With extra Financial institution of Canada rate cuts expected, variable-rate mortgages have gotten an more and more engaging choice.

However selecting flexibility comes with its challenges—debtors should weigh potential financial savings towards heightened market volatility and the rising uncertainty surrounding a doable trade war with the U.S.

Ron Butler of Butler Mortgages informed Canadian Mortgage Tendencies that that is probably the most unstable time he’s seen within the bond market “in perpetually.”

“It’s actually like 2008, in the course of the International Monetary Disaster, it’s so wild,” he stated.

Butler notes that the Canadian 5-year bond yield, which usually leads fixed-mortgage fee pricing, fell from a excessive of three.85% in April to 2.64% final week, a major change in such a brief time frame. Because of this, following six consecutive Financial institution of Canada fee cuts, 5-year variable charges at the moment are practically on par with fastened equivalents for the primary time since November.

Shoppers choosing variable charges in droves

Look previous the volatility—and the specter of devastating U.S. tariffs —and variable charges current a compelling case.

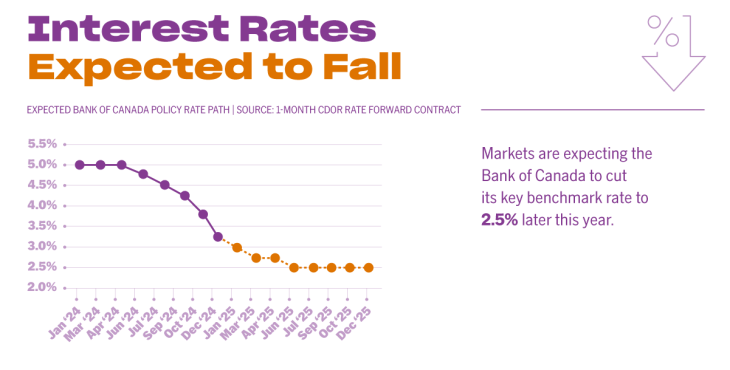

Markets are nonetheless pricing in at the least two extra quarter-point Financial institution of Canada cuts this yr, which might push variable mortgage charges down at the least one other 50 basis points.

Some forecast much more aggressive rate-cut motion can be required to counter the ecnoomic shock of a commerce struggle with the U.S.

“I don’t assume it’s a stretch to imagine that the Financial institution will scale back its coverage fee from its present stage of three.00% right down to at the least 2% in the course of the present fee cycle,” David Larock of Built-in Mortgage Planners in a current blog.

Nevertheless, he cautions that there’s additionally the chance that fee hikes come again into play ought to inflationary pressures re-emerge.

“Whereas I count on variable charges to outperform immediately’s fixed-rate choices, I warning anybody selecting a 5-year variable fee immediately to take action provided that they’re ready for a fee rise in some unspecified time in the future over their time period,” Larock added. “5 years is lengthy sufficient for the subsequent fee cycle to start, and for variable charges to rise from wherever they backside out over the close to time period.”

Nonetheless, it’s a danger increasingly more debtors are keen to take. Information from the Financial institution of Canada exhibits that as of November, practically 1 / 4 of latest mortgages have been variable-rate, up from lower than 10% earlier within the yr.

Butler says this development has solely accelerated in current months, noting that the share of variable mortgages he’s originating has surged from 7% final yr to 40% now.

“We advise purchasers to take variable as a result of we now have precise reporting from market analysts that it’s going to go down,” he says. “The charge advantage of variable is a assured penalty quantity; you simply don’t know what penalty you’re actually going to get with fastened.”

Not like fixed-rate mortgages, which frequently include interest rate differential (IRD) penalties that may quantity to tens of 1000’s of {dollars}, variable-rate mortgages sometimes carry a a lot smaller penalty—simply three months’ curiosity—making them a extra versatile choice for debtors who may have to interrupt their mortgage early.

Butler argues that if tariffs are imposed, their affect on the mortgage market gained’t be fast, as inflation would primarily rise attributable to retaliatory counter-tariffs. This lag, he says, might give variable-rate debtors a window to modify to a hard and fast fee earlier than larger inflation forces the Financial institution of Canada to reverse course and hike charges.

“This type of commerce struggle implies that to start with, the economic system deteriorates, and rates of interest go down; it takes 9 months or a yr for the inflation to actually lock into some extent the place the Financial institution has to lift charges,” he says. “The inflation spiral takes time. The Financial institution of Canada will lower lengthy earlier than prices begin to improve.”

Tracy Valko of Valko Monetary, nonetheless, means that in such a commerce struggle inflation turns into secondary to extra fast financial indicators, like unemployment. That, she warns, might skyrocket following a tariff announcement as corporations brace for affect.

“‘Inflation’ was the phrase final yr; this yr I feel it is going to be ‘employment,’ as a result of tariffs will drive unemployment, and other people gained’t be capable of afford housing, which can put quite a lot of strain on the federal government infrastructure,” she says. “I don’t assume it is going to be like inflation, which is a lagging indicator, as a result of companies should modify fairly rapidly, and we might see large unemployment in sure sectors.”

Even Trump’s latest tariff threat on aluminum and metal imports might have devastating impacts on Canadians employees in these industries inside days.

Valko provides that prime unemployment would probably drive rates of interest down quicker—probably even triggering an emergency rate cut, as Nationwide Financial institution had advised—to blunt the consequences of excessive tariffs. That potential situation, Valko says, provides to the variable fee argument, but in addition provides to the widespread feeling of uncertainty available in the market.

“Lots of people are actually pessimistic proper now on the longer term; we’ve had purchasers and owners which have had quite a lot of shocks within the mortgage market and the true property market, and will not be focused on having any extra instability,” she says. “Individuals are extra educated than they’ve ever been earlier than, so they’re actually taking a look at their financing — which is nice to see — however individuals are very cautious, so to take variable, it needs to be a really risk-tolerant shopper.”

Fee choices for the extra risk-averse debtors

Valko notes that debtors cautious of financial uncertainty are more and more selecting shorter-term fastened charges, providing stability with out locking in for the lengthy haul.

“Three-year fastened has been most likely the preferred as a result of it’s not taking that larger fee for the standard five-year fastened fee time period,” she says. “They’re hoping in three years we’ll see a extra normalized and balanced market.”

For extra cautious debtors, hybrid mortgage—which break up the mortgage between fastened and variable charges—are an alternative choice and are at the moment obtainable by way of most main monetary establishments.

“There are some folks which are in the midst of that danger tolerance, and if they might put a portion in fastened and a portion and variable—and to have the ability to modify it rapidly—I feel it will be a extremely good choice,” Valko says.

Butler, nonetheless, disagrees.

“A hybrid mortgage means you might be at all times half mistaken about mortgage charges,” he says. “If the steadiness of likelihood clearly signifies variable is the proper short-term reply, take variable and thoroughly monitor the motion of fastened charges.”

Visited 36 instances, 36 go to(s) immediately

5-year bond yield Bank of Canada bond yields Dave Larock fixed or variable fixed vs. variable IRD jared Lindzon rate outlook ron butler tracy valko variable mortgage rate variable rate mortgages variable rates

Final modified: February 11, 2025