My retirement planning for the previous two years since retiring has centered on the Bucket Strategy to have the appropriate funds in the appropriate funding buckets to have high-risk adjusted returns whereas minimizing taxes over my lifetime. This text focuses on forty of the highest performing ETFs that I consider can type a superb basis for the approaching decade. I wrote Investing in 2025 And the Coming Decade describing why I believe bonds will outperform shares on a risk-adjusted foundation as a result of rates of interest must keep increased for longer to finance the nationwide debt and beginning fairness valuations are so excessive. Federal Reserve Chairman Jerome Powell mainly stated as a lot this previous Wednesday and the S&P 500 dropped 3%.

I rated over 5 hundred ETFs that I observe in over 100 Lipper Classes, utilizing the MFO Threat and Score Composites, Ferguson Mega Ratio which “measures consistency, threat, and expense adjusted outperformance”, Return After-Tax Publish Three Yr Score, and the Martin Ratio (risk-adjusted efficiency) to pick out the highest fund for every Lipper Class. I then subjectively adjusted the funds to favor the Nice Owls and for my very own preferences of Fund Households. I eradicated the Lipper Classes the place the ultimate fund had a excessive price-to-earnings ratio and fell additional than the S&P 500 following Mr. Powell’s announcement. I used the Factset Rating System to get rid of a number of funds. I eradicated virtually twenty funds to maintain the ultimate listing of funds to maintain the choice diversified and easy.

What Will the Investing Atmosphere Herald The Subsequent Decade?

The approaching decade will convey uncertainty as a result of:

- Nationwide debt as a share of gross home product (GDP) has not been this excessive since World Battle II.

- Federal Debt as a share of (GDP) is rising at six % including to the nationwide debt.

- Inhabitants development which drives financial development has slowed for many years.

- Tax cuts are coming and are more likely to scale back Federal income with advantages favoring the rich and including to the nationwide debt.

- Tariffs elevate the price of inflation favoring conserving charges increased for longer.

- Inventory valuations are excessive implying beneath common long-term returns.

- Rates of interest will seemingly be elevated in comparison with historic averages with the intention to finance the nationwide debt and comprise inflation.

- Geopolitical threat has risen.

- Political brinkmanship has risen.

For concepts about easy methods to put together for extra risky markets, I refer you to David Snowball’s article final month, “Building a chaos-resistant portfolio”, in addition to mine, “Envisioning the Chaos Protected Portfolio”. The choice of ETFs on this article displays a few of these concepts from the MFO December e-newsletter.

Bucket Strategy

The Bucket Strategy is an easy idea of segregating funds into three classes to satisfy short-, intermediate-, and long-term spending wants. It may be extra sophisticated in a dual-income family with separate account possession, and totally different tax traits. For these in increased tax brackets, asset location to handle taxes is essential.

For instance, if an investor owns each Conventional and Roth IRAs, then funds with decrease development and fewer tax effectivity needs to be put into the Conventional IRAs. Roth IRAs are perfect for increased development funds which are much less tax-efficient. After-Tax accounts held for the long run are finest suited to tax-efficient “purchase and maintain” funds with low dividends and better capital beneficial properties.

These are the ideas included within the following buckets. Buyers want to pick out what is suitable for his or her particular person circumstances. Some funds can match comfortably into a number of buckets or accounts with totally different tax traits.

I organize my accounts so as of which of them I’ll withdraw cash from first. The primary ones are essentially the most conservative and the final ones are essentially the most aggressive. I want to contemplate these being in Funding Buckets. On the day that the S&P 500 fell 3%, my accounts that may fund the subsequent ten years of residing bills fell 0.35% whereas producing earnings.

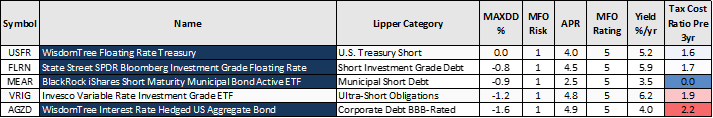

Bucket #1 – Security and Residing Bills for Three Years

The listing of funds in Bucket #1 is brief as a result of I used fund efficiency in 2022 and the COVID recession to push funds with excessive drawdowns into Bucket #2. Cash market funds, certificates of deposit, and bond ladders needs to be thought of a staple of a conservative bucket for emergencies and residing bills. The Tax Value Ratio displays the portion of the returns that will probably be misplaced because of taxes. The upper one’s tax brackets, the extra relevant it turns into to spend money on municipal bonds. For an investor wanting to attenuate taxes, BlackRock iShares Brief Maturity Municipal Bond Lively ETF (MEAR) could also be an incredible alternative.

The blue shaded cells signify a Nice Owl Fund which has “delivered prime quintile risk-adjusted returns, based mostly on Martin Ratio, in its class for analysis intervals of three, 5, 10, and 20 years, as relevant.”

Bucket #1 – Security and Residing Bills for Three Years

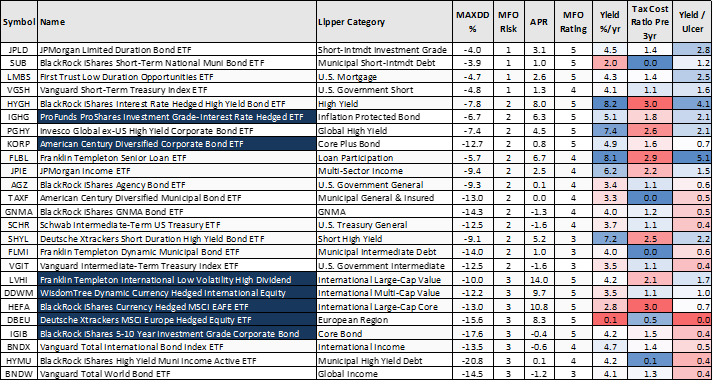

Bucket #2 – Intermediate (three to 10 years) Spending Wants

There’s a crucial distinction between MFO Threat and MFO Score. MFO Threat is predicated on threat as measured by the Ulcer Index which is a measure of the depth and period of a drawdown. MFO Threat applies to all funds. MFO Score is the quintile ranking of risk-adjusted efficiency as measured by the Martin Ratio for funds with the identical Lipper Class.

I just lately modified my funding technique for Bucket #2 from Whole Return to Earnings as a result of rates of interest are traditionally excessive. Within the desk beneath, I calculate the Yield to Ulcer ratio to see how a lot threat I is perhaps taking for that earnings. The chance over the previous three years has come from rising charges and the anticipation of a recession which can have reworked right into a tender touchdown. I anticipate rates of interest to stay comparatively excessive for longer however progressively fall. I favor bonds with intermediate durations.

Bond portfolios needs to be prime quality, however riskier bond funds might be added to diversify for increased earnings or complete return. Excessive Yield, Mortgage Participation, and Multi-Sector Earnings funds carry extra threat than high quality bond funds however are sometimes much less dangerous than fairness funds.

A number of Worldwide Fairness Funds make it into Bucket #2 as a result of the valuations are decrease and so they have decrease volatility. Franklin Templeton Worldwide Low Volatility Excessive Dividend Index ETF (LVHI) stands out for having a excessive yield and Yield/Ulcer ratio together with excessive returns, however it’s not significantly tax-efficient.

Bucket #2 is the place I see essentially the most alternative over the subsequent 5 to 10 years due to excessive beginning rates of interest. I will probably be monitoring higher-risk bond funds and income-producing funds to doubtlessly add.

Bucket #2 – Intermediate (three to 10 years) Spending Wants

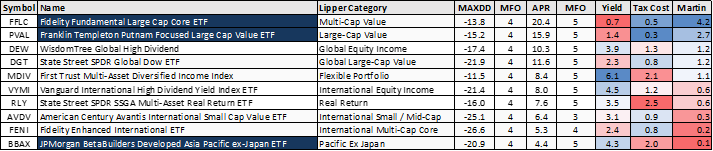

Bucket #3 – Passing Alongside Inheritance, Longevity, Progress

My issues about Bucket #3 are largely excessive valuations. The theme in Bucket #3 is development at an inexpensive value. Fairness funds could do properly in 2025 and 2026 due to tax cuts. I supply fewer funds to contemplate in Bucket #3 as a result of I excluded these with excessive valuations and excessive current volatility.

I used to be pondering of shopping for Berkshire Hathaway subsequent 12 months, however now favor Constancy Elementary Giant Cap Core ETF (FFLC) as a substitute.

Bucket #3 – Passing Alongside Inheritance, Longevity, Progress

Closing

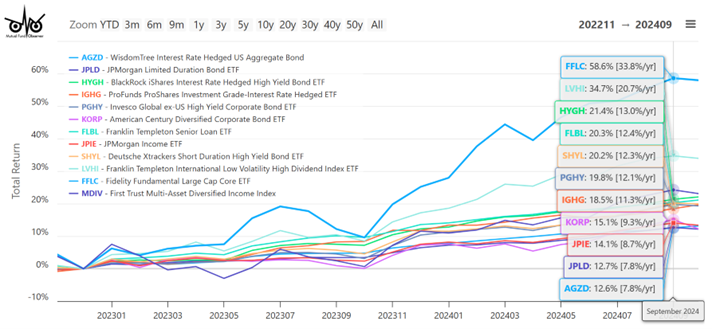

I’ve delayed making some small adjustments to my portfolio till subsequent 12 months with the intention to maintain taxes decrease in 2024. I plan to make regular withdrawals from riskier investments to decrease my stock-to-bond ratio. Beneath is a chart of Whole Return of a few of the funds that I’m monitoring with essentially the most curiosity.

Determine #1: Chosen Writer’s ETF Picks for 2025

I want everybody and productive and nice new 12 months.