Union Finance Minister Smt Nirmala Sitharaman on February 1st 2025 introduced her eighth consecutive Union Finances 2025 within the Lok Sabha. Beneath are the most recent private finance associated proposals which have been made in Finances 2025-26 ;

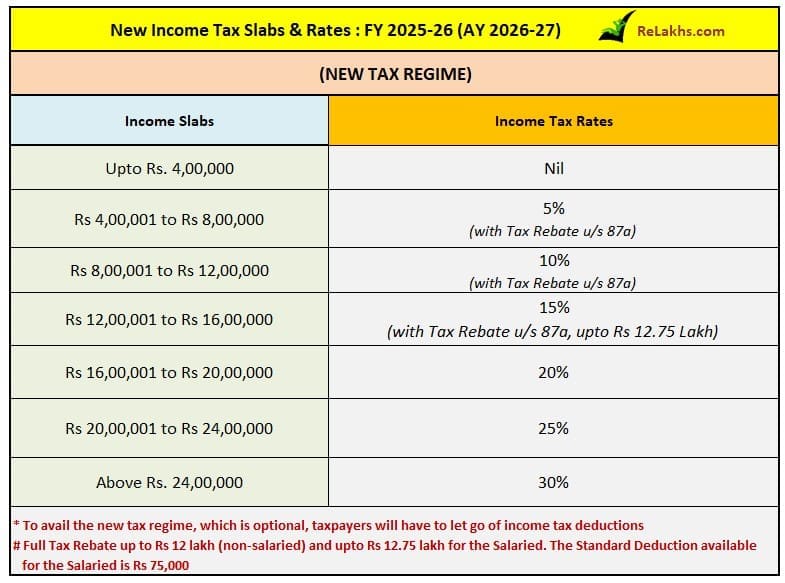

1) Revised Earnings Tax Slab Charges for FY 2025-26

- Beneath the brand new tax regime, the essential exemption restrict has been elevated from Rs 3 lakh to Rs 4 lakh.

- As per the Finances 2025, no earnings tax might be payable on earnings as much as Rs 12 lakh has been proposed.

- The salaried people eligible for the standard deduction good thing about Rs 75,000 won’t be required to pay any taxes if their gross taxable earnings doesn’t exceed Rs 12.75 lakh.

- In case your earnings exceeds Rs 12 lakh then you must pay tax at relevant slab charges.

2) Revised Part 87A Tax Rebate FY 2025-26 / AY 2026-27

- The restrict for claiming the tax rebate is elevated from the prevailing Rs 7 lakh to Rs 12 lakh for earnings beneath Part 115BAC. The utmost rebate will rise from Rs 25,000 to Rs 60,000.

- Kindly observe that this rebate won’t apply to particular grade incomes reminiscent of capital positive aspects.

- In case your regular earnings aside from particular price earnings (reminiscent of capital positive aspects) is as much as Rs 12 lakh, a tax rebate is being offered along with the profit on account of slab price discount in such a fashion that there isn’t any tax payable by you.

- In easier phrases, if you happen to’re a daily salaried particular person or earn other forms of “regular earnings” as much as Rs 12 lakh, you gained’t need to pay any tax, due to each the tax rebate and the diminished earnings tax slabs. Nonetheless, if you happen to earn earnings from sources like capital positive aspects, that earnings gained’t profit from the rebate, and it is going to be taxed individually beneath totally different guidelines.

Regular Earnings or common earnings refers to your wage, wages, rental earnings or enterprise income. The place as Particular Price earnings refers to capital positive aspects, the place relevant tax charges are totally different. So, LTCG & STCG from Fairness or different particular charges property should not tax free inside this Rs 12 lakh.

Associated article : What is the difference between Normal Income and Special Rate Income?

3) Revised TDS restrict for Senior Residents

The restrict for tax deduction at supply on curiosity earnings for senior residents is being doubled from the current Rs 50,000 to Rs 1 lakh.

4) Revised TDS restrict on Hire

The annual restrict of Rs 2.40 lakh for TDS on hire is elevated to Rs 6 lakh.

5) Revised time restrict to replace ITRs

- Finances 2025 has proposed to increase the time restrict for submitting up to date earnings tax returns from the prevailing 24 months to 48 months.

- Whereas Finances 2025 has prolonged the time restrict for submitting up to date ITR, the penal tax payable on the extra earnings declared within the ITR has been pegged at 60% and 70% for up to date ITRs filed within the third and 4th 12 months from the tip of the respective evaluation 12 months.

6) Good thing about two Self-Occupied Properties

Presently earnings tax assessees ca declare the annual worth of self-occupied properties as nil solely on the fulfilment of sure circumstances. Contemplating the difficulties confronted by taxpayers, it’s proposed to permit the advantage of two such self-occupied properties with none situation.

7) TCS modifications for remittances beneath LRS

The edge to gather tax at supply (TCS) on remittances beneath RBI’s Liberalized Remittance Scheme (LRS) is proposed to be elevated from Rs 7 lakh to Rs 10 lakh. The FM additionally proposed to take away TCS on remittances for schooling functions, the place such remittance is out of a mortgage taken from a specified monetary establishment.

8) Tax free withdrawals from NSS

Withdrawals from outdated NSS accounts (Nationwide Financial savings Scheme) might be fully tax-free if the funds are withdrawn on or after August 29, 2024. There might be no tax legal responsibility on withdrawals from these accounts.

9) NPS Vatsalya Account

It’s proposed to increase the tax advantages obtainable to the Nationwide Pension Scheme (NPS) beneath Part 80CCD of the Act to the contributions made to the NPS Vatsalya accounts as nicely. No extra profit is relevant for deposits in NPS vatsalya account.

10) Taxation on ULIPs

- The taxation of ULIPs (Unit Linked Insurance coverage Plans) has been rationalised to supply that each one ULIPs which aren’t exempt beneath part 10(10D) might be taxable as capital positive aspects much like fairness oriented funds. At the moment solely these ULIPs that are bought after 01 Feb 2021 with premium/ aggregage premiums greater than INR 2.5 lakhs p.a. are taxable as capital positive aspects.

- Submit the modification, a ULIP bought say in 2005 for which the premium payable in any 12 months exceeds 10% of the particular sum assured, will even be taxable as capital acquire as a substitute of being taxed as earnings from different sources. The ULIPs which have been exempt beforehand will proceed to stay so.

Kindly observe that this text might be up to date/edited as and when extra info is obtainable.

(Submit first printed on : 01-February-2025)