Naturally, the danger of accidents would stay the identical. It could even improve.

This makes it abundantly clear that danger shouldn’t be born from an occasion or exercise. It’s born from the best way individuals take part in it. Utilized to investing, this suggests that danger shouldn’t be born from the market or an funding asset in itself. It’s born from the best way individuals take part within the markets and spend money on varied belongings. If traders had been to stay prudent and show balanced behaviour when investing, danger would stay low. However all traders are emotional and show polarised funding behaviour every so often. That is what creates excesses and heightens funding danger on varied events.

What Is Danger Administration?

Danger administration is the final word take a look at of our funding talent. Trying solely at our funding returns doesn’t realistically replicate our funding talent. The important thing query we should ask ourselves is: How a lot danger did I bear to earn this return?. To grasp this higher, take a look at the graphic given under. It represents the returns earned by 5 traders when :

- The market rises 10%

- The market falls 10%

These outcomes could also be interpreted as follows :

Investor A: Matches the market each on the upside in addition to the draw back. This will likely point out that investor A is an index investor. However he doesn’t must exhibit any diploma of discernable talent to earn these returns.

Investor B: Enjoys outsized beneficial properties on the upside, however suffers disproportionate losses on the draw back. Once more, there isn’t any discernable talent on show right here. It simply implies that investor B follows an excessively aggressive technique.

Investor C: Does higher than the market on the draw back, but additionally lags the market on the upside. Once more there isn’t any talent concerned, simply an excessively defensive technique

Investor D: Beats the market on the upside and matches it on the draw back. This may be thought-about as an excellent consequence for the investor.

Investor E: Matches the market on the upside and loses lower than the market on the draw back. This is a wonderful consequence for the investor.

However what’s the purpose behind the higher outcomes achieved by traders D and E? It’s their capability to understand and handle danger higher than the opposite traders. They can do that as a result of they’ve a greater sense of the vary of attainable outcomes to numerous occasions. This permits them to organize adequately for varied outcomes attainable to every occasion. Doing this requires a substantial diploma of perception and talent. The truth that traders D and E have managed danger successfully exhibits that they’re extra skillful in comparison with the opposite traders.

When Is Danger Administration Required? Danger administration is required each time a destructive final result happens to an occasion. However it’s inconceivable to foretell precisely when a destructive final result would happen prematurely. Due to this fact it could be prudent to be ready for destructive outcomes always. Doing this requires danger administration to be proactive moderately than reactive. Due to this fact danger administration is a continuing prerequisite for efficient investing.

How Ought to Danger Be Managed? Managing danger is extraordinarily difficult. It is because most occasions are dynamic. The circumstances beneath which occasions occur maintain altering in actual time. And we get little or no time to reply to them. Danger administration should due to this fact be constructed into the best way we plan for occasions and reply to them. In different phrases we should plan in such a approach that we’re ready for destructive outcomes, though we don’t count on them to occur. This can be a very huge a part of the rationale why we buy insurance coverage.

Take medical health insurance for instance. When one purchases medical health insurance, they don’t count on to develop main well being points that require hospitalisation. Nonetheless, by buying medical health insurance, they might be nicely ready if such a scenario had been to come up sooner or later. Managing funding danger works a lot the identical approach. Danger administration should be constructed into the best way a portfolio is constructed. A well-constructed portfolio ought to permit the investor to take part adequately in constructive outcomes. However extra importantly, it should permit them to successfully resist the hostile penalties of destructive outcomes.

Managing danger in a portfolio requires traders to have a way for when to be aggressive (i.e allocate extra to dangerous belongings like fairness), and when to be defensive (i.e allocate extra to secure belongings corresponding to bonds and glued revenue investments). Only a few traders (if any) have the information and perception required to guage this precisely and persistently. This is the reason traders are suggested to stick to ideas corresponding to asset allocation, diversification and portfolio rebalancing. It prepares traders for a wider vary of destructive outcomes. This could assist the portfolio survive over lengthy intervals of time. With the ability to profit from constructive outcomes can be a pure consequence of this.

What Ought to The Reader Keep in mind About Understanding And Managing Funding Danger?

There are just a few important classes that each reader of this text can take away. Traders should not count on to revenue if they don’t bear funding danger. They need to additionally not count on to be compensated simply because they’re keen and in a position to bear a sure diploma of funding danger. Efficient danger administration requires traders to restrict uncertainty whereas sustaining substantial potential for beneficial properties. Doing this requires two issues. Traders should have a superior sense of the vary of attainable outcomes related to an occasion. They need to additionally be capable of guage whether or not the reward on provide is definitely worth the diploma of danger being taken. Most traders should not able to doing these two issues precisely and persistently. They need to due to this fact put together themselves for as vast a variety of outcomes as attainable. That is probably the most nicely rounded method to perceive and handle danger.

Do share this text with your pals utilizing the buttons under.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& be a part of our neighborhood of 7000+ customers!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ Greater than 2,500 traders and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We additionally publish month-to-month equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

Podcast: Let’s Get RICH With PATTU! Every single Indian CAN grow their wealth!

You can watch podcast episodes on the OfSpin Media Friends YouTube Channel.

🔥Now Watch Let’s Get Rich With Pattu தமிழில் (in Tamil)! 🔥

- Do you’ve a remark concerning the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Have a query? Subscribe to our publication utilizing the shape under.

- Hit ‘reply’ to any electronic mail from us! We don’t provide customized funding recommendation. We will write an in depth article with out mentioning your title when you have a generic query.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Hyperlink takes you to our electronic mail sign-up kind)

About The Writer

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product growth. Join with him through Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Gets a Superpower! for teenagers. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Fee-only India,” an organisation selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product growth. Join with him through Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Gets a Superpower! for teenagers. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Fee-only India,” an organisation selling unbiased, commission-free funding recommendation.

Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ Greater than 3,000 traders and advisors are a part of our unique neighborhood! Get readability on plan in your objectives and obtain the mandatory corpus irrespective of the market situation is!! Watch the primary lecture totally free! One-time cost! No recurring charges! Life-long entry to movies! Cut back worry, uncertainty and doubt whereas investing! Discover ways to plan in your objectives earlier than and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ Greater than 700 salaried staff, entrepreneurs and monetary advisors are a part of our unique neighborhood! Discover ways to get individuals to pay in your abilities! Whether or not you’re a skilled or small enterprise proprietor who needs extra shoppers through on-line visibility or a salaried individual wanting a aspect revenue or passive revenue, we are going to present you obtain this by showcasing your abilities and constructing a neighborhood that trusts and pays you! (watch 1st lecture totally free). One-time cost! No recurring charges! Life-long entry to movies!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Most investor issues could be traced to an absence of knowledgeable decision-making. We made dangerous selections and cash errors after we began incomes and spent years undoing these errors. Why ought to our youngsters undergo the identical ache? What is that this ebook about? As dad and mom, what wouldn’t it be if we needed to groom one capability in our youngsters that’s key not solely to cash administration and investing however to any side of life? My reply: Sound Determination Making. So, on this ebook, we meet Chinchu, who’s about to show 10. What he needs for his birthday and the way his dad and mom plan for it, in addition to educating him a number of key concepts of decision-making and cash administration, is the narrative. What readers say!

Should-read ebook even for adults! That is one thing that each mother or father ought to educate their children proper from their younger age. The significance of cash administration and choice making primarily based on their needs and wishes. Very properly written in easy phrases. – Arun.

Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new e-book is for these fascinated by getting aspect revenue through content material writing. It’s obtainable at a 50% low cost for Rs. 500 solely!

Do you wish to verify if the market is overvalued or undervalued? Use our market valuation tool (it would work with any index!), or get the Tactical Buy/Sell timing tool!

We publish month-to-month mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content material coverage. Freefincal is a Information Media Group devoted to offering authentic evaluation, experiences, critiques and insights on mutual funds, shares, investing, retirement and private finance developments. We accomplish that with out battle of curiosity and bias. Observe us on Google News. Freefincal serves greater than three million readers a 12 months (5 million web page views) with articles primarily based solely on factual info and detailed evaluation by its authors. All statements made will likely be verified with credible and educated sources earlier than publication. Freefincal doesn’t publish paid articles, promotions, PR, satire or opinions with out knowledge. All opinions will likely be inferences backed by verifiable, reproducible proof/knowledge. Contact info: letters {at} freefincal {dot} com (sponsored posts or paid collaborations is not going to be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Aim-Primarily based Investing

Revealed by CNBC TV18, this ebook is supposed that can assist you ask the correct questions and search the right solutions, and because it comes with 9 on-line calculators, you too can create customized options in your way of life! Get it now.

Revealed by CNBC TV18, this ebook is supposed that can assist you ask the correct questions and search the right solutions, and because it comes with 9 on-line calculators, you too can create customized options in your way of life! Get it now.

Gamechanger: Neglect Startups, Be part of Company & Nonetheless Stay the Wealthy Life You Need

This ebook is supposed for younger earners to get their fundamentals proper from day one! It’s going to additionally allow you to journey to unique locations at a low value! Get it or gift it to a young earner.

This ebook is supposed for younger earners to get their fundamentals proper from day one! It’s going to additionally allow you to journey to unique locations at a low value! Get it or gift it to a young earner.

Your Final Information to Journey

That is an in-depth dive into trip planning, discovering low cost flights, price range lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (instant download)

That is an in-depth dive into trip planning, discovering low cost flights, price range lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (instant download)