Not too long ago, there was a lot ado about nothing over whether or not or not finfluencers in Singapore should be licensed. And due to the path of the information protection, many individuals at the moment are beneath the mistaken impression that finfluencers (together with yours actually right here) now should be licensed.

Let me clear the air as soon as and for all:

Finfluencers do NOT should be licensed in Singapore.

This large false impression began on 13 November, after the Straits Instances revealed a information article with the next selection of headline:

In consequence, it has precipitated an enormous hoo-ha over nothing, together with reactions from varied different media shops which have continued to select up on this piece of stories (which I deem as deceptive), particularly contemplating there was no change to MAS’ stance concerning finfluencers.

There are a couple of key details to be identified right here:

- Over the previous 5 years, MAS had obtained a mean of fewer than 5 complaints per yr towards finfluencers.

- MAS and the Industrial Affairs Division will take enforcement motion towards people offering monetary recommendation with no licence. Enforcement motion has been taken towards six people, none of whom was a finfluencer, over the previous three years.

- A finfluencer who supplies monetary recommendation must be appointed as a consultant of a monetary advisory agency.

- The authorities commonly advises the general public to cope with and make investments by way of solely individuals regulated by the MAS.

Sadly, anybody studying simply the information headlines as an alternative of diving into particulars and getting the phrase from the horse’s mouth instantly (i.e. the Financial Authority of Singapore, on this case) has utterly missed the purpose – or worse nonetheless, grossly misinterpreted your entire scenario.

In our finfluencer circle, many people have since been questioned by varied manufacturers and monetary establishments (who work with us for advertorials or sponsored instructional items) and requested to indicate proof of our licence.

But, we would not have one, as a result of there at present exists no licence that enables for us to function the way in which we do with out having to solicit or meet gross sales KPIs.

The present necessities to be eligible for and apply for a monetary licence are outlined by MAS here. It’s made very clear that solely “people conducting monetary advisory actions on behalf of licensed FAs or exempt FAs should be appointed as representatives”.

In Singapore’s present finfluencer panorama, there are solely a really small handful of finfluencers – outlined as people or media manufacturers who covers finance-related subjects and have a major social media following on-line – who conduct these monetary advisory actions. Those I do know of do certainly maintain a license and go on to just accept or handle their followers-turned-clients’ funds for them.

Finfluencers like myself, The Woke Salaryman (500k followers) Kelvin Learns Investing (100k followers), Adam Khoo (1 million followers) and even dealer Rayner Teo (2 million followers), don’t absorb our followers cash to take a position or handle it on their behalf. As an alternative, what we do is monetary training i.e. clarify monetary ideas, details, execs and cons, and so forth. We commonly train our followers develop into higher at managing their personal cash.

Due to the aftermath, I’ve since written to the authorities to make clear instantly if media manufacturers equivalent to SG Finances Babe (and some of my finfluencer associates) are required to be licensed consequently. Right here’s MAS response:

“We want to guarantee you that there isn’t a change in MAS’ coverage place and the two-stage take a look at within the Guidelines on Provision of Financial Advice stay related in assessing whether or not an individual is carrying on a enterprise of offering a monetary advisory service.

On this regard, content material that are factual info on monetary terminology and fundamental options of insurance coverage or funding merchandise, in addition to normal, non-personalised issues on the significance of financial savings (e.g. suggestions for financial savings or spending properly) or what a client ought to look out for earlier than buying monetary merchandise, wouldn’t be thought of monetary recommendation.

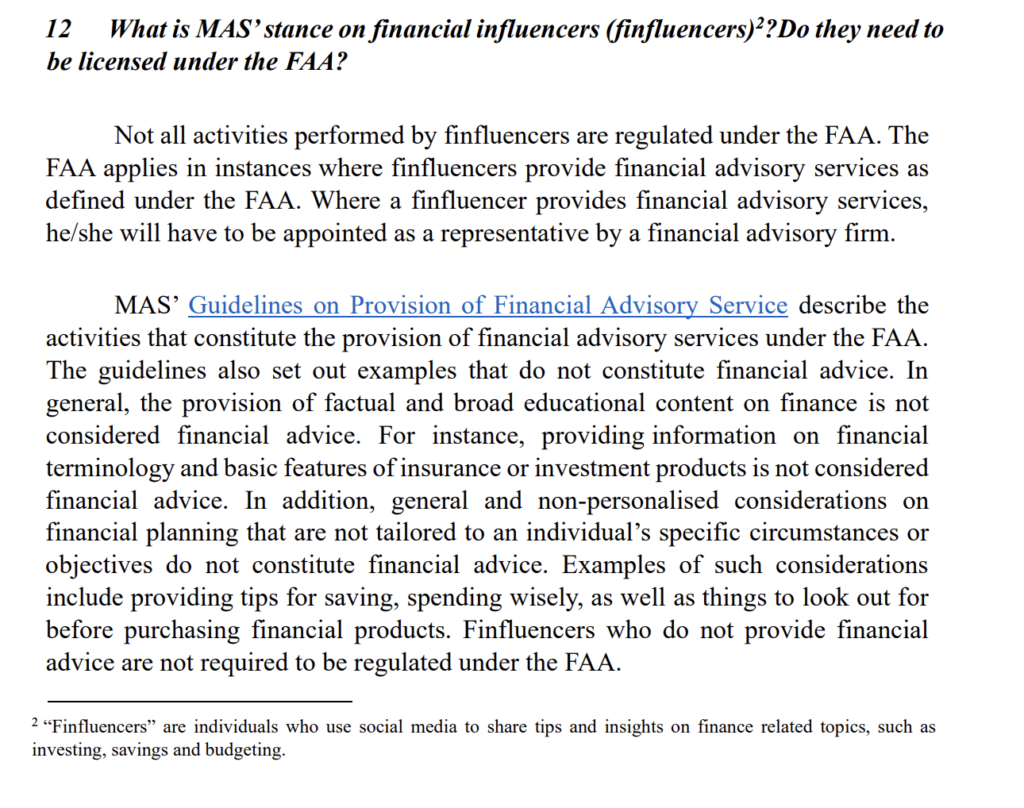

We’ve up to date the FAQs on Financial Advisers Act, Financial Advisers Regulations, Notices and Guidelines (see Part I FAQ 12) to make clear MAS’ place on whether or not finfluencers require licensing beneath the Monetary Advisers Act. Finfluencers ought to apply the two-stage take a look at to judge whether or not their actions quantity to the supply of economic recommendation.”

The updated guidelines by MAS, published very recently on 28 November 2024 here, clearly state right here that almost all of finfluencers don’t should be licensed:

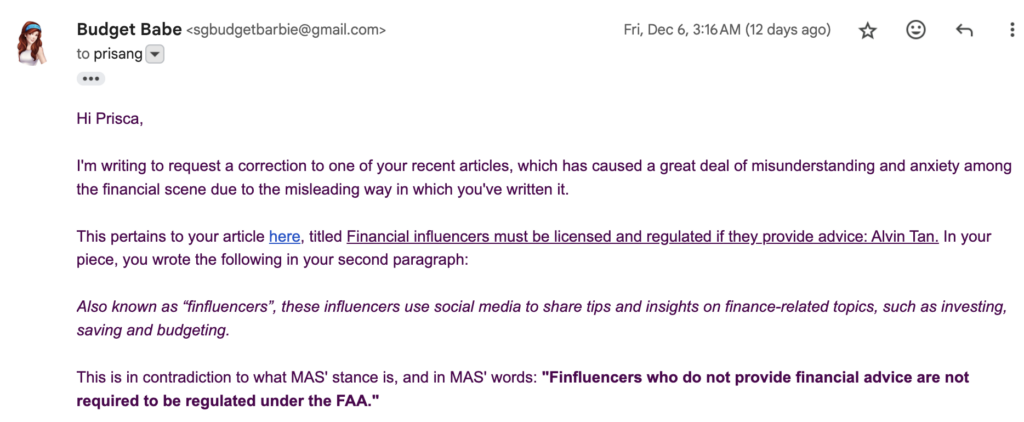

I’ve written to the unique journalist of the article that began this complete saga, however sadly, she has ignored my electronic mail and there’s nonetheless no replace on her piece:

Prime Minister Lawrence Wong has additionally addressed this explicitly (together with in response to my title) throughout his latest speech beneath. He made it very clear that even when the federal government had been to control native finfluencers like Finances Babe, the inhabitants can nonetheless entry info by abroad finfluencers which may very well be much more detrimental.

“Even when we regulate in Singapore, it’s an open Web. You may get all kinds of recommendation on the Web, and we are able to’t cease individuals from accessing this stuff on-line.

If you recognize of any explicit influencers who’ve crossed the road, tell us and we may have a pleasant dialog with them.”

– Prime Minister Lawrence Wong, 2 July 2024

So far as I do know, none of my finfluencer associates or myself have been known as up for a “kopi chat” with the authorities to this point. Do you actually assume they’re not watching our work, particularly when of us are naming us explicitly in these dialogue classes with the ministers?

Keep in mind prominent overseas Youtubers of the previous era including CryptoNick, whom I called out here? Or these US-based influencers who were charged by the SEC for their stock manipulation schemes promoted on Discord and Twitter? Or Logan Paul, who is being accused of misleading his followers (which embody Singapore-based followers, by the way in which) over crypto investments which have since misplaced cash?

Are finfluencers actually a systemic danger right here?

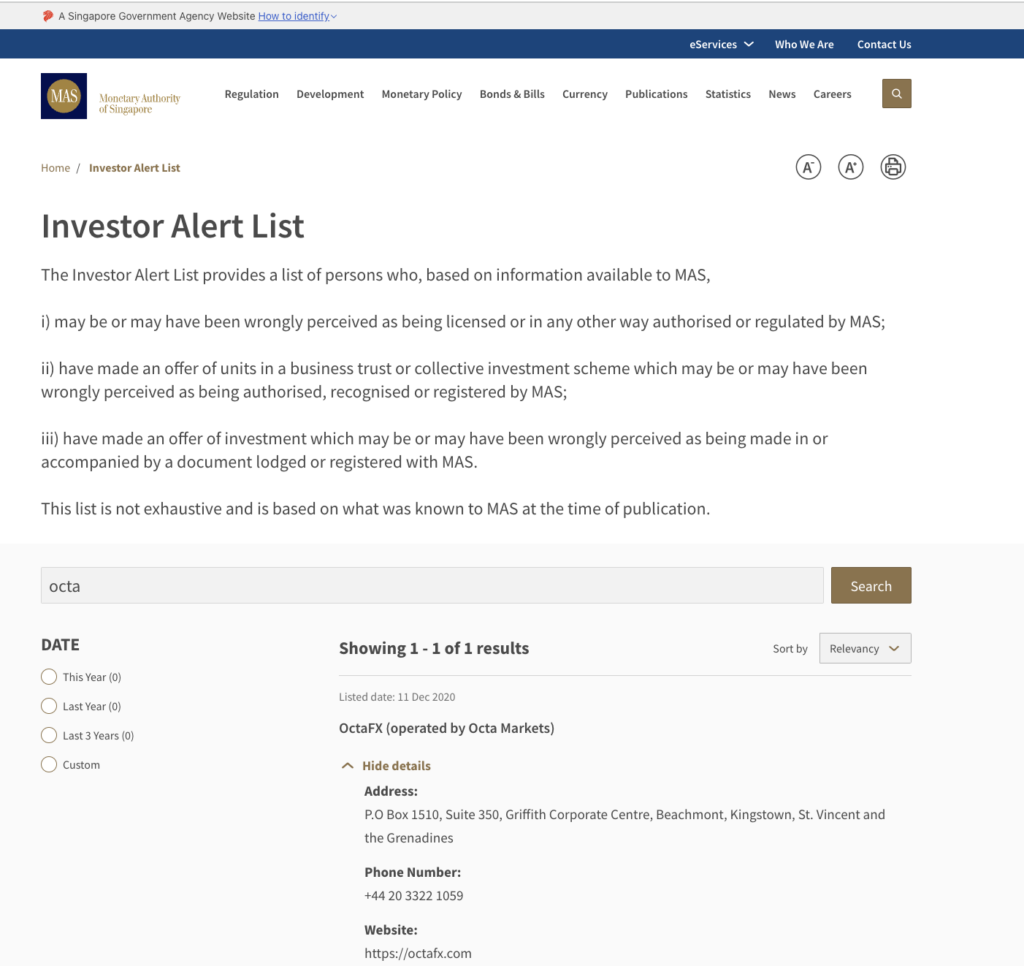

In at this time’s world, even finance manufacturers are selecting to rent life-style influencers and celebrities to advertise their platform and monetary merchandise. Keep in mind EndowUs’ adverts that includes Joanne Peh and Benjamin Kheng, that had been so prominently plastered throughout our MRT stations? Or YouTrip working with meals and journey creator Aiken Chia, or how about buying and selling app Octa working with in style Youtubers Benranaway, Mayiduo and Simon Boy?

Adultery and buying and selling? These movies, promoted by Mayiduo and Simonboy, reached over 1 million views. In distinction, most of us finfluencers don’t even command such a large attain…and neither will we wish to be related to Octa, which coincidentally occurs to be on the MAS Investor Alert Listing.

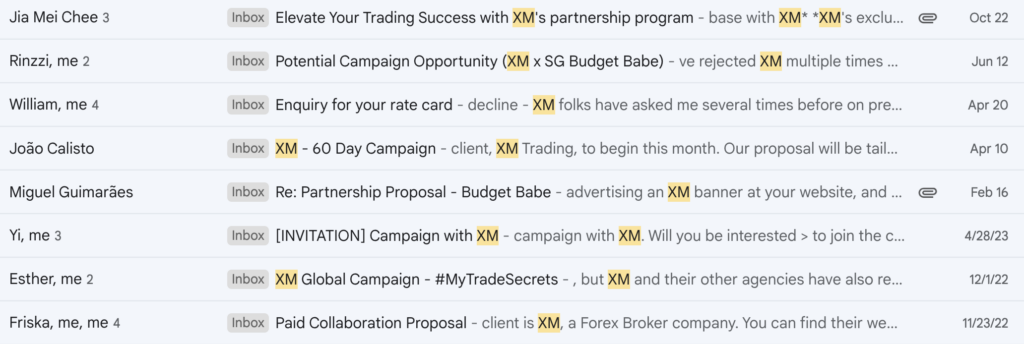

I’ve been supplied gigs by foreign exchange and CFD buying and selling platforms as effectively, which I’ve repeatedly turned down. Want proof? Right here’s me turning down XM regardless of repeated affords in the previous couple of years, as a result of I’m aware that not all of my followers could possibly handle the (larger) dangers concerned in FX and CFD buying and selling and thus I’ve zero curiosity in selling such a message to them:

However right here’s what Ryan and Jonathan inform their followers about CFD buying and selling as an alternative:

“It’s essential commerce futures or foreign exchange, and it must be a leveraged commerce. If you happen to’re taking a look at crypto, you most likely must go 20 / 50 / 100x. And if it’s foreign exchange, most likely a 1000 instances leverage. Funding requires a very long time horizon. What buying and selling futures assist you to do is you may make respectable earnings whether or not it goes up or goes down. In truth, the extra it goes down and also you brief the market, you may make cash.”

– Johnathan Chua, 2 November 2024

And who can overlook Tammy Tay, who opportunistically rode on the previous crypto bull run to launch her NFTs for over S$400 each? The final I checked, these NFTs are hardly price something now. She later then disclosed on an interview with Jianhao Tan and Xiaxue that she misplaced 1,000,000 {dollars} which was why she needed to flip to doing grownup content material on OnlyFans. The curious query is, how a lot of that was from the crypto investments that she made (and was additionally recommending on Instagram to her followers)?

“”I’ve misplaced over 1,000,000 {dollars}. It took 10 years to construct my life financial savings, and it took solely 2 years for me to lose all of it.”

Bitcoin is now at over $100,000. If Tammy Tay purchased Bitcoin between 2020 – 2022, even when on the peak of $60,000 then, she would nonetheless be within the inexperienced now. However, did she?

Finfluencers dare to talk out and name out BS

It is usually price stating that finance isn’t the best subject to sort out. It is usually a really slender area of interest – you’ll get higher traction (and sponsors cash) in case you develop into a life-style, journey or magnificence influencer as an alternative. However most of us select to do it as a result of we really feel keen about educating individuals about finance, and occur to know finance somewhat higher than the typical particular person.

This additionally means we are able to additionally scent out b*llsh*t after we see it within the sector.

Want a latest instance? Many people spoke out towards Belief Financial institution’s latest card launch, the place they employed many life-style and journey influencers to advertise the “15% cashback” provide. We known as it out for the deceptive promoting, and highlighted how the very best cashback final result you’ll ever get on the cardboard was nearer to 4+% and by no means anyplace close to 15%, in contrast to what others would have you ever consider. A number of of us then obtained an electronic mail from CASE afterward to thank us for bringing it up, and who mentioned that they’d since spoken to Belief Financial institution to right the deceptive claims. Psst, the correction was made means past the marketing campaign run dates, the place it most likely reached hundreds of thousands of eyeballs throughout that interval.

There was actually no finfluencer who promoted Belief Financial institution’s card as having 15% cashback. Zero. However there have been loads of non-finfluencers who did.

If finfluencers must be licensed, then how about non-finfluencers who promote monetary messages like foreign currency trading, leverage and deceptive bank card affords?

Is licensed recommendation essentially higher?

Final however not least, allow us to not overlook that extra shoppers have misplaced cash by taking the “recommendation” of licensed practitioners quite than listening to finfluencers:

To have a license at this time, you have to develop into a registered consultant of a agency providing regulated monetary providers. This license often comes with a number of necessities, together with gross sales KPIs – however most of us finfluencers have zero curiosity in promoting insurance coverage insurance policies or funding plans to our followers; we’re extra motivated to show them develop into savvier and handle their cash higher themselves.

The licensed professionals ask you handy their cash over to them to handle for you (at a charge), whereas we finfluencers inform you to by no means give your cash to us beneath any circumstances.

So…is there even a related licence for us to get?