This can be a Nationwide Pension Scheme Fund Screener to shortlist constantly performing NPS schemes. You may also spot NPS schemes with a better return than a benchmark at a decrease threat. That is comparable in design to the freefincal Equity Mutual Fund Performance Screener.

Inside, you get discounted hyperlinks to our robo advisory tool and two programs: How to get people to pay for your skills (aka earn from abilities) and the lectures on goal-based portfolio management.

The benchmarks used are given under.

Benchmarks Used

| Class | Benchmark (index) |

| Various Property | CRISIL Composite Index, CRISIL HYBRID 85:15 |

| Atal Pension Yojana | CRISIL Composite Index, CRISIL HYBRID 85:15 |

| Company bond | CRISIL Composite Index, CRISIL HYBRID 85:15 |

| Fairness | N200TRI, N50TRI |

| Gilt | IBEX (I-Sec Sovereign Bond Index) |

| Authorities | CRISIL HYBRID 85:15, IBEX (I-Sec Sovereign Bond Index) |

| Hybrid max 10% -25% fairness | CRISIL Composite Index, CRISIL HYBRID 85:15 |

Observe: The benchmarks used for non-equity schemes are solely notional. They might not be good representatives of the asset class. Consumer discretion is suggested.

Use this screener file to rapidly discover the best-performing NPS schemes that constantly outperform class benchmarks/indices with sufficient draw back safety (higher efficiency when the index is down) and upside efficiency (higher efficiency when the index is up).

Observe: Opposite to in style perception, NPS schemes are usually not index funds! They’ve a benchmark and are anticipated to beat it.

What does this NPS Efficiency Screener cowl?

It provides you three outputs:

- Rolling return outperformance consistency: the NPS scheme/fund returns are in contrast with class benchmark returns over each potential 1Y,2Y,3Y,4Y, and 5Y interval. The upper the outperformance consistency, the higher. Suppose 876 fund returns had been in contrast with 876 benchmark returns, and the fund has crushed the benchmark 675 occasions. The consistency rating might be 675/876 ~ 77%.

- Upside efficiency consistency over each potential 1Y,2Y,3Y,4Y, and 5Y: The upper, the higher. A rating of 70% signifies that 7 out of 10 occasions, the NPS fund carried out higher than the class benchmark when the benchmark elevated. This can be a measure of reward.

- Draw back efficiency consistency over each potential 1Y,2Y,3Y,4Y, and 5Y: The upper, the higher. A rating of 60% means 6 out of 10 occasions, the NPS fund carried out higher than the class benchmark when the benchmark was shifting down. This can be a measure of threat safety.

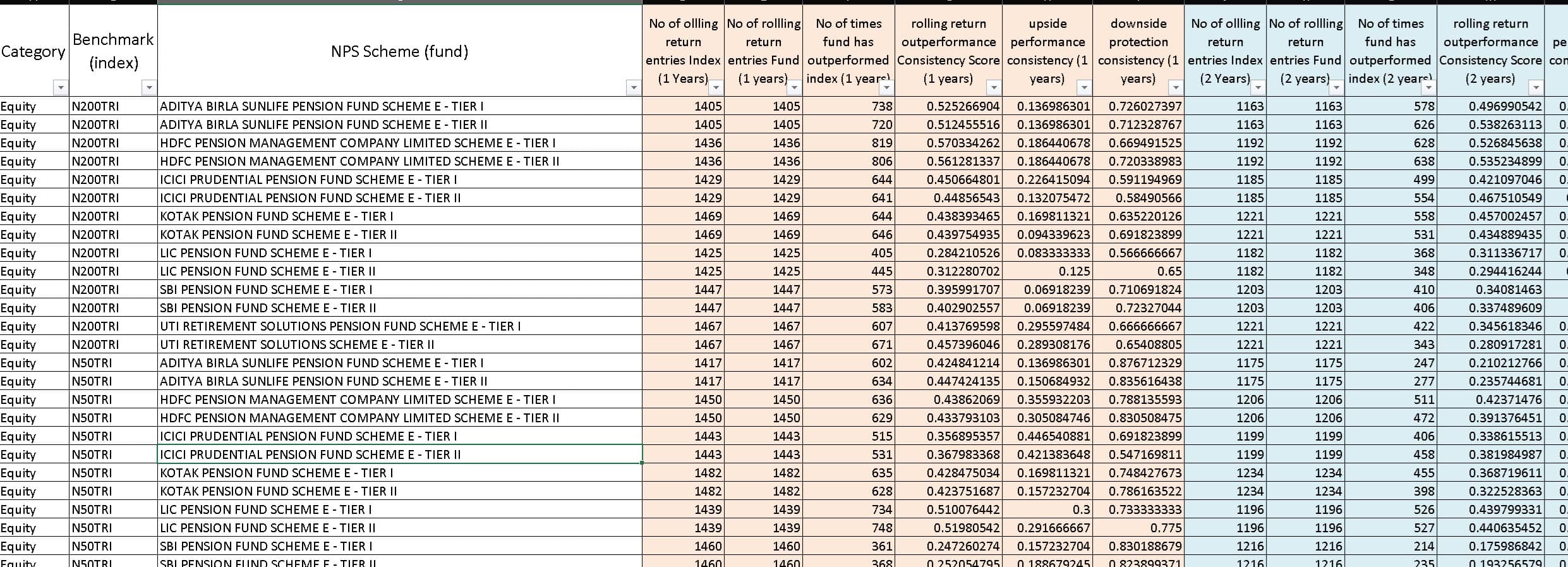

Should you open the screener file, you see column headings like this.

You might have the scheme class, benchmark, NPS scheme identify, no of 1Y returns of the benchmark(index), no of 1Y returns of the fund, no of occasions the fund 1Y return is above index 1Y return, the 1Y rolling return consistency; upside efficiency consistency and draw back safety consistency. These columns are repeated for 2Y,3Y,4Y and 5Y.

You may display screen by filtering out funds with return outperformance consistency of >=60%, a draw back safety consistency of >= 60% and so forth. That is solely an instance. You may apply your criterion for screening.

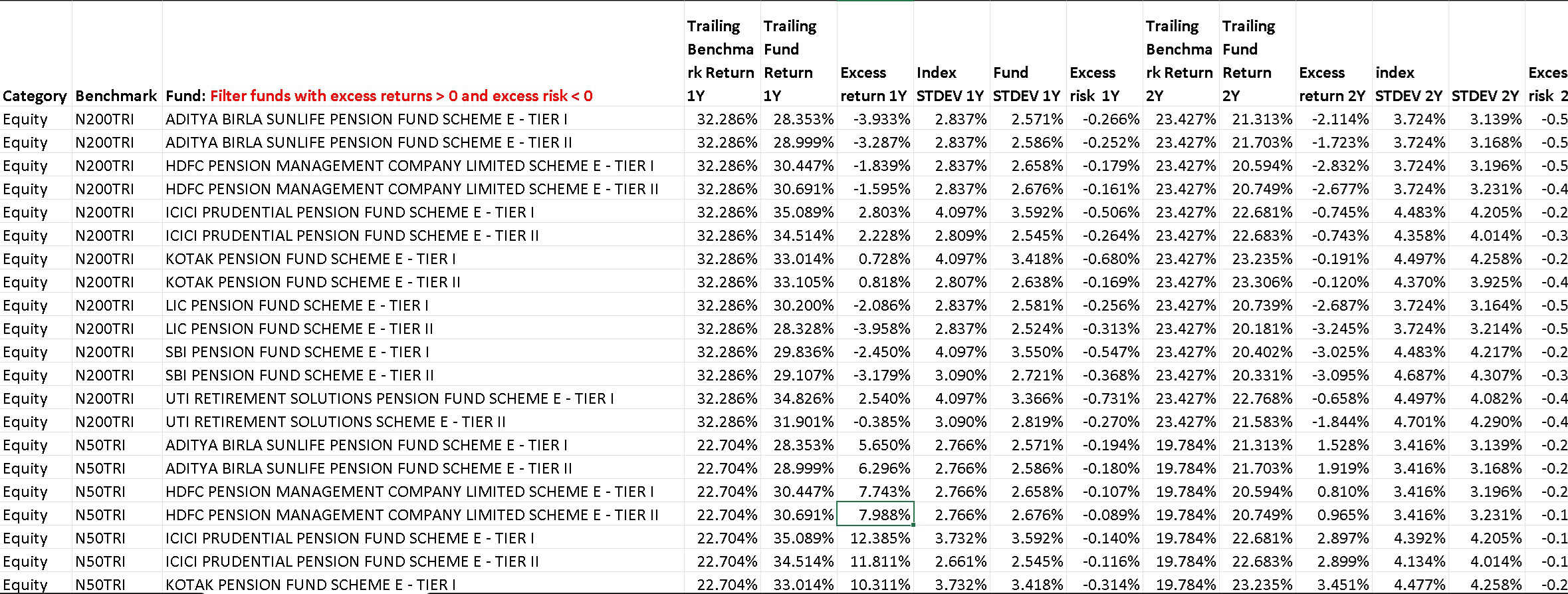

Display for NPS schemes with greater than benchmark returns with decrease threat

Right here, you possibly can display screen for funds with extra return > 0 within the final 1,2,3,4,5 12 months trailing durations. This implies the fund return is bigger than the index return. You may also add extra threat < 0 filters for a similar durations. Because of this the fund threat is lower than the index threat. Therefore, the surplus threat is detrimental.

Take, for instance, ICICI PRUDENTIAL PENSION FUND SCHEME E – TIER I

- Trailing Benchmark Return 1Y: 22.704%

- Trailing Fund Return 1Y: 35.089%

- Extra return 1Y: 12.385% (constructive extra return is sweet!)

- Index commonplace deviation (NAV volatility) 1Y: 3.732%

- Scheme commonplace deviation 1Y: 3.592%

- Extra threat of the scheme: -0.140% (detrimental extra threat is sweet!)

So, over the past 1Y, the NPS scheme has considerably outperformed the index with decrease NAV volatility.

The thought right here is to seek out funds which have crushed the index by way of greater returns (extra return >0) and decrease threat (extra threat <0) within the final 1,2,3,4,5 12 months interval. You may calm down it to three/4/5 12 months durations if you want.

This can be a screenshot of the information.

Reward measure: Rolling returns outperformance consistency.

Rolling returns are a easy estimate of how constantly a fund has outperformed a benchmark.

Take the ICICI PRUDENTIAL PENSION FUND SCHEME E – TIER II for instance. There are 476 five-year rolling returns compared with Nify 200 TRI. Out of those, the fund beat the benchmark 220 occasions. So the Rolling returns outperformance consistency = 220/476 = 46.2%. Naturally, the upper the rolling return outperformance consistency, the higher.

Reward and Danger Measure: Upside Efficiency & Draw back Seize

Upside efficiency consistency over each potential 1Y,2Y,3Y,4Y, 5Y: Increased the higher. A rating of 70% means, 7 out of 10 occasions, the Fund carried out higher than the class benchmark when the benchmark elevated. This can be a measure of reward. It’s computed from rolling upside seize knowledge.

Draw back efficiency consistency over each potential 1Y, 2Y, 3Y,4Y, and 5Y. The upper, the higher. A rating of 60% means 6 out of 10 occasions, the Fund carried out higher than the class benchmark when the benchmark was shifting down. This can be a measure of threat safety. It’s computed from rolling draw back seize knowledge.

Should you want to perceive how these are calculated, please learn this: Introduction to Downside and Upside Capture Ratios and proceed to this one, for instance. For some funds, a excessive draw back seize consistency will result in higher returns; for some funds, a excessive upside seize consistency will result in higher returns. The screener might help distinguish between the 2 forms of performers. Advocate studying: What is mutual fund downside protection, and why is it important?

Methods to use the NPS Efficiency Screener

There are a number of methods to display screen for mutual funds. I’ll talk about two examples.

Then, technique A: Set the 3Y and 5Y rolling return outperformance consistency to be above 60% or 70% or so. That ought to provide you with a pleasant shortlist to select from. Then, you possibly can visually search for funds with the proper draw back safety consistency and choose one. Methodology B: Search for funds above 60% or 70% draw back safety consistency over 3Y and 5Y and select one. Keep in mind, by no means set slim filters and don’t be too demanding. Wanting to pick the fund with one of the best previous efficiency is apparent immaturity. Your screening standards ought to yield 5-6 funds always. Why ought to I take advantage of this screener? Why can’t I take a look at trailing returns and display screen? Trailing returns are 3Y or 5Y returns calculated with the final enterprise date (3Y and 5Y prior). This is only one knowledge level to contemplate. Right here, we discover much more to find out consistency.

Extra Danger vs Extra Return Screener: The thought right here is to seek out funds which have crushed the index by way of greater returns (extra return >0) and decrease threat (extra threat <0) within the final 1,2,3,4,5 12 months interval. You may calm down it to three/4/5 12 months durations if you want.

Vital Info

- This screener prices Rs. 150 and is supposed for private use solely.

- Inside, you get a reduced hyperlink to our robo advisory tool and two programs: How to get people to pay for your skills (aka earn from abilities) and the lectures on goal-based portfolio management.

- The fee is just for the information within the sheet.

- You’ll get an Excel file with the information. You may allow knowledge filters and display screen it as you want. You may add this file to any spreadsheet software program.

- Whereas freefincal will do its greatest to publish up to date screener sheets every month, it can not assure the identical.

- The file accommodates no purchase or promote suggestions and solely has the abovementioned knowledge.

- Sufficient care and energy have been put into removing errors. Nevertheless, we can not assure that the sheet is freed from error.

- The client should analysis utilizing the data within the spreadsheet. No suggestions or help are included within the sheet and won’t be supplied individually.

- We won’t present any additional assist or help in utilizing the sheet.

- The sheet bought is for private use and shouldn’t be shared privately or publicly. A purchase order implies you conform to the phrases within the necessary data part.

Click here to pay Rs. 150 and download (instantly) the latest Freefincal NPS Fund Screener.

Are you residing exterior India? You may pay by way of this PayPal link (5 USD) and e mail us: freefincal at Gmail.

Do share this text with your folks utilizing the buttons under.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& be part of our group of 7000+ customers!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ Greater than 2,500 traders and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We additionally publish month-to-month equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

Podcast: Let’s Get RICH With PATTU! Every single Indian CAN grow their wealth!

You can watch podcast episodes on the OfSpin Media Friends YouTube Channel.

🔥Now Watch Let’s Get Rich With Pattu தமிழில் (in Tamil)! 🔥

- Do you’ve gotten a remark in regards to the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Have a query? Subscribe to our publication utilizing the shape under.

- Hit ‘reply’ to any e mail from us! We don’t supply customized funding recommendation. We will write an in depth article with out mentioning your identify when you have a generic query.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Hyperlink takes you to our e mail sign-up type)

About The Creator

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him by way of Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Gets a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Fee-only India,” an organisation selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him by way of Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Gets a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Fee-only India,” an organisation selling unbiased, commission-free funding recommendation.

Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ Greater than 3,000 traders and advisors are a part of our unique group! Get readability on easy methods to plan to your targets and obtain the mandatory corpus regardless of the market situation is!! Watch the primary lecture at no cost! One-time fee! No recurring charges! Life-long entry to movies! Scale back concern, uncertainty and doubt whereas investing! Learn to plan to your targets earlier than and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ Greater than 700 salaried workers, entrepreneurs and monetary advisors are a part of our unique group! Learn to get folks to pay to your abilities! Whether or not you’re a skilled or small enterprise proprietor who needs extra shoppers by way of on-line visibility or a salaried particular person wanting a aspect earnings or passive earnings, we are going to present you easy methods to obtain this by showcasing your abilities and constructing a group that trusts and pays you! (watch 1st lecture at no cost). One-time fee! No recurring charges! Life-long entry to movies!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Most investor issues might be traced to a scarcity of knowledgeable decision-making. We made unhealthy choices and cash errors once we began incomes and spent years undoing these errors. Why ought to our kids undergo the identical ache? What is that this e book about? As dad and mom, what would it not be if we needed to groom one capability in our kids that’s key not solely to cash administration and investing however to any facet of life? My reply: Sound Determination Making. So, on this e book, we meet Chinchu, who’s about to show 10. What he needs for his birthday and the way his dad and mom plan for it, in addition to instructing him a number of key concepts of decision-making and cash administration, is the narrative. What readers say!

Should-read e book even for adults! That is one thing that each mother or father ought to train their children proper from their younger age. The significance of cash administration and choice making primarily based on their needs and wishes. Very properly written in easy phrases. – Arun.

Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new e book is for these occupied with getting aspect earnings by way of content material writing. It’s accessible at a 50% low cost for Rs. 500 solely!

Do you need to test if the market is overvalued or undervalued? Use our market valuation tool (it would work with any index!), or get the Tactical Buy/Sell timing tool!

We publish month-to-month mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content material coverage. Freefincal is a Information Media Group devoted to offering authentic evaluation, studies, evaluations and insights on mutual funds, shares, investing, retirement and private finance developments. We accomplish that with out battle of curiosity and bias. Comply with us on Google News. Freefincal serves greater than three million readers a 12 months (5 million web page views) with articles primarily based solely on factual data and detailed evaluation by its authors. All statements made might be verified with credible and educated sources earlier than publication. Freefincal doesn’t publish paid articles, promotions, PR, satire or opinions with out knowledge. All opinions might be inferences backed by verifiable, reproducible proof/knowledge. Contact data: letters {at} freefincal {dot} com (sponsored posts or paid collaborations won’t be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Aim-Primarily based Investing

Revealed by CNBC TV18, this e book is supposed that will help you ask the proper questions and search the proper solutions, and because it comes with 9 on-line calculators, you too can create customized options to your life-style! Get it now.

Revealed by CNBC TV18, this e book is supposed that will help you ask the proper questions and search the proper solutions, and because it comes with 9 on-line calculators, you too can create customized options to your life-style! Get it now.

Gamechanger: Overlook Startups, Be a part of Company & Nonetheless Dwell the Wealthy Life You Need

This e book is supposed for younger earners to get their fundamentals proper from day one! It would additionally make it easier to journey to unique locations at a low price! Get it or gift it to a young earner.

This e book is supposed for younger earners to get their fundamentals proper from day one! It would additionally make it easier to journey to unique locations at a low price! Get it or gift it to a young earner.

Your Final Information to Journey

That is an in-depth dive into trip planning, discovering low cost flights, price range lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (instant download)

That is an in-depth dive into trip planning, discovering low cost flights, price range lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (instant download)