The 2025 Union Price range introduced aid for a lot of taxpayers since incomes as much as Rs 12 lakh won’t be taxed, however many people are struggling to know the way it truly works.

The first motive for all of the confusion is the under assertion made by the union FM minister in her funds speech;

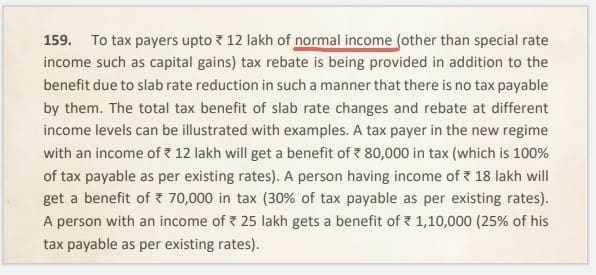

“Tax payers upto Rs 12 lakh of regular earnings (apart from particular charge earnings similar to capital positive factors) tax rebate is being supplied along with the profit as a consequence of slab charge discount in such a way that there isn’t any tax payable by them…”

So, what is supposed by Regular earnings? What’s the distinction between Regular earnings and Particular charge earnings?

Regular Earnings Vs Particular Fee Earnings

Regular Earnings refers to your common incomes like Wage, enterprise earnings, rental earnings or wages. These incomes are charged at under relevant (revised) slab charges.

As per the brand new proposal, earnings as much as Rs 12 lakh has no tax legal responsibility. What you probably have say Rs 7 lakh as wage earnings and Rs 5 lakh as Brief Time period Capital Beneficial properties arising out of your inventory buying and selling? Does this Rs 5 lakh can be eligible for tax rebate?

The reply is NO!

The Capital Beneficial properties are thought-about as Particular charge incomes and are taxed at totally different charges. The Tax rebate just isn’t relevant on these incomes. So, the tax aid is relevant solely in your Rs 7 lakh wage earnings and tax charge @ 15% is relevant on STCG of Rs 5 lakh. One other instance for particular charge earnings is ‘earnings from lotteries’.

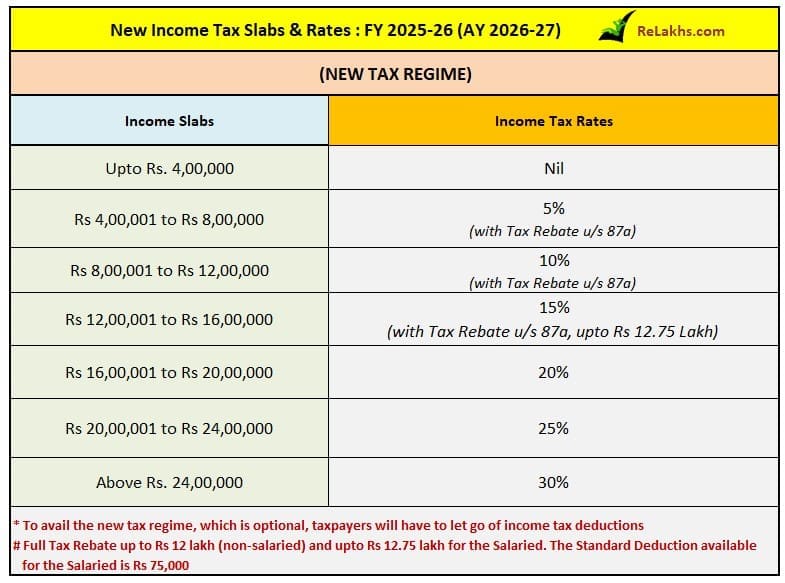

So, the Finance Minister has revised the essential exemption restrict to Rs 4 lakh and people incomes between Rs 4 lakh and Rs 12 lakh pays taxes at a lowered charge (5% & 10% relying on earnings), which, mixed with the tax rebate, results in zero tax. However, these earnings ought to be the usual incomes and never particular charge ones. The aid measures strictly apply to plain earnings taxed beneath Part 115BAC. (Lowered charge can be referred as slab charge discount.)

Earnings chargeable u/s 115BBE like unexplained money credit, investments, cash, bullion, jewellery, or different invaluable articles can be thought-about as particular earnings.

Kindly be aware that this text can be up to date/edited as and when extra info is on the market.

(Put up first revealed on : 01-February-2025)