Nicely, it occurred once more. The Federal Reserve introduced one other price minimize and mortgage charges surged increased.

In truth, the 30-year fastened now begins with a 7 as a substitute of a 6 for many mortgage situations. What’s happening?

Whereas it appears to defy logic, it’s a pretty common occurrence. It truly occurred again in September too.

This could make it crystal clear that the Fed doesn’t set mortgage charges.

In different phrases, in the event that they minimize, mortgage charges don’t additionally go down. And in the event that they hike, mortgage charges don’t additionally go up. However oblique results are definitely attainable.

What Does the Fed Charge Reduce Imply for Mortgage Charges?

Yesterday, the Federal Reserve announced its third price minimize because it pivoted from hikes a few 12 months in the past.

They lowered the federal funds rate (FFR) one other 25 foundation factors (0.25%) to attain employment and inflation objectives, often called its twin mandate.

Briefly, inflation is liable to reigniting, however unemployment can also be liable to rising. In order that they felt one other minimize was warranted.

On a traditional day, this might need zero impact on mortgage rates, that are long-term charges just like the 30-year fastened.

Fed coverage entails short-term charges, with the FFR being an in a single day lending price that banks cost each other when they should borrow.

So the important thing right here is the FFR and 30-year fastened are very totally different when it comes to maturity, and thus typically have little correlation.

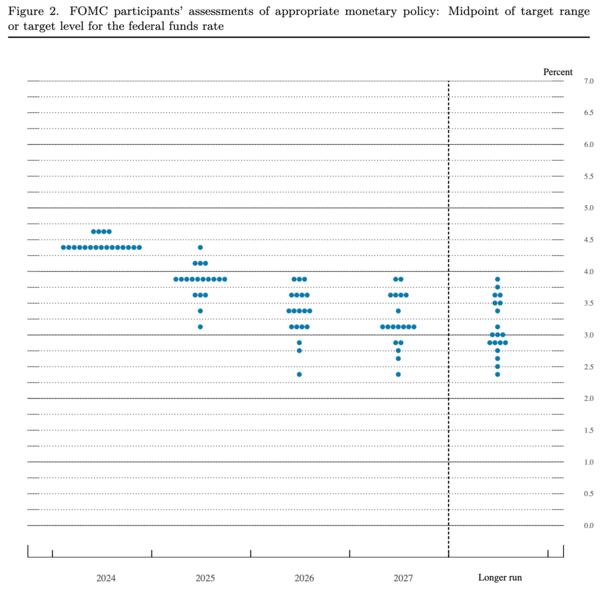

Nevertheless, the Federal Reserve does extra than simply minimize or elevate the FFR. It additionally communicates long-term coverage targets and releases a dot plot that maps out with future price cuts or hikes.

This dot plot is launched quarterly in March, June, September, and December conferences inside their Summary of Economic Projections.

It may be extra related to mortgage charges as a result of it offers an extended anticipated path of financial coverage extending a number of years out.

The newest exhibits the place the Federal Open Market Committee (FOMC) contributors see the FFR in 2025, 2026, 2027, and past.

In different phrases, a long-term view that’s extra related to long-term mortgage charges.

And what in the end received mortgage charges yesterday was a revised dot plot that was much more hawkish in tone.

Merely put, fewer future price cuts are within the playing cards. Greater for longer may be right here to remain.

Why Is the Fed Slowing Down Its Charge Cuts?

It boils all the way down to financial information, which was displaying indicators of cooling for a lot of the previous 12 months earlier than warming up recently.

“The median projection within the SEP for complete PCE inflation is 2.4 p.c this 12 months and a pair of.5 p.c subsequent 12 months, considerably increased than projected in September,” Powell said in prepared remarks.

“Thereafter, the median projection falls to our 2 p.c goal.”

The concern now’s inflation reigniting, which might at minimal drive the Fed to finish its price reducing cycle early.

Or at worst, presumably even drive the Fed to hike charges once more, although Powell indicated that was unlikely in 2025.

Fed chair Jerome Powell famous in his press convention yesterday that coverage contributors cited “extra uncertainty round inflation” and mentioned, “When the trail is unsure you go just a little bit slower.”

In different phrases, the Fed isn’t so certain extra price cuts are obligatory, particularly if they’ve an inflationary impact.

Their newest dot plot backs this up, indicating that solely 1-2 price cuts are anticipated in 2025, down from 3-4 beforehand.

That is what pushed mortgage charges increased yesterday. The long-term outlook, not the speed minimize itself.

However the Fed Admits There’s a Lot of Uncertainty

Right here’s the factor although. The Fed nonetheless expects inflation to maneuver towards its 2% goal, as Powell mentioned in his quote above.

It simply may be a rocky highway getting there, as a straight line is rarely the path for anything, together with mortgage charges.

On high of the uncertainty is the incoming administration, with Trump’s tax cuts and proposed tariffs seen as inflationary.

However once more, it’s unclear what is going to truly occur, although Powell did admit they count on “important coverage modifications.”

Nevertheless, we don’t understand how these will truly play out. Might they be inflationary, certain? Might they be so much much less impactful than some count on, certain.

Might unemployment soar in 2025 whereas the financial system falls into recession, certain!

Finish of the day, we simply gained’t know till Trump will get into workplace and begins his second time period.

That alone may be why the Fed and bond merchants are being so defensive, with the 10-year yield additionally up almost 20 bps in the past couple days.

And the Fed acknowledging this uncertainty yesterday simply made issues worse.

Bear in mind, you possibly can track mortgage rates by looking at the direction of the 10-year yield.

When it rises, mortgage charges are likely to rise, and vice versa. This explains why the 30-year fastened jumped from 6.875% to round 7.125%.

Mortgage lenders are additionally taking part in protection like everybody else as a result of they don’t need to get caught out on the mistaken facet of the commerce.

So actually all of it comes all the way down to everybody taking part in protection, whether or not it’s the bond merchants, the Fed, or banks and lenders.

And you’ll’t actually blame them, given the uncertainty round inflation coupled with a brand new incoming U.S. president.

[Mortgage Rates Tend to Fall Within 12 Weeks of a First Fed Rate Cut]

Financial Situations Can Change Rapidly

Let me simply add one last item. As shortly as mortgage charges surged increased the previous couple days, they may additionally reverse course.

If it seems inflation isn’t heating up once more, and/or that Trump doesn’t implement all this proposed polices, mortgage charges might return down.

The identical goes for unemployment. If claims and job losses preserve rising, as they’ve been, the Fed will must be extra accommodative once more.

And there may very well be a flight to security as buyers ditch high-risk shares and purchase lower-risk bonds, which helps mortgage charges.

Bear in mind, the Fed nonetheless expects inflation to fulfill its goal goal quickly, regardless of some hiccups alongside the best way.

When you recall inflation on the best way up, there have been durations the place it appeared beat, earlier than getting even worse.

Now on the best way down, there may be comparable durations the place regardless of disinflating, there are head fakes and unhealthy months of information.

However should you zoom out, it may be extra evident that mortgage charges can proceed to come back down from these 7-8% ranges.

Sadly, charges at all times are likely to take longer to fall than they do go up. So persistence may be the secret right here.

I nonetheless count on mortgage charges to renew their downward path into 2025, with 30-year fastened charges within the high-5s nonetheless a risk.

Learn on: 2025 mortgage rate predictions