Welcome to the April Mutual Fund Observer!

My mother used to say, “March generally is available in like a lion.” She by no means added, “after which it eats you.”

March, named for the God of Warfare, strikes me for 2 causes. First, it’s the month that has encompassed an entire sequence of catastrophes within the monetary markets and past. March 2025 marked:

- The fifth anniversary of the COVID lockdowns and flash crash, during which the S&P 500 misplaced 34% in 33 days.

- March 24 was the 25th anniversary of the collapse of the dot-com bubble, which vaporized $5 trillion in market worth (concerning the quantity vaporized in Q1 2025, however 2020 was again within the days when a trillion nonetheless counted for one thing) and noticed the NASDAQ down practically 80%.

- The 30th anniversary of the social media revolution, sparked by Yahoo! and the Yahooligans.

- The 87th anniversary of Hitler’s Anschluss, the annexation of Austria which marked Nazi Germany’s first act of territorial enlargement, violated worldwide treaties, emboldened Hitler’s aggression resulting in World Warfare II, and intensified persecution of Austria’s Jewish inhabitants beneath Nazi rule.

- And the 107th anniversary of the outbreak of the lethal Spanish flu epidemic – which contaminated a 3rd of the world’s inhabitants and killed 50 – 100 million – started. (To be clear, they died of influenza or secondary bacterial infections, not from a not-yet-invented flu vaccine or mysterious army vaccine.)

Second, maybe there’s one thing to be taken from the truth that we’ve survived so many end-of-the-world catastrophes that we don’t even bear in mind them anymore. We’ve got been distinctive in some ways, and that has served us nicely for greater than a century.

The query turns into, will we select to stay distinctive in a optimistic approach? In case you make the reply primarily based on three months, it’s “no.” However we’re not judged on the weird moments; we’re judged by what we select to embrace – or just allow – over time. I think about us, if solely as a result of an unlimited variety of individuals have dedicated their lives to creating their communities, our nation, our world, and our technology a greater place.

Unstable March was named for the god of struggle. April, in distinction, was named for the everlasting turning of the seasons. Its identify doubtless derives from the Latin phrase for “budding out” or “opening.” Have fun the unchanging change. There may be an unsure flutter of the seasons right here the place a heat week is herald to the primary spring blooms … that are shortly buried within the final winter snows. And nonetheless, they endure the adversity, sure that their day will come.

Have fun, pricey readers, the seasons, the issues which change, and the issues which by no means will.

On this month’s Observer …

I’m not optimistic concerning the prospects for the US inventory market. That’s not a prediction, pricey associates, that’s only a disclosure of a private perspective. Markets thrive on predictability since funding selections must be made within the framework of a three-to-five-year plan. (Hypothesis, not a lot.) Given the proliferation of coverage by pique, traders should not more likely to have the mandatory confidence to make regular and ongoing commitments to the US fairness market. Or, they could shock us. This month and subsequent MFO will attempt to tackle among the angst brought on by that instability. Normally, long-term traders want to remain within the fairness market. That’s far simpler in case your publicity is hedged. Hedging could be both low-cost and simple or advanced and costly. We favor the previous, and so this month, we’ll profile The Dry Powder Gang, 2025. The Dry Powder Gang are excellent funds that, like Warren Buffett, are keen to sit down on money when equities aren’t paying for the chance you’re taking.

In Could, we’ll profile the handful of hedged funds that really earn their maintain.

We share a Launch Alert for GlacierShares Nasdaq Iceland ETF, a fund that can divide its portfolio about evenly between the shares of Icelandic firms and the shares of firms in different (primarily) Nordic nations with substantial ties to Iceland. There’s been an upsurge within the ranks of the Arctic-curious, from funding managers to … uh, politicians whose eyes have turned north towards Greenland, Norway, and the Nordic nations usually. The mix of sound economies and wholesome nationwide cultures, mixed with anxiousness a few stretch of unhabitable actual property, has extra of us pondering the potential of the North.

I educate about Communication and Rising Applied sciences (cool day job, eh?), and few applied sciences are extra emergent than synthetic intelligence. There’s a reputable argument that just about each occupation on the planet will, inside 5 years, be reshaped by synthetic intelligence, and the funding business isn’t any exception. Morningstar has taken tentative steps towards making a human-light analytic surroundings (from its Q-analyst rankings pushed by machine-learning know-how to its AI spokesmodel, Mo), whereas a dozen funding managers have dedicated to AI-driven portfolios. In “The Ghost within the Machine,” I’ll stroll you thru what AI is, how the AI fashions operating one portfolio – Clever Livermore ETF – advocate you deal with their fund, and eventually, what qualifies as the larger image of AI fund administration.

I educate about Communication and Rising Applied sciences (cool day job, eh?), and few applied sciences are extra emergent than synthetic intelligence. There’s a reputable argument that just about each occupation on the planet will, inside 5 years, be reshaped by synthetic intelligence, and the funding business isn’t any exception. Morningstar has taken tentative steps towards making a human-light analytic surroundings (from its Q-analyst rankings pushed by machine-learning know-how to its AI spokesmodel, Mo), whereas a dozen funding managers have dedicated to AI-driven portfolios. In “The Ghost within the Machine,” I’ll stroll you thru what AI is, how the AI fashions operating one portfolio – Clever Livermore ETF – advocate you deal with their fund, and eventually, what qualifies as the larger image of AI fund administration.

Lynn helps us all get grounded once more. His April articles proceed the theme he’s been creating all 12 months, highlighting how bonds present stability and earnings whereas worldwide equities supply higher valuations than U.S. shares. In Overview of Secular Markets Lynn Bolin examines long-term market tendencies, contrasting the 1995-2012 interval with current years. He notes that elevated P/E ratios and altering financial circumstances recommend worldwide equities and bonds might outperform U.S. shares in coming years. Bolin analyzes present treasury yields, bond returns, and mixed-asset funds, recommending a diversified portfolio given present market uncertainty.

He follows that up with Fairness Fund Scores, the place Bolin presents his four-tier system for evaluating fairness funds primarily based on threat, valuations, efficiency, and momentum. Every tier represents totally different risk-yield profiles, from Tier One (decrease threat, decrease valuations, increased yield) to Tier 4 (increased threat). He highlights particular funds inside every class, noting that worldwide shares are at present performing nicely whereas know-how shares have declined.

Lynn’s final article continues his inquiry into bonds and fixed-income as a competitor to equities. Funding Buckets for Bonds outlines Lynn’s bucket technique for bond investments: Bucket #1 (security, 1-3 years), Bucket #2 (intermediate, 3-10 years), and Bucket #3 (long-term, 10+ years). For every bucket, he evaluates bond classes and particular funds primarily based on length threat, high quality threat, yield, and momentum, sharing his present allocations and up to date efficiency information.

The Shadow, devoted as ever, gives a Briefly Famous tackle the business and its churning. Highlights embrace kudos to CrossingBridge, structural adjustments at two Schwab funds that may sign a broader judgment about the place property are going, and, pushed by reader curiosity, the addition of a brand new characteristic: Launches and Conversions to assist take care of the growing tempo of lively fund to ETF conversions.

Successful methods aren’t what you’d anticipate

If we had been to ask what labored finest over the previous quarter-century, a technology of younger traders (and lots of more and more dotty senior traders) would say the identical factor: tech works! Giant works, development works! Disruptors ruuuule!

Yeah, about that … not a lot.

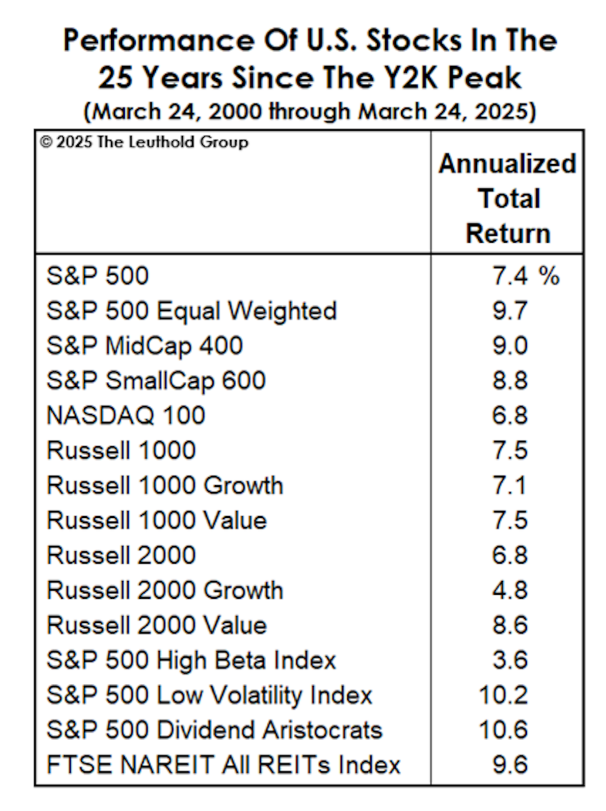

The great of us at Leuthold shared the info on exactly this query. In case you purchased into the market 1 / 4 century in the past, the place ought to you’ve got been? The reply is beneath:

Supply: Leuthold Group, March 2025

Supply: Leuthold Group, March 2025

Right here’s the story:

Worth beat development, both by somewhat or by quite a bit, relying on the slice of the market.

Boring (low volatility, excessive dividends) beat thrilling (excessive beta) by about 3:1.

Contrarian (the equal-weight 500) beat momentum (the five hundred) by over 200 bps per 12 months.

All the pieces between tech and telecom.

Rising beat developed worldwide markets (by about 2.5% per 12 months), although the US handily beat each.

“American exceptionalism” is the story that the US can rely on being #1 – in affect, commerce, tech, and market efficiency – as a result of we’re particular. Extra rational, extra dependable, extra resilient, extra smart, extra pragmatic … much less impulsive (taking a look at you, Italy!), much less authoritarian, much less erratic, much less self-destructive, much less xenophobic. If our actions undercut the judgments that others make of us, we shouldn’t be stunned when our distinctive efficiency evaporates.

Efficiency Replace on a Chaos-Resistant Portfolio

In Building a Chaos-Resistant Portfolio, we famous that issues had been more likely to be chaotic for moderately longer than you’d like and provided ideas for managing it. The theme of “chaos” is echoed by an growing variety of first-tier managers.

Commerce coverage inconsistencies, waning shopper confidence, and renewed recessionary considerations are all weighing closely on broad market indexes. (J Dale Harvey, Poplar Forest Quarterly Letter, 4/2025).

The tariffs that the U.S. is imposing on its buying and selling companions will result in a number of prices which are essential for traders to grasp. A few of these prices are inherent to what a tariff is, whereas others stem from the truth that U.S. industrial coverage has, and appears to proceed to have, an enormous quantity of uncertainty related to it. That persevering with uncertainty will hit funding ranges, return on capital and total development globally, with the U.S. bearing the brunt of it. (Ben Inker and John Pease, “Tariffs: Making the U.S. Distinctive, however Not in a Good Approach,” GMO Quarterly Letter, 4/2025)

One set of ideas is likely to be translated as “get a life,” which is to say, cease doom-scrolling and trying to micro-manage your portfolio. The opposite set of ideas had been to depend on good tacticians to fret in your behalf (FPA, Leuthold, and Standpoint), to extend your publicity to high quality shares (GQG), and to think about including a short- or ultra-short mounted earnings fund into the combo. Right here’s the efficiency of the eight funds we highlighted, YTD by way of the top of March 2025. “Nice Owl” funds are flagged with a blue field.

| YTD, by way of 3/28/25 | ||

| Vanguard Whole Inventory Market | VTSMX | -4.85 |

| High quality | ||

| GQG Companions US High quality Worth | GQHIX | 9.27 |

| GQG Companions US Choose High quality Fairness | GQEIX | -0.67 |

| GMO US High quality ETF | QLTY | -2.07 |

| Versatile | ||

| FPA Crescent | FPACX | -0.20 |

| Leuthold Core | LCORX | -0.8 |

| Standpoint Multi-Asset | BLNDX | -4.5 |

| Quick-Time period Fastened Earnings | ||

| Intrepid Earnings | ICMUX | 1.24 |

| RiverPark Quick Time period Excessive Yield | RPHYX | 0.99 |

Supply: Morningstar.com

The objective right here is to not win within the quick time period. It’s to create a fund pairing (FPA and RiverPark, in my case) that’s unusually proof against downturns and pushed by examined methods.

ETF filings, from the ridiculous to the elegant

Tuttle Capital has filed for the UFO Disclosure AI Powered ETF (UFOD), which goals to put money into firms believed to have potential publicity to “reverse-engineered alien know-how” primarily based on authorities disclosures about UFOs. The ETF will allocate at the least 80% of its property to aerospace and protection contractors rumored to work on labeled know-how associated to UFO analysis. Moreover, the ETF will quick firms that would develop into out of date on account of any superior alien know-how that is likely to be disclosed. The launch of UFOD is contingent on adequate authorities disclosures about UFOs, and it’s pending regulatory approval.

(sigh)

GQG has filed for the GQG US Fairness ETF (QGUS), slated for launch in June 2026. The fund would be the GQG Companions US Choose Fairness technique in an ETF wrapper. The fund has, predictably, clubbed its friends since its inception, averaging 11.7% per 12 months in comparison with its friends’ 7.9%. A significant distinction is that the ETF will cost 0.45%, whereas the fund prices 0.67%. In our evaluation, the fund is affordable at that value, and the ETF might be a serious discount.

The GQG fund might be managed by a group managed by CIO/founder Rajiv Jain. As we famous in our profile of GQG Global Quality Dividend (5/2024):

In case you imagine that it is advisable to make investments in opposition to the prospect that markets are going to be marked by persistent if not crippling inflation, vital rates of interest, and inconsistent development, you must most likely put money into high-quality shares with sustainably high-dividend earnings. You’ll earn increased whole returns over time, endure much less volatility, and luxuriate in an precise money stream out of your portfolio.

If that prospect intrigues you, nobody has finished it higher for longer than GQG. They warrant your consideration.

Credit score to Eva Thomas of CityWire for catching the GQG submitting (“GQG preps to enter ETF market,” 4/1/2025)

A Chasm of Want: How you can Assist in the Wake of USAID Defunding

A protracted-time member of the Observer group, who has moderately extra direct expertise with such issues than I, shared the next reflection on the federal authorities’s precipitous retreat from worldwide engagement. Such assist packages have usually flowed from two distinct impulses:

- To strengthen America’s safety by lowering the prevalence of pandemic illnesses elsewhere (which might finally attain right here), to scale back the prevalence of political and financial instability elsewhere (which might finally value us extra by way of army battle or market losses), and to extend the US standing on the planet (so-called “delicate energy diplomacy”) and

- To enact our shared sense of dedication to and compassion for our brothers and sisters in humanity.

Politicians have usually fostered the parable of “huge giveaways” (moderately, beneath 1% of the federal funds, and falling) and “welfare,” however these aren’t analytic statements. They’re political posturing. Till this 12 months, they had been largely malignant noise. What follows is a good friend’s report on the transition from one type of malignity to a different and the way we’d make a distinction as people at the same time as our collective will falters.

On Friday, March 28, 2025, the U.S. Company for Worldwide Growth was formally shuttered, with solely 15 statutorily required positions retained out of 10,000, and the remaining skeletal workers shedding their jobs later this 12 months. In accordance with a Pew Research Center report from February 6, 2025, the U.S. was on observe to ship about $58 billion in worldwide assist in FY 2025. That determine is a tiny share of the US federal funds however accountable for an unlimited influence worldwide. The ripple results from the defunding of the majority of grants and contracts overseen by USAID are more likely to be monumental. The lack of abilities and processes developed to place collectively advanced NGO funding networks provides one other dimension to the issue.

On Friday, March 28, 2025, the U.S. Company for Worldwide Growth was formally shuttered, with solely 15 statutorily required positions retained out of 10,000, and the remaining skeletal workers shedding their jobs later this 12 months. In accordance with a Pew Research Center report from February 6, 2025, the U.S. was on observe to ship about $58 billion in worldwide assist in FY 2025. That determine is a tiny share of the US federal funds however accountable for an unlimited influence worldwide. The ripple results from the defunding of the majority of grants and contracts overseen by USAID are more likely to be monumental. The lack of abilities and processes developed to place collectively advanced NGO funding networks provides one other dimension to the issue.

U.S. residents should not spared the consequences of the defunding of USAID assist packages. In accordance with AP reporting, “the overwhelming majority of U.S. international help really went by way of U.S.-based organizations.” These organizations are going darkish, and American employees are shedding jobs.

U.S. residents should not spared the consequences of the defunding of USAID assist packages. In accordance with AP reporting, “the overwhelming majority of U.S. international help really went by way of U.S.-based organizations.” These organizations are going darkish, and American employees are shedding jobs.

The AP article (February 26, 2025) lists a number of nonprofits which have devoted funding to teams affected by the lack of USAID program cash. Unlock Assist, which advocated for USAID pursuits, has arrange the Foreign Aid Bridge Fund to assist frontline teams working to ship medicines, immunizations, diet, loans for small companies, and different life- and livelihood-saving interventions.

Due to the advanced construction of donor organizations, getting assist as immediately as potential to these in want is one thing of a conundrum. For now, events may also take into account the UN World Meals Program, which acquired about half its funding from USAID and has now closed its southern Africa workplace.

Thanks, as ever . . .

To our devoted “subscribers,” Wilson, S&F Funding Advisors, Greg, William, William, Stephen, Brian, David, and Doug, thanks! We wave, with particular delight, to our latest “subscriber,” Altaf from Naperville.

To Tom & Mes from Tennessee (we completely needed to seek for your hometown and found … the most effective espresso store trailer in Tennessee?) and to John from PA, thanks! And for extra than simply monetary assist. You make a distinction.

It’s planting time. We’re ready for our garlic bulbs to reach, doubtless late this month, however I’ve already been pulled out winter grasses, turning the compost pile and scattering wildflower seeds.

Planting is an act of hope. Gardening is a gesture of resilience. Pursue each, pricey associates.

As ever,