On this period of high-yield financial savings accounts supplied by banks, do you know that our SRS funds yield solely 0.05% p.a.? If you wish to shield your SRS funds from shedding buying energy as a result of inflation, take into account investing in ETFs, which may doubtlessly supply greater returns.

Disclosure: This submit is dropped at you in collaboration with Nikko Asset Administration. All analysis and opinions are that of my very own, and shouldn't be taken as monetary recommendation on your particular scenario(s) as I do know nothing about your particular person monetary circumstances, danger tolerance or funding goals. I extremely suggest that you simply use this as a place to begin to grasp extra in regards to the numerous ETFs supplied by NikkoAM which you should utilize for SRS investing, after which click on into the respective hyperlinks above to retrieve the fund prospectus and efficiency in order that will help you resolve whether or not it suits into your funding goals.

With the yr coming to an finish, some people are topping up their Supplementary Retirement Scheme (SRS) accounts to cut back their tax invoice when It’s time to file tax returns within the new yr.

Should you’re making an attempt to do the identical, bear in mind to finish your funds switch inside this month – by 31 December of every yr – so as to qualify for the tax reduction in your tax invoice served to you in April.

However what occurs after you prime up your SRS?

Should you’re responsible of leaving the funds idle in your account, that’s an enormous missed alternative as a result of over time, inflation alone would negate any tax advantages you get from contributing to your SRS account. Your cash not solely loses its buying energy annually, however you’re additionally lacking out on the possibility to have grown the cash for greater returns which will earn you extra than simply 0.05% every year. Nonetheless, you will want to pay attention to and handle the funding dangers of being uncovered to the monetary markets once you put your SRS monies to work, vs leaving it in your checking account to earn 0.05% pa curiosity.

Though most banks have raised their rates of interest over the previous couple of years, this doesn’t apply to your SRS account. Go forward and test – you’re nonetheless solely incomes 50 cents for each $1,000 saved. Should you had maximized your SRS contributions to cut back your earnings tax, that’s solely $7.65 on each $15,300!

Should you requested me, I feel it’s foolish to only contribute to your SRS account; you will want to speculate your funds as nicely.

What do individuals make investments their SRS funds in?

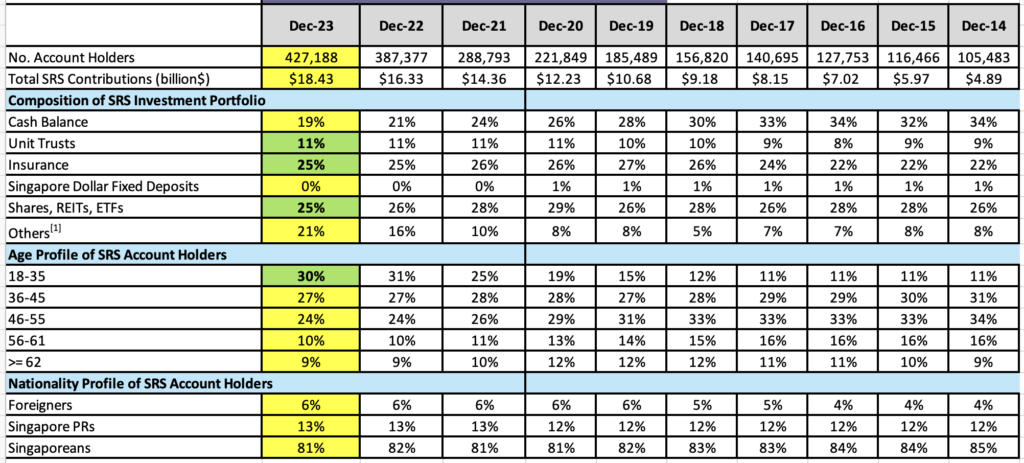

To get an concept of what most individuals make investments their SRS cash in, you’ll be able to refer to those statistics launched by the Ministry of Finance right here, which reveals that the most well-liked instruments used are:

- insurance coverage (25%)

- shares, actual property funding trusts (REITs) or alternate traded funds (ETFs) (25%)

- Singapore Authorities Bonds, Company Bonds, International Forex Fastened Deposits and Fund Administration (Others) (21%)

- unit trusts (11%)

[1] “Others” comprise of Singapore Authorities Bonds, Company Bonds, International Forex Fastened Deposits and Fund Administration

Single Premium Insurance coverage Insurance policies

Shopping for a single premium insurance coverage plan has usually been a extremely popular choice amongst SRS account holders. These are often your endowment or annuity plans, that are bought by insurance coverage brokers and are designed to offer a lump sum payout at maturity or a gentle stream of earnings sooner or later, ranging from a date* of your selection. Its attractiveness lies in the truth that a portion of funding returns is often assured, which explains why such insurance coverage have historically been well-received amongst those that are extra conservative.

*Sidenote: you would possibly wish to set a date after you flip 62 years outdated, or later. That is so that you gained’t incur the 5% early withdrawal penalty and be subjected to solely 50% of the withdrawn quantity being taxable.

Shares, REITs or ETFs?

Should you’re in search of investments with decrease charges, then shopping for particular person shares, REITs or ETFs straight from an alternate is perhaps extra of your cup of tea as in comparison with non-listed merchandise.

And in case you choose to not handle particular person counters, then investing by way of ETFs can present a cheap method that additionally takes much less time to analyse and monitor. A single ETF will help you obtain diversification as you’re uncovered to completely different corporations and industries, and diversification can usually assist to dilute volatilities coming from the person inventory counters. .

For instance, the Nikko AM Singapore STI ETF –tracks the highest 30 corporations listed on the SGX-ST Mainboard ranked by full market capitalisation.– and has a low complete expense ratio (TER)of 0.26% p.a (audited as of monetary interval ended 30 June 2024) and the ETF has a TER cap of 0.25% p.a.2.

Over the long-run, particularly in case you intend to speculate long-term on your SRS monies earlier than withdrawing them in your retirement years, placing this sum to work will assist keep away from having its worth being eroded by inflation.

Bonds

1 in 5 SRS account holders have presently invested their monies in bonds, which usually come issued with mounted maturity dates, permitting you as an investor to know when you’ll be able to count on to obtain your principal again. What’s extra, bonds are in style for his or her mounted earnings payouts (generally known as “coupons”) which works again into your SRS account.

Some examples of bonds that you possibly can spend money on together with your SRS funds are the Singapore Authorities Securities (SGS) bonds and Treasury Payments (T-Payments), which have a minimum application amount of S$1,000 and is subject to a $2 transaction fee.

Should you choose to spend money on a basket of bonds moderately than handle particular person bond positions your self, then different options you possibly can take a look at embrace the ABF Singapore Bond Index Fund which invests primarily in Singapore authorities/government-linked bonds, or the Nikko AM SGD Investment Grade Corporate Bond ETF which tracks the iBoxx SGD Non-Sovereigns Massive Cap Funding Grade Index, which is made up of funding grade bonds issued primarily by established and credible Singaporean corporations (resembling DBS and Singtel)* and Singaporean statutory boards.

*as of 31 October 2024

Try this text: Are Bond ETFs worth investing in?

Unit Trusts

As you’ll be able to see from the desk, unit trusts are an alternative choice that SRS buyers go for. A fast search on FSMOne’s Funds & ETF Selector with “SRS” chosen because the fee methodology will present up its complete universe of roughly 1,230 funds for buyers to select from.

These unit trusts are actively managed by a fund supervisor. As such, energetic administration charges will apply.

What ETFs can I take advantage of my SRS funds for?

Your SRS monies can be utilized to buy any ETFs listed on SGX, the place there are presently over 70 kinds of ETFs which you can select from. You need to use a inventory screener resembling FSMOne’s Funds & ETF Selector to filter by way of and see what is sensible to you (see beneath screenshot).

A few of the extra distinguished names embrace the Nikko AM Singapore STI ETF, which has a 1-year return of 21.92% as of 31 Oct 2024,* or the NikkoAM-Straits Trading Asia ex Japan REIT ETF that has persistently been paying distributions 4 occasions a yr, for the previous 7 years^.

*Returns are calculated on a NAV-NAV foundation and assuming all dividends and distributions are reinvested, if any. Previous efficiency isn't indicative of future efficiency. Please discuss with the Fund factsheet for the total vary of returns.^Distributions usually are not assured and are on the absolute discretion of the Supervisor. Any distribution is predicted to end in an instantaneous discount of Fund’s NAV. Distributions could also be paid out of capital which can end in capital erosion and discount within the Fund’s NAV, which will probably be mirrored within the redemption worth of the Models.

The charges you pay for such passively-managed funds are usually low. Right here’s the full fund charges buyers can count on to pay on the above 4 funds:

Supply: Nikko AM web site, November 2024

Footnotes:1 Audited as of monetary interval ended 30 Jun 2024. Administration Payment and Trustee Payment are included within the calculation of Whole Expense Ratio.

2 Audited as of monetary interval ended 30 Jun 2024. The Supervisor has decreased the cap on the full expense ratio of the Fund to 0.25% every year of the Deposited Property with impact from 1 December 2023. Any charges and bills which can be payable by the Fund and are in extra of 0.25% every year of the Deposited Property will probably be borne by the Supervisor and never the Fund.

3 Audited as of monetary interval ended 30 Jun 2024. Administration Payment and Trustee Payment are included within the calculation of Whole Expense Ratio.

4 Audited as of monetary interval ended 30 Jun 2024. The Supervisor intends to cap the full expense ratio at 0.55% every year. Any charges and bills which can be payable by the Fund and are in extra of 0.55% every year of the Deposited Property will probably be borne by the Supervisor and never the Fund.

Nonetheless, observe that other than the full expense ratio, additionally, you will incur brokerage charges every time you make a purchase or promote transaction. To reduce this, some SRS buyers might select to speculate solely a couple of times a yr, however in case you choose to not strive timing the markets and do dollar-cost averaging as a substitute, then you’ll be able to arrange a Common Financial savings Plan (RSP) to speculate persistently each month, whatever the buying and selling worth.

Sponsored Message

Do you know? Buyers can now use their SRS monies to purchase ETFs utilizing the ETF RSP function on FSMOne so that you can make investments often with zero processing charges on every buy!

- FSMOne is working an SRS promo from 1st November 2024 until 31st Jan 2025.

- This SRS promo is accessible for all SRS-enabled ETFs.

- The SRS promo mechanism is as follows:

| ETF Web Funding Quantity *(Regular Purchase + ETF RSP Purchase – Promote) **Qualifying Interval from 1st November 2024 until 31st Jan 2025 | Present SRS Buyers | New SRS Buyers (i.e. haven’t carried out any SRS transaction on FSMOne platform earlier than) |

| S$10,000 – S$19,999 | S$10 + S$5* | S$20 + S$5* |

| S$20,000 – S$49,999 | S$20 + S$5* | S$40 + S$5* |

| S$50,000 and above | S$50 + S$5* | S$100 + S$5* |

*You possibly can earn an extra S$5 bonus once you make investments at the very least S$10,000 in mixture into any Nikko AM ETF by way of your SRS account and assembly the required Web Funding Quantity.

Go to Nikko AM ETF site to seek out all their ETFs. There are 4 Nikko AM ETFs which you’ll be able to make investments utilizing your SRS :

To learn extra about how one can make investments utilizing SRS, go to How to invest in ETFs using SRS.

TL;DR Conclusion

No matter your most well-liked frequency, it is very important observe that permitting your SRS funds to stay idle in your checking account might end in missed alternatives for potential development. Should you’ve been procrastinating, Finances Babe is telling you now: make right this moment the final day you accomplish that.

Be aware: Whereas ETFs present a fuss-free technique to make investments, it's best to observe that every one investments usually are not with out dangers. Particularly, key dangers of the ETFs talked about embrace market and credit score dangers, liquidity dangers, product-specific dangers together with monitoring error dangers, danger related to the funding technique of the Fund or a scarcity of discretion by the Supervisor to adapt to market modifications, rising market dangers (as well as for the ABF Singapore Bond Index Fund), and rate of interest danger and credit score danger (as well as for Nikko AM SGD Funding Grade Company Bond ETF). Investments within the Fund might also be uncovered to different dangers of an distinctive nature occasionally. Please discuss with the Fund Prospectus and Product Highlights Sheet for additional particulars.

Essential Data by Nikko Asset Administration Asia Restricted:

This doc is solely for informational functions solely without any consideration given to the precise funding goal, monetary scenario and specific wants of any particular individual. It shouldn't be relied upon as monetary recommendation. Any securities talked about herein are for illustration functions solely and shouldn't be construed as a suggestion for funding. It's best to search recommendation from a monetary adviser earlier than making any funding. Within the occasion that you simply select not to take action, it's best to take into account whether or not the funding chosen is appropriate for you. Investments in funds usually are not deposits in, obligations of, or assured or insured by Nikko Asset Administration Asia Restricted (“Nikko AM Asia”).

Previous efficiency or any prediction, projection or forecast isn't indicative of future efficiency. The Fund or any underlying fund might use or spend money on monetary by-product devices. The worth of items and earnings from them might fall or rise. Investments within the Fund are topic to funding dangers, together with the attainable lack of principal quantity invested. It's best to learn the related prospectus (together with the danger warnings) and product highlights sheet of the Fund, which can be found and could also be obtained from appointed distributors of Nikko AM Asia or our web site (www.nikkoam.com.sg) earlier than deciding whether or not to spend money on the Fund.

The knowledge contained herein might not be copied, reproduced or redistributed with out the specific consent of Nikko AM Asia. Whereas cheap care has been taken to make sure the accuracy of the data as on the date of publication, Nikko AM Asia doesn't give any guarantee or illustration, both specific or implied, and expressly disclaims legal responsibility for any errors or omissions. Data could also be topic to alter with out discover. Nikko AM Asia accepts no legal responsibility for any loss, oblique or consequential damages, arising from any use of or reliance on this doc. This commercial has not been reviewed by the Financial Authority of Singapore.

The efficiency of the ETF’s worth on the Singapore Alternate Securities Buying and selling Restricted (“SGX-ST”) could also be completely different from the web asset worth per unit of the ETF. The ETF might also be suspended or delisted from the SGX-ST. Itemizing of the items doesn't assure a liquid marketplace for the items. Buyers ought to observe that the ETF differs from a typical unit belief and items might solely be created or redeemed straight by a collaborating vendor in massive creation or redemption items.

The Central Provident Fund (“CPF”) Strange Account (“OA”) rate of interest is the legislated minimal 2.5% every year, or the 3-month common of main native banks' rates of interest, whichever is greater, reviewed quarterly. The rate of interest for Particular Account (“SA”) is presently 4% every year or the 12-month common yield of 10-year Singapore Authorities Securities plus 1%, whichever is greater, reviewed quarterly. Solely monies in extra of $20,000 in OA and $40,000 in SA could be invested beneath the CPF Funding Scheme (“CPFIS”). Please discuss with the web site of the CPF Board for additional info. Buyers ought to observe that the relevant rates of interest for the CPF accounts and the phrases of CPFIS could also be various by the CPF Board occasionally.

The items of Nikko AM Singapore STI ETF usually are not in any approach sponsored, endorsed, bought or promoted by FTSE Worldwide Restricted ("FTSE"), the London Inventory Alternate Plc (the "Alternate"), The Monetary Instances Restricted ("FT") SPH Knowledge Providers Pte Ltd ("SPH") or Singapore Press Holdings Ltd ("SGP") (collectively, the "Licensor Events") and not one of the Licensor Events make any guarantee or illustration by any means, expressly or impliedly, both as to the outcomes to be obtained from using the Straits Instances Index ("Index") and/or the determine at which the stated Index stands at any specific time on any specific day or in any other case. The Index is compiled and calculated by FTSE. Not one of the Licensor Events shall be beneath any obligation to advise any individual of any error therein. "FTSE®", "FT-SE®" are commerce marks of the Alternate and the FT and are utilized by FTSE beneath license. "STI" and "Straits Instances Index" are commerce marks of SPH and are utilized by FTSE beneath licence. All mental property rights within the ST index vest in SPH and SGP.

The items of NikkoAM-StraitsTrading Asia ex Japan REIT ETF usually are not in any approach sponsored, endorsed, bought or promoted by FTSE Worldwide Restricted ("FTSE''), by the London Inventory Alternate Group corporations ("LSEG''), Euronext N.V. ("Euronext"), European Public Actual Property Affiliation ("EPRA"), or the Nationwide Affiliation of Actual Property Funding Trusts ("NAREIT") (collectively the "Licensor Events") and not one of the Licensor Events make any guarantee or illustration by any means, expressly or impliedly, both as to the outcomes to be obtained from using the FTSE EPRA/NAREIT Asia ex Japan Web Whole Return REIT Index (the "Index") and/or the determine at which the stated Index stands at any specific time on any specific day or in any other case. The Index is compiled and calculated by FTSE. Nonetheless, not one of the Licensor Events shall be liable (whether or not in negligence or in any other case) to any individual for any error within the Index and not one of the Licensor Events shall be beneath any obligation to advise any individual of any error therein. "FTSE®" is a commerce mark of LSEG, "NAREIT®" is a commerce mark of the Nationwide Affiliation of Actual Property Funding Trusts and "EPRA®" is a commerce mark of EPRA and all are utilized by FTSE beneath licence."

Neither Markit, its Associates or any third social gathering information supplier makes any guarantee, specific or implied, as to the accuracy, completeness or timeliness of the info contained herewith nor as to the outcomes to be obtained by recipients of the info. Neither Markit, its Associates nor any information supplier shall in any approach be liable to any recipient of the info for any inaccuracies, errors or omissions within the Markit information, no matter trigger, or for any damages (whether or not direct or oblique) ensuing therefrom. Markit has no obligation to replace, modify or amend the info or to in any other case notify a recipient thereof within the occasion that any matter acknowledged herein modifications or subsequently turns into inaccurate. With out limiting the foregoing, Markit, its Associates, or any third social gathering information supplier shall haven't any legal responsibility by any means to you, whether or not in contract (together with beneath an indemnity), in tort (together with negligence), beneath a guaranty, beneath statute or in any other case, in respect of any loss or injury suffered by you because of or in reference to any opinions, suggestions, forecasts, judgments, or another conclusions, or any plan of action decided, by you or any third social gathering, whether or not or not based mostly on the content material, info or supplies contained herein. Copyright © 2024, Markit Indices Restricted.

The Markit iBoxx SGD Non-Sovereigns Massive Cap Funding Grade Index are marks of Markit Indices Lmited and have been licensed to be used by Nikko Asset Administration Asia Restricted. The Markit iBoxx SGD Non-Sovereigns Massive Cap Funding Grade Index referenced herein is the property of Markit Indices Restricted and is used beneath license. The Nikko AM SGD Funding Grade Company Bond ETF isn't sponsored, endorsed, or promoted by Markit Indices Restricted

Nikko Asset Administration Asia Restricted. Registration Quantity 198202562H.