It’s no doubt that I declare 2024 as my most tiring 12 months of labor until date, but in addition one which has been financially rewarding as we reaped the fruits of our efforts this 12 months.

The outcome? I’ve formally crossed the $1 million mark (the worth of my HDB flat isn’t included within the equation).

Trying again, attending to $1M was doable solely as a result of I constantly (i) grew my earnings, (ii) stored bills low and (iii) stored investing in shares and cryptocurrencies over the previous 10 years.

2024 noticed the inventory markets and cryptocurrencies explode to new all-time excessive, and my funding portfolio has been a beneficiary of that phenomenon. On the identical time, this 12 months was the 12 months the place my salaried earnings doubled and my aspect hustles took off exponentially.

If not for these, I in all probability wouldn’t have been in a position to cross one million {dollars} this 12 months, however it nonetheless blows me away that this occurred in 2024.

In order the 12 months involves an finish, that is my annual evaluation of my funds to verify the place we at the moment are relating to our monetary targets and progress. Throughout this yearly evaluation, I sometimes look at my earnings progress, bills, financial savings, insurance coverage protection, and funding efficiency – which helps me to raised strategize for the brand new 12 months forward.

Time flies, and this marks the eleventh 12 months that I’m doing this on the weblog! Earlier than I’m going into this 12 months’s evaluation, right here’s a fast recap of my earlier years:

- 2014: Saved $20,000

- 2015: Saved $30,000 and grew income

- 2016: Saved $40,000 and grew income, hit $100k in net worth at age 26 including CPF

- 2017: Saved $45,000 and doubled my net worth in a year

- 2018: Saved $50,000

- 2019: Saved $35,000 (didn’t realise I fully missed out on a round-up submit, however right here’s our child-related expenses instead)

- 2020: Saved $30,000 and achieved crazy (abnormal) investment returns

- 2021: Saved $40,000, grew income but saw reduced investment returns

- 2022: Saved $45,000 and battled a bearish investment climate

- 2023: Saved $60,000 and investments turned the corner

Financial savings & Revenue

This 12 months’s financial savings hit an all-time excessive, largely fuelled by the expansion in my earnings. As an worker, I 2X my paycheck by placing in double the time at work. On weekday evenings and weekends, I labored on my aspect hustles which then did one other 3X this 12 months.

Right here’s my cumulative financial savings whole since I began monitoring on this weblog:

| 2014 | $20,000 |

| 2015 | $30,000 |

| 2016 | $40,000 |

| 2017 | $45,000 |

| 2018 | $50,000 |

| 2019 | $35,000 |

| 2020 | $30,000 |

| 2021 | $40,000 |

| 2022 | $45,000 |

| 2023 | $60,000 |

| 2024 | $200,000 |

I discussed here final 12 months that I received promoted and was concerned in build up a brand new line of enterprise for the corporate, which was the rationale that my bosses provided to double my wage final 12 months. In consequence, that stored me busy all through this 12 months, however due to working with the most effective colleagues and workforce at work, we pulled it off! The enterprise basis has now been laid and our CEO lately gave me a shoutout throughout our year-end firm assembly – with a devoted slide to our line of enterprise (one which didn’t exist a 12 months in the past). I used to be additionally nominated as one of many firm’s 6 “rockstars” (an award for many who embody all 6 values of the corporate), so the massive sense of accomplishment is indescribable.

With the ability to do impactful work and get recognised for it? Superior.

My aspect hustles additionally took off this 12 months, as my Youtube channel lastly certified for monetisation. Phrase-of-mouth referrals meant that my e-commerce enterprise continued to see new prospects, beneficial by their family and friends members who had benefited from my store’s choices.

Whereas I slogged for lively earnings, my passive earnings additionally grew considerably this 12 months because the shares I owned continued to boost their dividends, together with DBS and Keppel, amongst others. It was actually a bumper 12 months of dividends for me as an investor!

I additionally talked about final 12 months that I used to be attempting to construct a brand new supply of earnings for 2024 (teaching and talking), and I’m proud to say that it was an unimaginable success. A lot in order that I used to be invited to share about it onstage on the current Nas Summit Asia in Singapore, the place I used to be seated subsequent to the IMDA workforce (Infocomm Media Improvement Authority) and had the privilege of assembly different world content material creators with tens of millions of followers, together with Jordan Matter and his kids, Salish and Husdon.

It’s value noting that quite a lot of 2024’s work accomplishments weren’t an in a single day success; somewhat, it was my monitor document, outcomes and fame over 10 years of content material creation that compounded and bore fruit these few years. For that, I’m extremely grateful – particularly to all my readers and the manufacturers who’ve supported me all through this journey.

I’m trying to construct one other new supply of earnings for 2025, within the type of royalties. That’s as a result of my childhood dream to change into a printed writer is about to occur; a global writer approached me to put in writing a ebook and naturally I mentioned sure! Though that led to many sleepless nights as I labored on the manuscript, I’m positive it’ll repay in 2025 when the ebook makes it to print, and I’m excited to see the place that can take me.

To sum up, my document earnings progress this 12 months was fuelled by the next:

- Salaried earnings (company)

- E-commerce enterprise

- Talking and training enterprise

- Content material creation (throughout numerous platforms as Finances Babe)

- Passive earnings by way of inventory dividends

Nevertheless, I’ll need to caveat that this progress in earnings got here at a value. My well being has suffered; I’ve largely been surviving on 4-5 hours of sleep each day for this 12 months, and it received to the purpose the place I skilled 3 bouts of debilitating migraine assaults which left me unable to work for a number of days every time. My immune system grew to become so weak that I contracted COVID-19 twice, despite the fact that none of my relations had it (and didn’t catch it from me afterwards both)!

In consequence, my focus for 2025 can be to construct again my HEALTH. I intend to decide to common exercises and go to the gymnasium extra usually – a behavior that I developed in 2022 – 2023 however fell off monitor this 12 months on.

Well being is wealth, and I’m gonna get that again subsequent 12 months as an alternative of simply specializing in one aspect of the equation like I did this 12 months.

Bills

This marks the final 12 months we’ll be paying excessive childcare charges, as my eldest little one will likely be coming into Main 1 subsequent 12 months so our bills ought to go down consequently.

Our present month-to-month family spending this 12 months remained pretty much like what we spent in 2023:

| Nate: childcare & enrichment | $1,200 |

| Finn: childcare & enrichment | $1,000 |

| Helper wage and levy | $1,000 |

| Mortgage & dwelling insurance coverage | $1,300 |

| City council, carpark and utilities | $650 |

| Eating & groceries | $1,500 |

| Household insurance coverage insurance policies | $1,200 |

This excludes our particular person eating bills, the allowances that we give to our mother and father (a 5-figure sum every year) and different miscellaneous bills that aren’t recurring in nature, so the precise sum is rather a lot greater.

Our family’s largest expense this 12 months was on travelling. My husband and I went on a 2-week journey within the US in February/March, the place I received to go to my alma matter and finest good friend who lives overseas. Shortly after in April, I used to be despatched to New York on a brief 3-day journey to symbolize Singapore finfluencers on the NASDAQ headquarters, which was actually a second to recollect! As well as, my husband and I needed to make a number of enterprise journeys to Malaysia and China for my e-commerce enterprise, and the year-end holidays noticed us travelling to Batam and Shanghai upon the youngsters’ requests. I used to be too busy to essentially monitor our journey spending this 12 months, however I estimate that it might have crossed $25,000 in whole (though not all would have been at our personal price since some had been claimable underneath enterprise bills).

Insurance coverage

We didn’t make any new strikes in our insurance coverage portfolio this 12 months, since there have been no new life milestones. Nevertheless, one spotlight was getting our portfolio reviewed by the specialists at Havend, and I used to be fairly proud to listen to that they too, agreed with the choices I’d made for our household insurance policies.

For those who’re in search of unbiased insurance coverage recommendation and wish to have licensed professionals evaluation your portfolio, I can not advocate the oldsters at Havend sufficient. Read about my experience here to resolve if it’ll be value your time reserving a evaluation with them!

Investments

I saved the most effective for the final, as a result of this 12 months was actually an enormous breakthrough for our funding portfolio. Anybody who has stayed invested all through the previous couple of years and stored shopping for ought to in all probability see their portfolio up by not less than 2 if not 3 digits too.

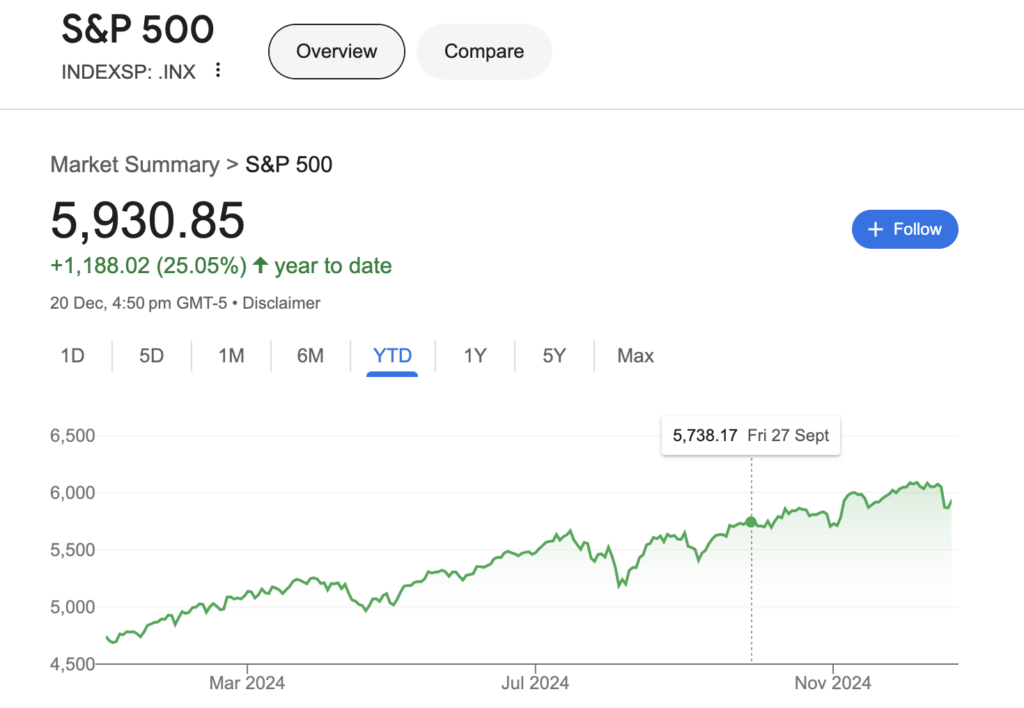

For those who thought the S&P500’s +25% achieve final 12 months was loopy, guess what? The index repeated its feat once more this 12 months, coming in at one other +25%. That is beginning to really feel slightly bubbly although, so I’ve been paying nearer consideration to valuations as a result of I don’t need to make the error of overpaying for shares on this local weather:

The bullishness of the markets had been attributed to the hype and pleasure over synthetic intelligence, which propelled NVIDA and Broadcom to new heights. I personal each shares, so I benefited from their surge. Right here’s among the extra notable good points I loved this 12 months, which has now pushed my funding portfolio to new all-time highs:

| Inventory | Positive aspects |

| Meta (purchased in ’22 and ’23) | 200% |

| C*** (secret, finance) | 180% |

| M*** (secret, healthcare) | 50% |

| Tencent (purchased extra in Dec ’23) | 55% |

| S*** (secret, information) | 65% |

| DBS (new tranche purchased in Feb ’24) | 50% |

| Keppel DC REIT (purchased in Apr ’24) | 30% |

| Shopify (purchased extra in Might ’24) | 88% |

| Zoom (purchased extra in June ’24) | 45% |

| Amazon | 36% |

| Disney | 25% |

All of those led to some unimaginable good points this 12 months, particularly liquidated ones like Great Eastern (where I made close to 50% in a few months) as my thesis that OCBC would possibly privatise them materialised. Whereas there have been definitely some losers, the winners from my portfolio greater than dwarfed these losses by a number of multiples. I didn’t liquidate any shares at a loss although, as after analysing them I felt that the headwinds confronted are merely short-term, so I’ll be holding them till the enterprise recovers. I additionally moved aggressively to buy a number of shares during the August yen-carry trade collapse, which turned out to be an excellent transfer and these shortly recovered to be within the inexperienced proper now.

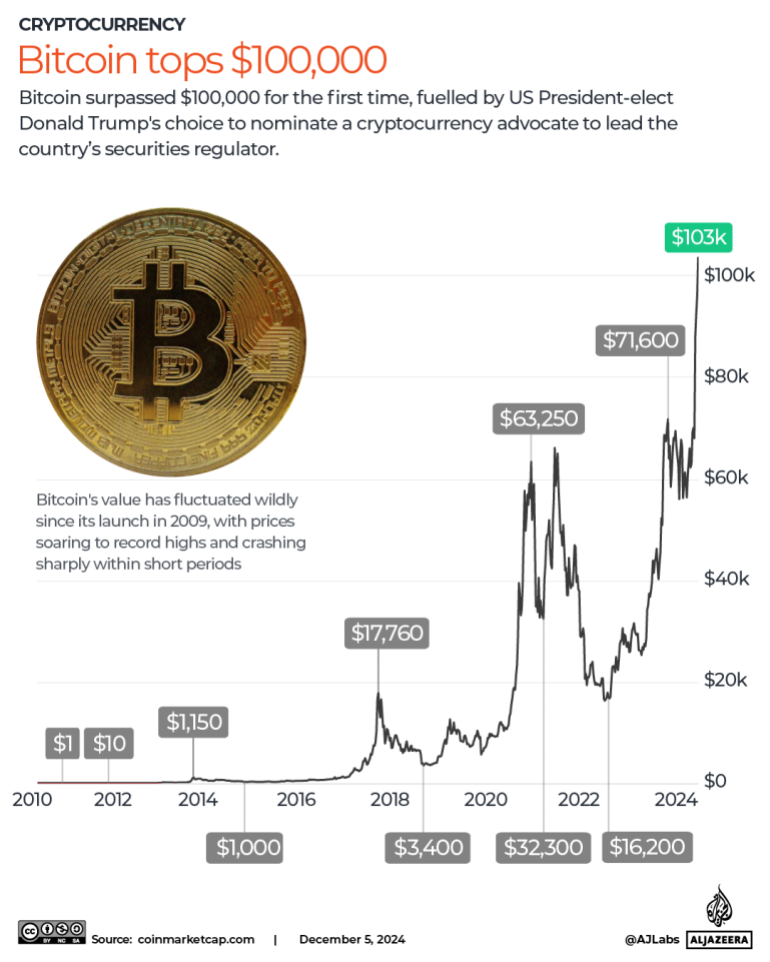

Within the cryptocurrency markets, Bitcoin went on to hit new historic highs because it broke previous $100,000 this 12 months. Older readers would possibly keep in mind me saying this might occur in due time as I predicted that Bitcoin would eventually play a significant role in investors’ portfolios as an alternative asset, particularly digital gold. That thesis performed out this 12 months because the SEC approved spot bitcoin and ethereum ETFs, and re-elected President Donald Trump introduced his help for crypto in addition to his intentions to build a Bitcoin strategic reserve for the country.

I began shopping for crypto in 2017, however obtained quite a lot of flak between 2017 – 2021 over my vocal help for cryptocurrencies then (particularly as I’ve spoken quite a few instances concerning the potential of Bitcoin, Ethereum, BNB and Solana), so this 12 months felt like a 12 months of redemption because the skeptics had been lastly silenced and governments worldwide stopped calling it a rip-off. The very best half? My crypto investments – the majority of which had been bought between 2017 – 2022, yielded me insanely good-looking returns. These are perks of staying the course and realizing absolutely properly why you invested in it within the first place.

On the property aspect, I additionally purchased a brand new property overseas utilizing among the enterprise good points that I earned within the earlier half of the 12 months. In Singapore, as costs are too excessive for our liking, we shelved our plans to spend money on an industrial property this 12 months. As a substitute, we plan to buy one other property in both Malaysia or China inside the subsequent 2 years, though it stays to be seen whether or not that can play out. The offers we noticed this 12 months haven’t been enticing sufficient to get us to half with our cash simply but.

All in all, my investments and money holdings have now crossed $1 million.

I by no means imagined that I’d change into a millionaire earlier than 35.

Constructing my a number of earnings streams

I keep in mind after I first began scripting this weblog, I used to be nonetheless very a lot a salaried employee (with a take-home pay of $2,000 after CPF) who dreamed of attaining monetary freedom by the age of 45.

Through the years, I’ve been extraordinarily fortunate that my content material on social media resonated with so a lot of you, which then drew manufacturers and sponsorships which have enabled me to create a second supply of earnings through social media. Whereas I spoke totally free at occasions and conferences at first, manufacturers began paying me to talk afterwards as the ability of my speeches and supply grew to become evident. Employers began to have interaction me to run monetary literacy workshops for his or her staff, and I’ve since been in a position to earn in many various methods due to the power of the Finances Babe model at this time.

In 2021 – 2022, my weight loss journey unexpectedly led to another side hustle in the form of my e-commerce store, which has since grown with each passing 12 months by the ability of profitable buyer testimonials and word-of-mouth referrals. I reluctantly gave up my tuition earnings to liberate time for this, which, on hindsight, was a smart transfer as my enterprise earnings grew to exceed my tuition earnings in lower than a 12 months!

I began podcasting work (see here) through the pandemic, and this began yielding earnings this 12 months as manufacturers began sponsoring the present and I received paid. One in every of my aspirations throughout college was to change into a radio DJ, so internet hosting a podcast is an effective way for me to attain that dream!

In 2023 – 2024, my passive income through dividends grew as corporations raised their dividend payouts (popping out from the pandemic disaster). I continued to make a number of investments into dividend shares, which elevated the passive earnings payouts I now take pleasure in – and I anticipate to take a position much more in 2025 to proceed constructing this in the direction of my retirement years.

In 2025, I’ll have a brand new supply of earnings (royalties) as soon as my ebook will get revealed. I’ve been instructed that authors don’t make rather a lot, so that you’ll have to remain tuned on this weblog for my subsequent few years of economic evaluations to see how a lot this brings in!

The one draw back of incomes extra is that you simply’ll need to pay greater earnings taxes as properly – each when it comes to my private earnings taxes and company earnings taxes (a painful 17%), however that is a matter I’ll gladly settle for as a result of with greater earnings, everybody must pay greater taxes anyway! After I look again at how my taxes payable has gone up through the years, it’s a reminder to me that my earnings has risen over the identical time. What’s extra, I received to make the most important donation I’ve ever made this 12 months (as a tax discount transfer) to assist enhance underprivileged lives, so for that, I’m grateful.

Conclusion

Fact be instructed, I wasn’t anticipating to cross the $1 million milestone this 12 months, and I’ve been so busy working all through 2024 that this didn’t even happen to me till I sat right down to work on my earnings (and tax discount strikes) final month.

For those who don’t know what to do to scale back your earnings tax invoice for subsequent 12 months, read this article I wrote earlier this year here!

For those who’ve been following my journey, you’ll have seen my laborious work, sweat and tears.

This wouldn’t have been doable if not for the help of my husband and relations. I’m blessed to have actually supportive in-laws, who’ve helped to step in and handle the youngsters through the instances the place we had been abroad. Whereas I can by no means shrug off working mum guilt, I’ve consciously carved out time a number of instances every week to be with my children and skim them their each day goodnight tales. We’ve constructed a number of treasured recollections this 12 months as a household, together with our visits to the Disney exhibition at MBS, Inside Out at Gardens by the Bay, Disney at OCBC My Account launch, attending friends’ birthday parties, a number of playdates and parent-accompanied faculty outings, celebrating Christmas early at illumina, and visiting the newest (and largest) Disneyland in Shanghai, amongst others. I hope that I’ve been a superb position mannequin for my children as they see how laborious their mom works – and by no means provides up – even after I encountered setbacks and challenges all through the way in which.

I mentioned this final 12 months:

“We must always proceed to work laborious and construct by way of our 20s and 30s, in order that we will have a better time in our later years.”

This 12 months was a 12 months of reaping the fruits of our labour, and the seeds (from my investments) that had been planted years in the past. I’m not the one one; a number of of my buddies who had additionally constructed diligently for the reason that early 2010s (across the identical time as I did) have additionally crossed the million-dollar mark this 12 months. They don’t monitor or reveal their funds yearly like I do, so their wins are stored slightly extra hush-hush, however I can attest to the truth that most of us who continued to earn, save, make investments and construct by way of the final bull-and-bear cycles ought to have seen our web value climb to new all-time highs this 12 months.

For these of you who’re nonetheless constructing, I hope this evokes you and reveals you that it actually is feasible to attain your monetary targets. You don’t need to be wealthy or working a gross sales job to change into a millionaire; so long as you retain on the 3 elementary guidelines of cash like I did, you’ll finally get there. The inventory market is really a wondrous place if you’re in it for the long-run and make investments properly, and allocating a portion of my funds to cryptocurrencies again in 2017 proved to be a salient transfer.

What a loopy 12 months of progress it has been in 2024! Don’t overlook to remain tuned for my ebook, which will likely be revealed subsequent 12 months someday in mid-2025. For those who’ve caught round these final 10 years, thanks in your help, and right here’s to extra to return in 2025.

I’m excited to see what subsequent 12 months will carry!

With love,

Finances Babe