Final week’s feedback, Tune Out the Noise, was my suggestion that buyers mustn’t get drawn into the firehose of noise, partisan wrestling matches, and trolling generated by the brand new administration. My emphasis was on staying centered on the long run. This contains setting objectives, having a monetary plan, and acknowledging our collective lack of ability to foretell the outcomes of geopolitical occasions (both home or abroad).

This doesn’t, nevertheless, imply we must always turn out to be sanguine about how quickly adjustments within the U.S. authorities could also be occurring. Issues are transferring quick, and whether or not you help 47’s agenda or not, fast change can result in unintended penalties. The primary month of Trump 2.0 has seen the boundaries of govt energy examined, together with an aggressive change to the Federal workforce. How that performs out within the courts and the financial system is as but unknown.

I’m not blasé about radical change. What is happening will get portrayed within the media in a binary black-and-white vogue. It requires some nuance, an understanding that issues aren’t all the time what they seem. Algorithmic Social Media is, at its core, a really profitable design to be taught what retains you engaged after which preserve feeding you that. Emotionality, angst, outrage, and even hatred are the way it captures eyeballs, hours, and clicks.

Quite than get sucked into the emotionality of a YES or NO framework, I recommend contemplating recognizing the place threat components are rising. “Transfer quick and break issues” may fit in Silicon Valley, however it isn’t what market individuals need from the White Home (or the Federal Reserve).

What threat components at play? There are financial dangers, market dangers, systemic components, foreign money dangers, constitutional questions, and in the end, the standing of the US as a world superpower and ally.

Danger is all the time current, and reward is a operate of taking intelligently calculated dangers. However the potential for a coverage mistake – both on a modest or grand scale – is on the rise. Whether or not it comes from DOGE or the Funds course of or a minor courtroom case or a extra critical problem, we must always concentrate on the altering atmosphere.

Let’s contemplate seven potential risks that, whereas nonetheless presently small, are additionally rising over the subsequent 12 months:

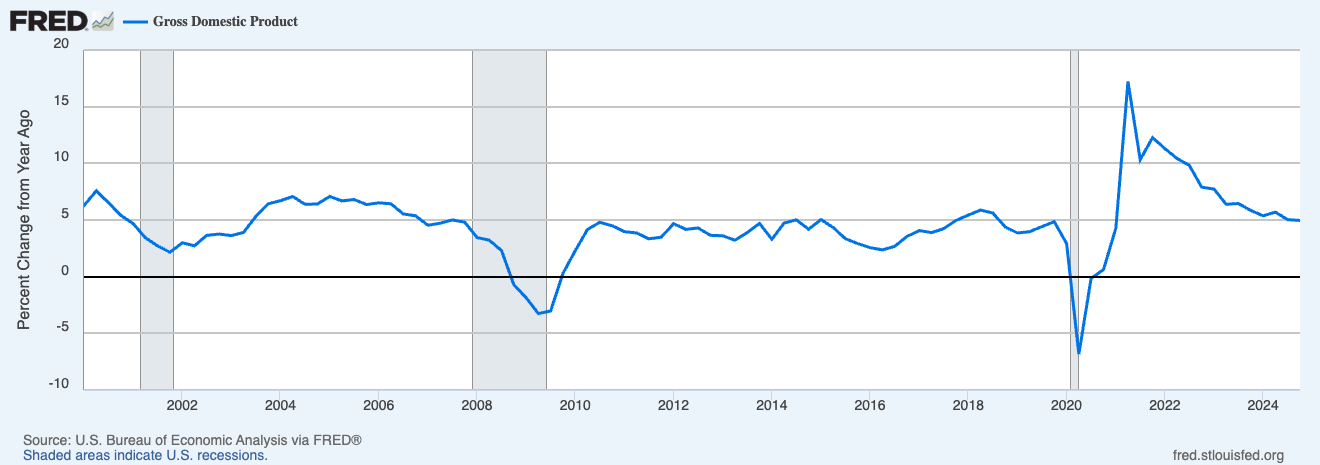

Recession: After a number of years of incorrectly forecasting a recession, Wall Avenue has lastly acknowledged the energy of the underlying financial system. However there are indicators of moderation (not contraction) price noting: Retail gross sales are softening, and sturdy items haven’t carried out particularly nicely currently (blame restricted housing gross sales). Sentiment has been a drag for some time.

None of those recommend a recession is imminent. They do improve the vulnerability of the financial system to a shock, and that’s the threat issue right here.

Chance of a recession: 15%, up from 5%

Volatility: We now have already seen an uptick in fairness value volatility regardless of notching a brand new all-time excessive within the S&P 500 index 9chart beneath). I imagine ATH’s are essentially the most bullish market indicator of all. Its the one on the finish of the bull market that fails that check.

5 years after the beginning of the pandemic, the CBOE S&P 500 Volatility Index (VIX chart above) was spiky however settling down. It’s beginning to creep up in the direction of 20. That is nothing too harmful, however it raises the potential for extra turmoil forward.

Bond yields proceed to swing. What has been unusual about this cycle is that client lending for vehicles and houses has seen rates of interest go up because the FOMC has lower charges. The Bloomberg Combination Bond value (inverse to yield) has moved rather a lot over the previous three years, and value swings are prone to getting even wilder.

Chance of a Market Dislocation: 20%, up from 10%

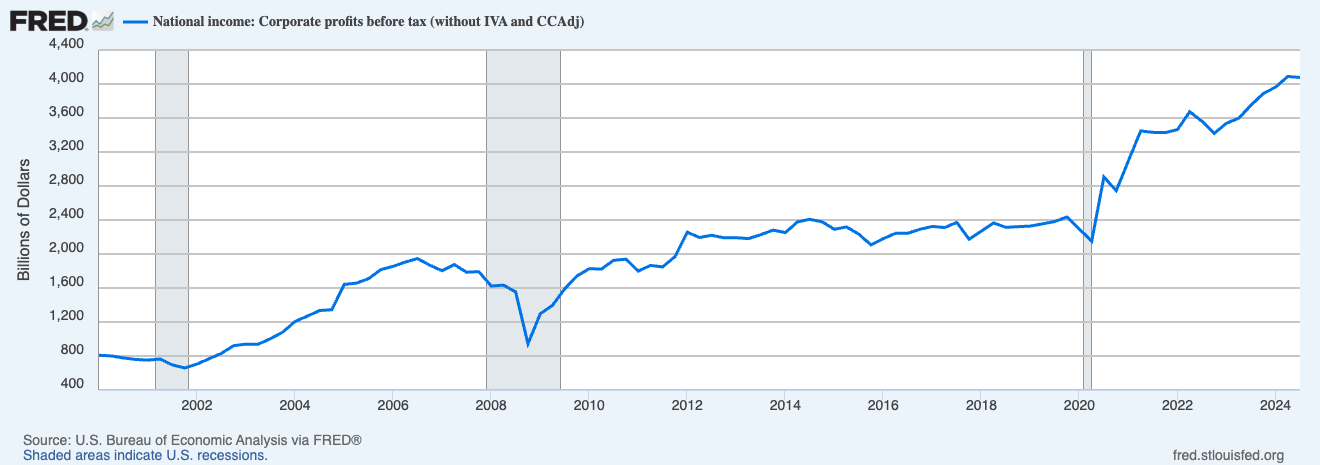

Income and Valuations: Not solely markets however company income are at or close to all-time highs. Buyers need to see profitability keep up, because it results in the psychological underpinning of a wholesome market. That manifests itself in buyers’ willingness to pay increasingly for every greenback of firm earnings, e.g., P/E a number of enlargement.

We typically overlook how a lot sentiment and luxury ranges can drive client spending and company revenues. Sentiment has been very robust to learn since 2020, with partisanship driving very low client sentiment whereas spending remained sturdy.

Chance of a Revenue Fall: 25%, up from 15%

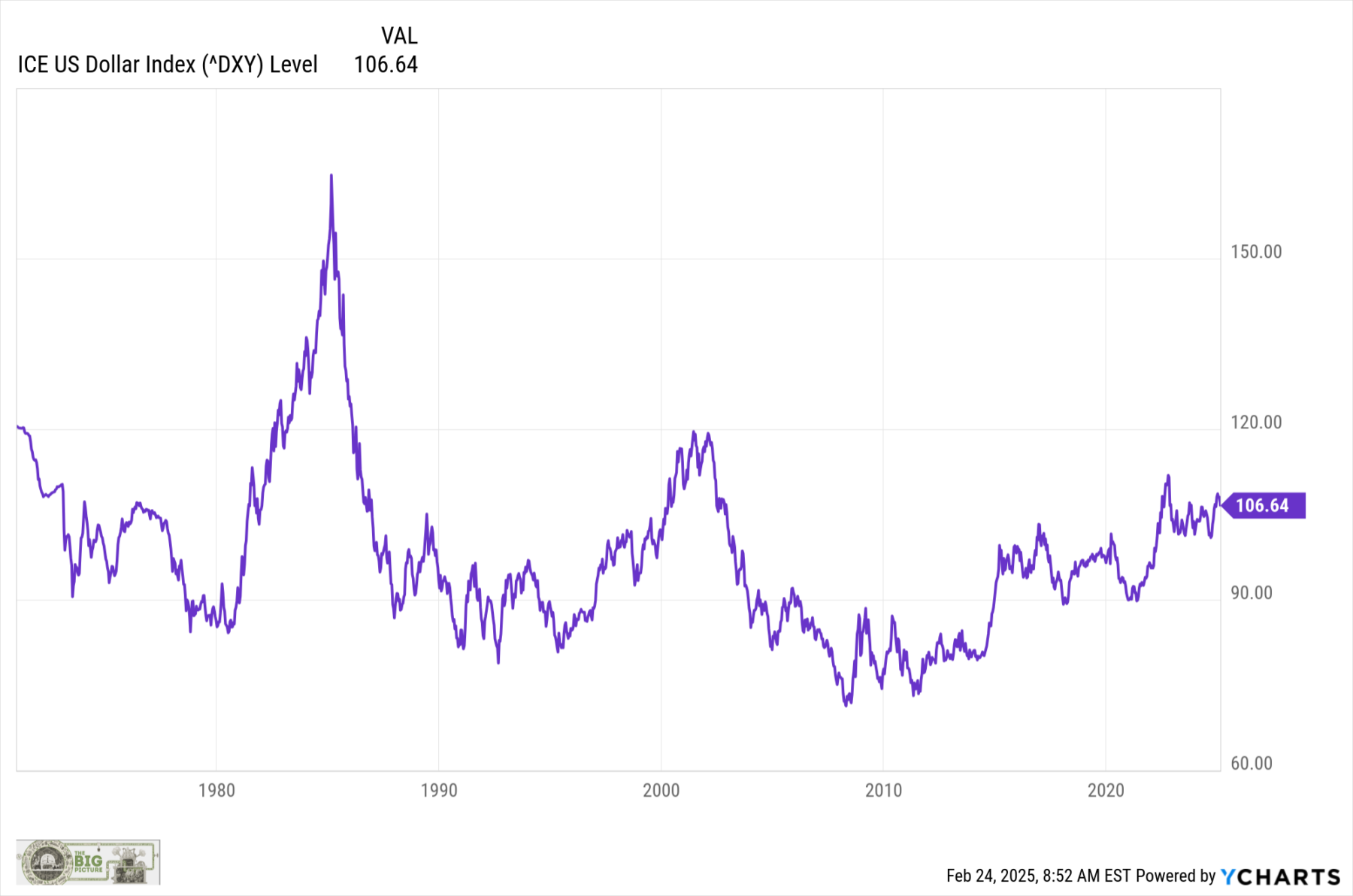

The Collapse of the US Greenback: Numerous events have been forecasting the collapse of fiat foreign money for hundreds of years (sometimes being by accident right) and the collapse of the greenback for many years. Nothing has challenged this

For the reason that finish of World Battle Two, the USD has been America’s “exorbitant privilege ” because the world’s reserve foreign money. Nevertheless, a number of components threaten this privilege: wide-scale tariffs, the embrace of other digital currencies, the breaking of long-standing alliances, and dallying with dictators.

For the reason that finish of World Battle II in 1945, the rise of the US because the world’s dominant financial, army, and cultural energy has led to a comparatively peaceable 75 years within the Western Hemisphere. Pax Americana has vastly benefited the U.S. and its allies. Placing that in danger could be one in all historical past’s best unforced errors.

Chance of a Greenback Collapse: 12ish%, up from 3ish%

Geopolitical Chaos: These subsequent three are tougher to evaluate. Our first 4 dangers have been (considerably) quantifiable. We now enter the realm of squishier, tougher to evaluate threat components. In every of the above, we’ve a good suggestion of what the end result set seems to be like upfront, however we have no idea what the precise outcomes might be. Now, we enter a extra unsure realm, the place we do not know what the complete vary of potentialities is, however we do see larger dispersion.

The Center East, Ukraine & Russia, China, Russia (alone) Europe, Canada, Greenland, Panama Canal, even Canada are potential flashpoints.

Chance of a Geopolitical Occasion: 37%, up from 20ish%

Constitutional Disaster: It’s onerous to inform what’s bluster and negotiating techniques and what’s actual. However assuming we take the present pattern to its (il)logical conclusion, the percentages of unhealthy issues occurring preserve rising. The Govt, Legislative, and Judicial branches are on a collision course. I do not know how this performs out…

Chance of a Constitutional Disaster: 30%, up from 2ish%

Failed Sovereignty: May the unthinkable happen? May the experiment of self-rule and democracy come to a screeching halt? I’m detest to ponder such an final result, however it was unthinkable because the finish of WW2. Positive, there have been crises, from the Civil Battle to Dred Scott choice to Civil Rights motion and extra just lately the challenges from GFC and the Residents United v. FEC case.

However in recent times, the thought of the US failing as a sovereign nation failing was really unimaginable. That’s now not the case.

Finish of the USA of A: Non-Zero chance, up from unthinkable.

~~~

I interact in these thought experiments in order to not get too caught up in my very own bias bubble. Final week’s Tune Out the Noise was written for the aim of avoiding an emotional error. This week’s evaluation is to verify I’m contemplating the entire worst-case eventualities that emotionality would possibly result in…

Beforehand:

Tune Out the Noise (February 20, 2025)