On November 1, 2024, the previous AlphaCentric Strategic Earnings Fund was rebranded as AlphaCentric Actual Earnings Fund with a brand new sub-advisor, broader technique, and new expense ratio to accompany its new identify.

CrossingBridge Advisors will handle the funding technique by using a group method. Portfolio managers are T. Kirk Whitney, CFA, who joined the agency as an analyst in 2013, Spencer Rolfe, who first joined in 2017, and David Sherman, CIO. CrossingBridge, with over $3.2 billion in belongings as of 8/31/24 was chosen to use a bottom-up, worth method to the technique.

The fund’s concentrate on “actual revenue” is new, however the agency’s just isn’t. All CrossingBridge methods begin with the identical philosophical assertion: “Return of principal is extra essential than return on principal.” Their hallmark is searching for undervalued income-producing investments having “neglected elements” that result in worth appreciation. The fund will personal a mixture of bonds and shares to supply revenue and capital appreciation.

The revised funding mandate is to spend money on corporations straight or not directly related to actual property and actual property. Actual property contains hard-asset companies, pipeline homeowners, transport corporations, and so forth. The managers anticipate investing in some fairness and most well-liked securities, in addition to some debt.

Though it is a new devoted technique for CrossingBridge, they’ve positions – asset-backed securities, mortgage-backed securities, and a few actual property corporations – of their current funds that will qualify for the Actual Earnings portfolio. This would be the first mutual fund through which CrossingBridge invests a considerable allocation in equities, so buyers ought to anticipate considerably better volatility than CrossingBridge’s conventional choices.

The opposite warning is that CrossingBridge is inheriting a portfolio constructed by different managers with different disciplines. It’s regular for funds to see a good quantity of portfolio turnover of their first month or months. Potential buyers may wish to wait a bit earlier than leaping in.

Three explanation why the fund could also be value your consideration.

Arduous belongings are enticing belongings.

These actual property/onerous asset investments are basically totally different from pure monetary asset investments. Forests, farmland, pipelines, and warehouses are all long-lasting bodily objects that generate predictable revenue streams over predictable time frames. That implies that they’ve a collection of points of interest:

- Diversification: These belongings can scale back portfolio threat by offering a counterbalance to monetary belongings. Actual property, for instance, has a weak optimistic relationship with the inventory market and a weak detrimental relationship with bonds.

- Inflation safety: Arduous belongings have a tendency to keep up or enhance in worth over time, at the same time as inflation rises. Actual asset returns are typically correlated with inflation, which implies that they rise as inflation does.

- Earnings technology: Many onerous belongings, comparable to actual property and commodities, can generate common revenue streams.

- Lengthy-term appreciation: Arduous belongings can admire over the long run, offering potential for capital positive aspects. That’s most pronounced should you’re counting on a affected person worth investor to amass them at costs under their intrinsic values.

Many advisers contemplate these to be “various investments” which may occupy 5-20% of a portfolio.

The CrossingBridge group are distinctive stewards of your cash.

CrossingBridge advises, or sub-advises, six open-ended mutual funds, and one exchange-traded fund. The latest addition was the Nordic High Income Bond. All are income-oriented, lively, and capacity-constrained. As well as, all have top-tier risk-adjusted returns since inception.

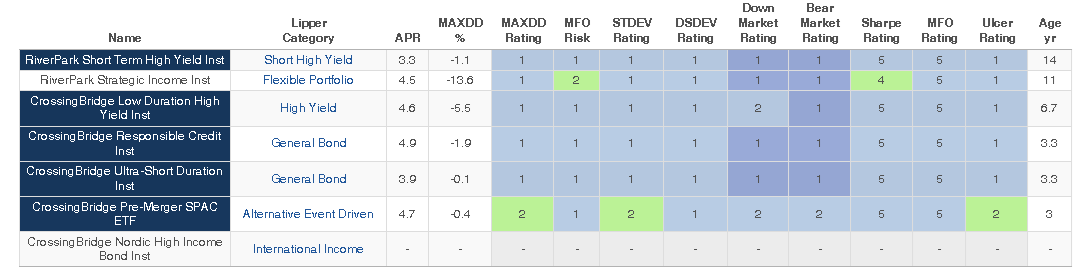

MFO Premium permits us to trace funds, together with ETFs, on an uncommon array of measures of risk-awareness, consistency, and risk-adjusted-performance. For the sake of these not prepared to obsess over whether or not an Ulcer Index of 1.3 is good, we all the time current color-coded rankings. Blue, in numerous shades, is all the time the highest tier, adopted by inexperienced, yellow, orange, and pink. Beneath are all the chance and risk-return rankings for all of the funds suggested or sub-advised by CrossingBridge since inception.

Whole and risk-adjusted efficiency since inception, all CrossingBridge funds (by 9/30/2024)

Supply: MFO Premium fund screener and Lipper world dataset. The class assignments are Lipper’s; their validity is, after all, open to dialogue.

Right here’s the brief model: each fund, by just about each measure, has been a top-tier performer since launch. That displays, in our judgment, the virtues of each an intense dislike of shedding buyers’ cash and a willingness to go the place bigger corporations can not.

Some members of MFO’s dialogue group fear that a few of the new funds are successfully clones of current ones. To evaluate that concern, we ran the three-year correlations between the entire funds that CrossingBridge advises or subadvises.

| RPHIX | RSIIX | CBLDX | CBRDX | CBUDX | SPC | |

| RiverPark Quick Time period Excessive Yield | 1.00 | |||||

| RiverPark Strategic Earnings | 0.54 | 1.00 | ||||

| CrossingBridge Low Length Excessive Yield | 0.70 | 0.81 | 1.00 | |||

| CrossingBridge Accountable Credit score | 0.60 | 0.67 | 0.75 | 1.00 | ||

| CrossingBridge Extremely-Quick Length | 0.80 | 0.48 | 0.71 | 0.45 | 1.00 | |

| CrossingBridge Pre-Merger SPAC ETF | 0.14 | 0.36 | 0.33 | 0.13 | 0.28 | 1.00 |

The correlations are constantly low; every new CrossingBridge fund brings one thing new to the desk.

The fund they’re inheriting is sort of small, about $55 million in belongings, and CrossingBridge already has substantial investments in actual property and actual property in its different funds, so the adoption poses minimal extra stress on administration.

A worth-oriented onerous asset portfolio affords cheap revenue and cheap development.

Mr. Sherman was clear that this fund is prone to expertise “extra volatility than our Strategic Earnings Fund with increased upside in comparison with a high-yield bond index. We now have a bias towards draw back safety so we’re fixed-income plus fixed-income-like fairness. Which may provide considerably decrease volatility than a inventory/bond hybrid fund however can even doubtless have much less upside.” The yield of a portfolio like that is “most likely 6-7%” and lively administration of the portfolio has the prospect of including 150-250 bps when measured over cheap time frames.

Web site: CrossingBridge Advisors and AlphaCentric Real Income Fund. On the level of publication, AlphaCentric had solely begun updating the fund’s pages to replicate these adjustments; for instance, the outdated administration group was nonetheless listed. People searching for to grasp CrossingBridge’s method may begin with their web site, examine the Corporate Finance Institute’s overview of hard or real assets, after which examine again with AlphaCentric.